Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0161

Pages:91

Published On:August 2025

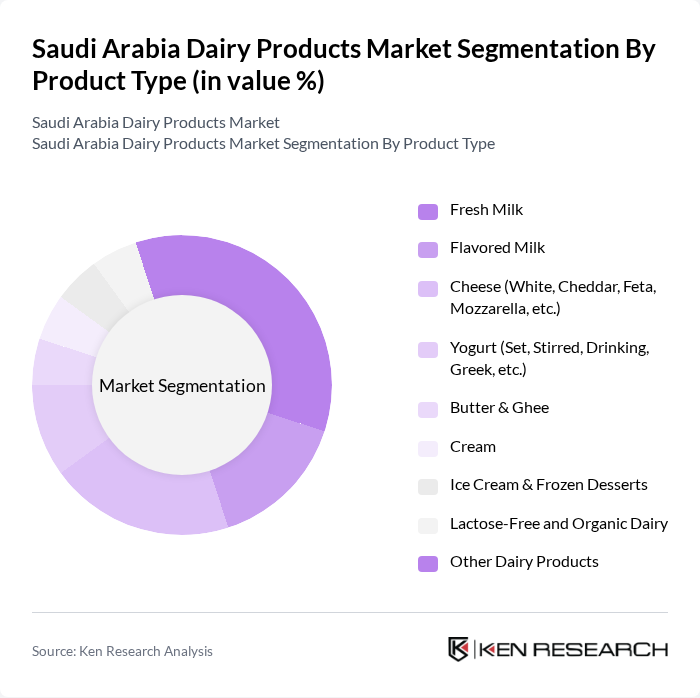

By Product Type:The dairy products market is segmented into various product types, including Fresh Milk, Flavored Milk, Cheese (White, Cheddar, Feta, Mozzarella, etc.), Yogurt (Set, Stirred, Drinking, Greek, etc.), Butter & Ghee, Cream, Ice Cream & Frozen Desserts, Lactose-Free and Organic Dairy, and Other Dairy Products. Among these, Fresh Milk and Cheese are the leading subsegments, driven by their essential role in daily diets and culinary applications. The market is also witnessing increased demand for fortified and functional dairy products, such as probiotic yogurts and organic milk, reflecting a shift toward health-focused consumption .

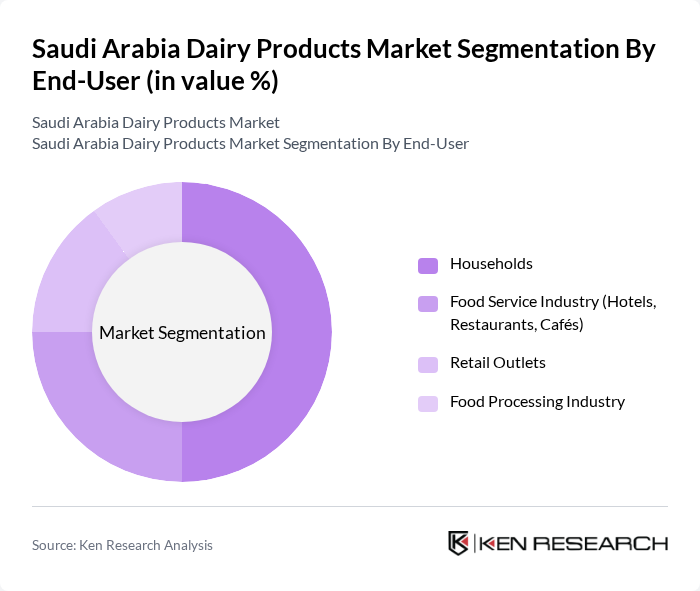

By End-User:The end-user segmentation includes Households, Food Service Industry (Hotels, Restaurants, Cafés), Retail Outlets, and Food Processing Industry. Households represent the largest segment, driven by the daily consumption of dairy products for nutrition and cooking. The Food Service Industry is also significant due to the increasing number of dining establishments and the growing trend of out-of-home consumption. Retail outlets play a vital role in product accessibility, while the Food Processing Industry utilizes dairy as a key ingredient in value-added products .

The Saudi Arabia Dairy Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, National Agricultural Development Company (NADEC), Saudia Dairy & Foodstuff Company (SADAFCO), Al Safi Danone, Al Othman Agriculture Production and Processing Company (NADA), Al-Jazira Dairy Company, Al-Watania Agriculture Company, Al Faisaliah Group (Dairy & Food Division), Almarai Foods Company, Al Rawabi Dairy Company, United National Dairy Company (UNDC), Almarai Poultry & Dairy Division, Al Safi Foods Company, Almarai Juice & Dairy Division, and Nestlé Saudi Arabia LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi dairy products market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and health will likely shape product offerings, with a shift towards organic and functional dairy products. Additionally, the expansion of e-commerce platforms is expected to enhance accessibility, allowing consumers to purchase a wider variety of dairy products conveniently. These trends indicate a dynamic market landscape that will continue to evolve in response to consumer demands and regulatory changes.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fresh Milk Flavored Milk Cheese (White, Cheddar, Feta, Mozzarella, etc.) Yogurt (Set, Stirred, Drinking, Greek, etc.) Butter & Ghee Cream Ice Cream & Frozen Desserts Lactose-Free and Organic Dairy Other Dairy Products |

| By End-User | Households Food Service Industry (Hotels, Restaurants, Cafés) Retail Outlets Food Processing Industry |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Direct Sales |

| By Packaging Type | Bottles Tetra Packs/Cartons Cans Pouches Cups & Tubs |

| By Price Range | Economy Mid-range Premium |

| By Product Form | Liquid Powdered Solid/Semi-solid |

| By Region | Central Region (Riyadh, etc.) Eastern Region (Dammam, etc.) Western Region (Jeddah, Mecca, etc.) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Dairy Product Sales | 100 | Store Managers, Category Buyers |

| Consumer Preferences in Dairy | 120 | Household Decision Makers, Health-Conscious Consumers |

| Dairy Product Manufacturing Insights | 80 | Production Managers, Quality Control Supervisors |

| Distribution Channel Effectiveness | 60 | Logistics Coordinators, Supply Chain Analysts |

| Market Trends and Innovations | 40 | Product Development Managers, Marketing Executives |

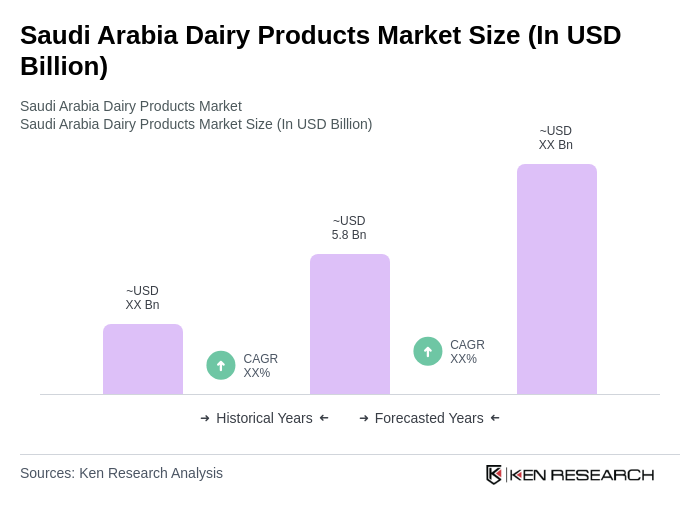

The Saudi Arabia Dairy Products Market is valued at approximately USD 5.8 billion, reflecting a significant growth driven by increasing consumer demand, health consciousness, and a growing population, alongside government support under Vision 2030.