Region:Global

Author(s):Geetanshi

Product Code:KRAB0119

Pages:95

Published On:August 2025

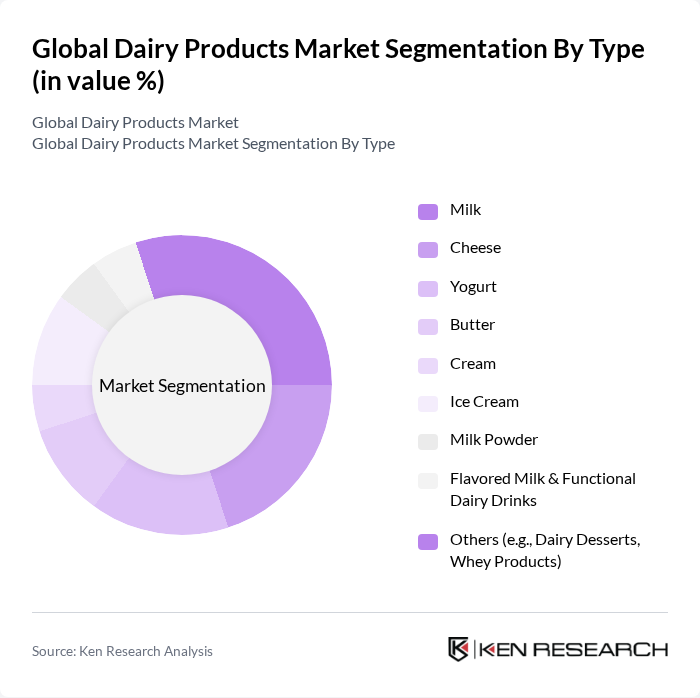

By Type:The dairy products market is segmented into various types, includingmilk, cheese, yogurt, butter, cream, ice cream, milk powder, flavored milk & functional dairy drinks, and others such as dairy desserts and whey products. Each sub-segment addresses different consumer preferences and dietary needs, contributing to the overall market dynamics. Milk remains the largest segment, driven by its role as a staple in daily diets and its nutritional value. Cheese and yogurt are experiencing strong growth due to evolving consumer tastes and increasing demand for protein-rich and probiotic foods. Butter, cream, and ice cream continue to be popular in both household and food service applications. Flavored milk and functional dairy drinks are gaining traction among health-conscious consumers seeking convenience and added nutritional benefits.

By End-User:The end-user segmentation includeshouseholds, the food service industry (hotels, restaurants, cafés), retailers, and food & beverage manufacturers. Each segment exhibits distinct purchasing behaviors and requirements, influencing the overall demand for dairy products. Households drive steady demand for staple dairy products, while the food service industry and retailers focus on variety, quality, and convenience. Food & beverage manufacturers are increasingly utilizing dairy ingredients in processed foods, beverages, and functional products.

The Global Dairy Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Lactalis Group, FrieslandCampina, Fonterra Co-operative Group Limited, Arla Foods Amba, Dairy Farmers of America, Inc., Saputo Inc., Unilever PLC, Müller Group, The a2 Milk Company, Chobani LLC, Bel Group, Parmalat S.p.A., Yili Group, Mengniu Dairy Company Limited, Gujarat Cooperative Milk Marketing Federation (Amul) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dairy products market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, dairy producers are likely to focus on developing functional and fortified products that cater to specific health needs. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential, as rising incomes and urbanization lead to increased dairy consumption. Companies that adapt to these trends will likely thrive in the competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Milk Cheese Yogurt Butter Cream Ice Cream Milk Powder Flavored Milk & Functional Dairy Drinks Others (e.g., Dairy Desserts, Whey Products) |

| By End-User | Households Food Service Industry (Hotels, Restaurants, Cafés) Retailers Food & Beverage Manufacturers |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Direct Sales Specialty Stores |

| By Packaging Type | Bottles Tetra Packs/Cartons Cans Pouches Bulk Packaging |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Liquid Powdered Solid/Semi-solid Others (e.g., Concentrates, UHT) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Milk Production Insights | 100 | Dairy Farmers, Production Managers |

| Cheese Market Dynamics | 80 | Cheese Makers, Product Development Heads |

| Yogurt Consumer Preferences | 90 | Marketing Managers, Consumer Insights Analysts |

| Dairy Distribution Channels | 60 | Logistics Coordinators, Supply Chain Managers |

| Retail Dairy Product Sales | 70 | Store Managers, Category Buyers |

The Global Dairy Products Market is valued at approximately USD 1,005 billion, reflecting a robust growth trend driven by increasing consumer demand for dairy products and rising health consciousness among consumers.