Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6626

Pages:85

Published On:October 2025

By Type:The segmentation by type includes Retail Colocation, Wholesale Colocation, Hybrid Colocation, Managed Colocation, and Others. Retail colocation is gaining traction due to the increasing number of SMEs seeking cost-effective solutions. Wholesale colocation is favored by large enterprises requiring extensive space and power. Hybrid colocation is becoming popular as businesses look for flexible solutions that combine on-premises and cloud resources. Managed colocation is appealing for companies that prefer outsourcing their IT management.

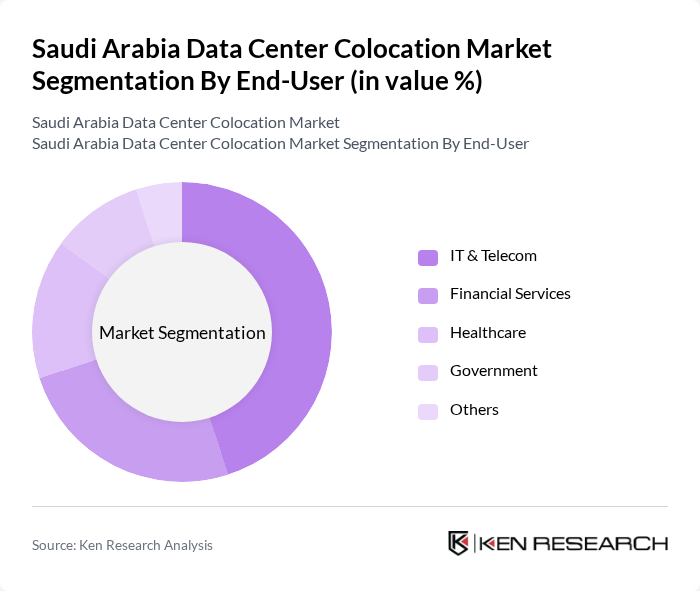

By End-User:The end-user segmentation includes IT & Telecom, Financial Services, Healthcare, Government, and Others. The IT & Telecom sector is the largest consumer of colocation services, driven by the need for robust infrastructure to support cloud services and data management. Financial services are increasingly adopting colocation for enhanced security and compliance. Healthcare organizations are also leveraging colocation to manage sensitive patient data securely, while government entities are focusing on data localization and security.

The Saudi Arabia Data Center Colocation Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Group, Mobily, Zain KSA, Saudi Telecom Company, NTT Communications, Equinix, Gulf Data Hub, Khazna Data Centers, Saudi Data Center, Digital Realty, Al-Falak, Axiom Telecom, Meraas, Aramco, Ooredoo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia data center colocation market appears promising, driven by ongoing digital transformation and government initiatives. As businesses increasingly adopt hybrid cloud solutions, the demand for colocation services is expected to rise significantly. Furthermore, the focus on sustainability and energy efficiency will likely lead to innovations in data center design and operations, enhancing competitiveness. The collaboration between local firms and global technology leaders will also play a crucial role in shaping the market landscape, fostering growth and technological advancement.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Colocation Wholesale Colocation Hybrid Colocation Managed Colocation Others |

| By End-User | IT & Telecom Financial Services Healthcare Government Others |

| By Industry Vertical | E-commerce Media & Entertainment Education Manufacturing Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Security Level | Standard Security Enhanced Security Compliance-Driven Security Others |

| By Pricing Model | Pay-as-you-go Subscription-based Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Center Needs | 100 | IT Directors, Data Security Officers |

| Healthcare Sector Colocation Requirements | 80 | IT Managers, Compliance Officers |

| Telecommunications Infrastructure Demands | 90 | Network Engineers, Operations Managers |

| Government Agency Data Management | 70 | IT Administrators, Project Managers |

| Retail Sector Cloud Integration | 60 | eCommerce Managers, IT Support Leads |

The Saudi Arabia Data Center Colocation Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing demand for cloud services, digital transformation initiatives, and government investments in digital infrastructure.