Region:Global

Author(s):Shubham

Product Code:KRAC0837

Pages:95

Published On:August 2025

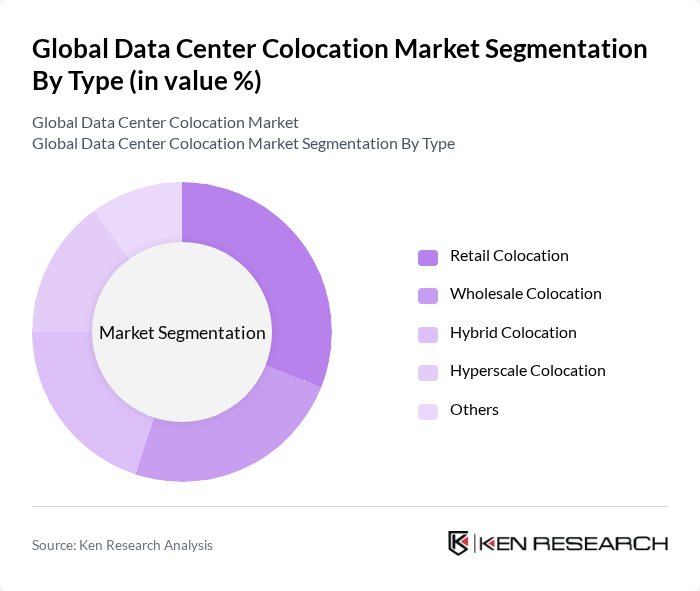

By Type:The market is segmented into Retail Colocation, Wholesale Colocation, Hybrid Colocation, Hyperscale Colocation, and Others. Retail colocation is gaining traction due to its flexibility and scalability, catering to small and medium-sized enterprises. Wholesale colocation is preferred by large enterprises for its cost-effectiveness and dedicated resources. Hyperscale colocation is increasingly popular among cloud service providers due to the need for massive data processing capabilities and the rise of AI-driven workloads. Hybrid colocation is also expanding as organizations seek to balance on-premises and cloud resources for greater operational agility .

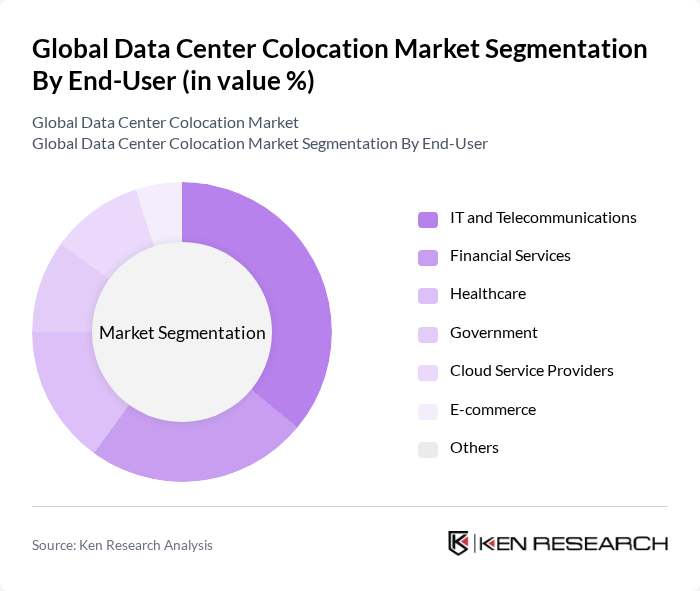

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services, Healthcare, Government, Cloud Service Providers, E-commerce, and Others. The IT and Telecommunications sector is the largest consumer of colocation services, driven by the need for reliable and scalable infrastructure and the ongoing expansion of 5G and cloud networks. Financial services also significantly contribute due to stringent regulatory requirements for data security and availability. Healthcare and government segments are increasingly adopting colocation to ensure data compliance and business continuity, while cloud service providers drive demand for hyperscale and wholesale colocation .

The Global Data Center Colocation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Digital Realty Trust, Inc., NTT Communications Corporation, CyrusOne Inc., CoreSite Realty Corporation, Interxion Holding N.V., Rackspace Technology, Inc., Iron Mountain Incorporated, Global Switch Holdings Limited, KDDI Corporation, China Telecom Corporation Limited, Cyxtera Technologies, Inc., Telehouse International Corporation, DataBank, Ltd., Flexential Corp., Centersquare, EdgeConneX Inc., TierPoint, LLC, Alibaba Cloud, OVHcloud, Amazon Web Services, Inc., Microsoft Azure, NaviSite, HostCircle Inc., Cogent Communications contribute to innovation, geographic expansion, and service delivery in this space.

The future of the data center colocation market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid cloud strategies, the demand for flexible and scalable colocation solutions will rise. Additionally, the integration of AI and machine learning in data management will enhance operational efficiency. Companies are expected to invest heavily in green technologies, aligning with sustainability goals while optimizing energy consumption, thus shaping a more resilient and innovative market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Colocation Wholesale Colocation Hybrid Colocation Hyperscale Colocation Others |

| By End-User | IT and Telecommunications Financial Services Healthcare Government Cloud Service Providers E-commerce Others |

| By Service Type | Managed Services Interconnection Services Security Services Disaster Recovery Services Remote Hands Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Deployment Model | On-Premises Off-Premises Hybrid |

| By Industry Vertical | E-commerce Media and Entertainment Education Manufacturing Energy & Utilities Others |

| By Pricing Model | Pay-as-you-go Subscription-based Usage-based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Colocation Services | 120 | IT Directors, Data Center Managers |

| Cloud Service Providers | 90 | Cloud Architects, Operations Managers |

| Telecommunications Data Centers | 60 | Network Engineers, Facility Managers |

| Edge Computing Facilities | 50 | Product Managers, Technical Leads |

| Colocation Market Trends | 70 | Market Analysts, Business Development Executives |

The Global Data Center Colocation Market is valued at approximately USD 95 billion, driven by the increasing demand for cloud services, digitalization, and the need for scalable IT infrastructure solutions without the high costs of building and maintaining private data centers.