Region:Middle East

Author(s):Shubham

Product Code:KRAA2263

Pages:100

Published On:August 2025

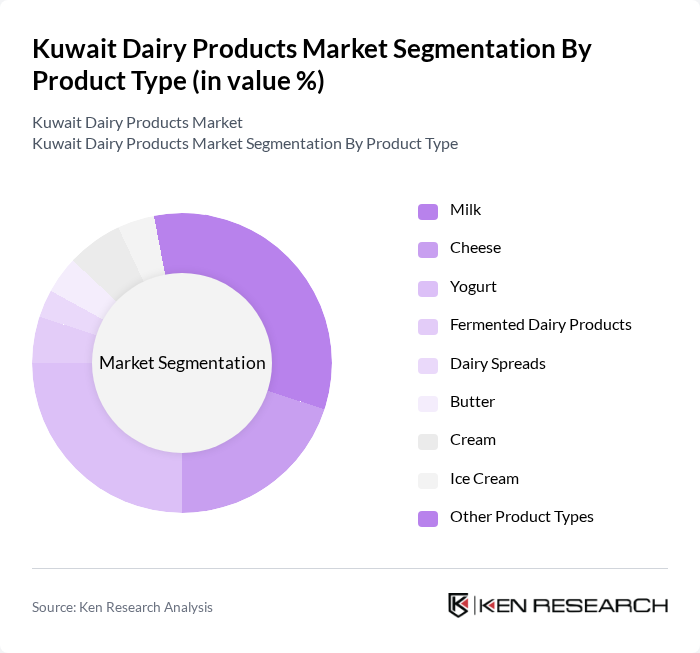

By Product Type:The product type segmentation includes milk, cheese, yogurt, fermented dairy products, dairy spreads, butter, cream, ice cream, and other product types. Milk and yogurt remain the most popular, driven by their nutritional value, versatility, and the growing demand for fortified and probiotic options. The health and wellness trend has notably increased yogurt consumption, especially products with added protein and probiotics. Cheese and cream are also gaining traction due to their use in home cooking and foodservice, while camel milk is emerging as a premium alternative.

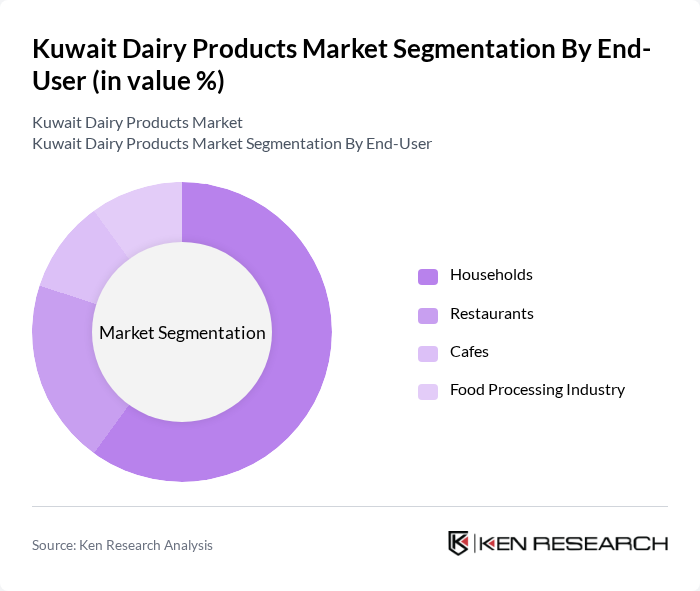

By End-User:The end-user segmentation covers households, restaurants, cafes, and the food processing industry. Households account for the largest share, reflecting the widespread integration of dairy products in daily diets and the popularity of home cooking. Restaurants and cafes drive demand for premium and specialty dairy products, while the food processing industry utilizes dairy ingredients in a variety of packaged foods.

The Kuwait Dairy Products Market features a dynamic mix of regional and international players. Leading participants such as Kuwait Dairy Company (KDC), Kuwait United Dairy Company (KUDC), Almarai Company, Al Safat Fresh Dairy Co., KDD (Kuwait Danish Dairy Company), SADAFCO (Saudia Dairy & Foodstuff Company), Arla Foods, Al Ain Dairy, Danone, Al-Safi Danone, Al-Babtain Group, Al-Mansour Dairy, Al-Jazeera Dairy, Al-Fahad Dairy, and Al-Muhalab Dairy contribute to innovation, geographic expansion, and service delivery. These companies are investing in product innovation, expanding distribution networks, and complying with evolving regulatory standards to maintain competitiveness.

The future of the Kuwait dairy products market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on health and wellness is likely to propel demand for functional and organic dairy products. Additionally, the rise of e-commerce platforms will enhance distribution channels, making dairy products more accessible. As local brands gain traction, the market is expected to witness a shift towards innovative product offerings, catering to the health-conscious consumer base while addressing sustainability concerns.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Milk Cheese Yogurt Fermented Dairy Products Dairy Spreads Butter Cream Ice Cream Other Product Types |

| By End-User | Households Restaurants Cafes Food Processing Industry |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Stores Other Distribution Channels |

| By Packaging Type | Bottles Tetra Packs Cans Pouches |

| By Price Range | Economy Mid-Range Premium |

| By Brand Category | Private Label Branded |

| By Nutritional Content | Standard Dairy Products Fortified Dairy Products Organic Dairy Products Functional Dairy Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Dairy Product Sales | 150 | Store Managers, Category Buyers |

| Dairy Production Insights | 100 | Dairy Farmers, Production Managers |

| Consumer Preferences in Dairy | 150 | Household Consumers, Health-Conscious Shoppers |

| Distribution Channel Analysis | 80 | Logistics Managers, Supply Chain Coordinators |

| Market Trends and Innovations | 70 | Product Development Managers, Marketing Executives |

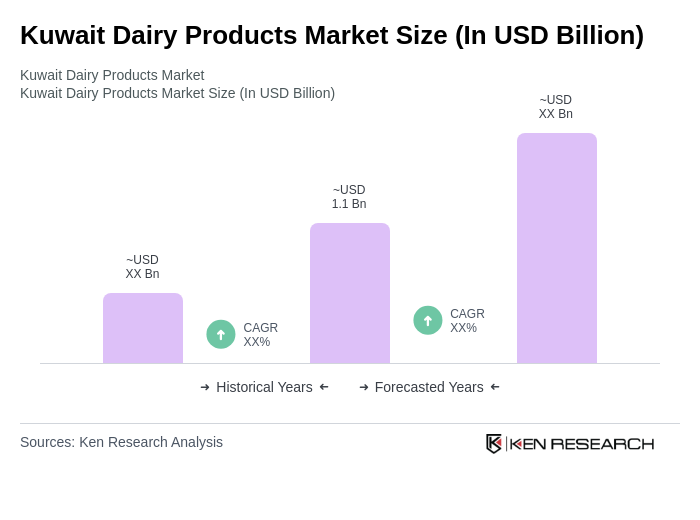

The Kuwait Dairy Products Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by increasing consumer demand for diverse and health-oriented dairy products, including functional and fortified options.