Region:Asia

Author(s):Shubham

Product Code:KRAE0431

Pages:87

Published On:December 2025

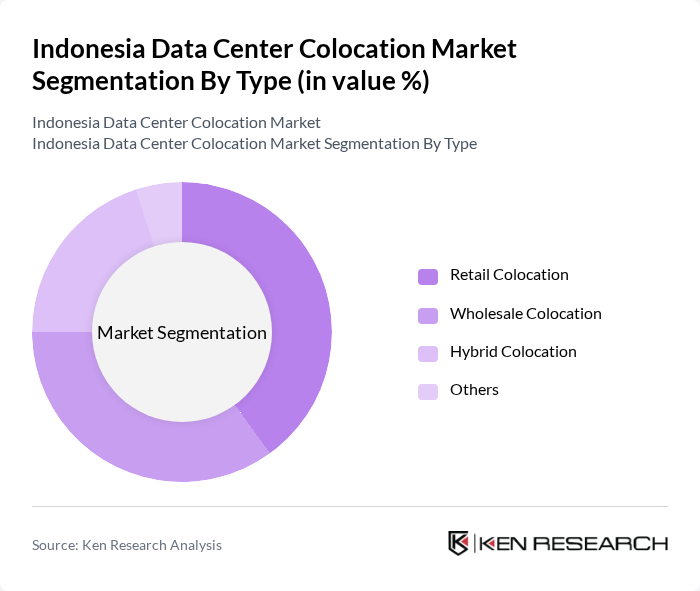

By Type:The market is segmented into Retail Colocation, Wholesale Colocation, Hybrid Colocation, and Others. Retail colocation is gaining traction due to the increasing number of small and medium enterprises seeking cost-effective solutions for their IT infrastructure. Wholesale colocation, on the other hand, is favored by larger enterprises and cloud service providers looking for scalable solutions. Hybrid colocation is also emerging as a popular choice, allowing businesses to combine on-premises and off-premises resources for enhanced flexibility.

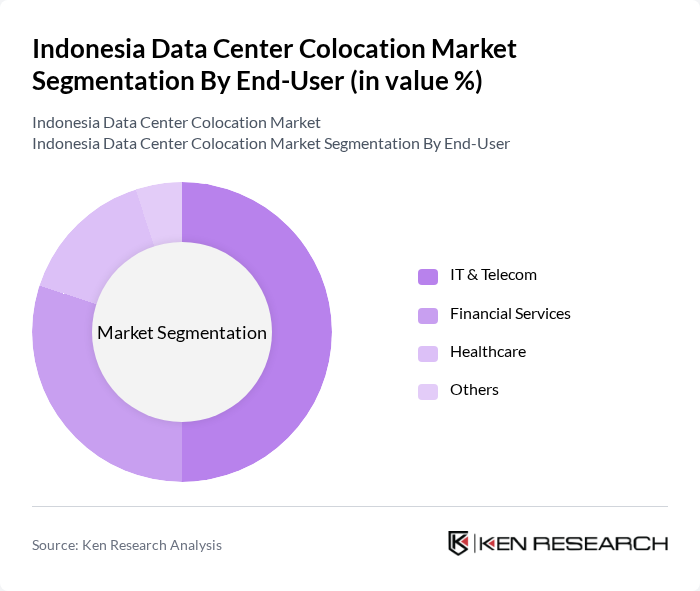

By End-User:The end-user segmentation includes IT & Telecom, Financial Services, Healthcare, and Others. The IT & Telecom sector is the largest consumer of colocation services, driven by the need for robust infrastructure to support increasing data traffic and cloud services. Financial services are also significant users, requiring high levels of security and compliance. The healthcare sector is increasingly adopting colocation solutions to manage sensitive patient data and comply with regulations.

The Indonesia Data Center Colocation Market is characterized by a dynamic mix of regional and international players. Leading participants such as DCI Indonesia, PT Telkom Indonesia, NTT Indonesia Nexcenter, BDx Data Centers, Equinix, and global hyperscalers like AWS and Google Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia data center colocation market appears promising, driven by ongoing digital transformation and increased investments in technology infrastructure. As businesses continue to embrace hybrid cloud solutions, the demand for colocation services will likely rise. Furthermore, the focus on sustainability and energy efficiency will shape the development of new data centers, aligning with global trends. Enhanced security measures will also become paramount as data privacy concerns grow, ensuring that providers remain competitive in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Colocation Wholesale Colocation Hybrid Colocation Others |

| By End-User | IT & Telecom Financial Services Healthcare Others |

| By Industry Vertical | E-commerce Media & Entertainment Government Others |

| By Service Model | Managed Services Professional Services Others |

| By Security Level | Standard Security Enhanced Security Compliance-focused Security Others |

| By Location | Urban Areas Suburban Areas Rural Areas Others |

| By Deployment Model | On-Premises Off-Premises Hybrid Deployment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Data Centers | 100 | IT Directors, Data Center Managers |

| Healthcare IT Infrastructure | 80 | Chief Information Officers, Compliance Officers |

| E-commerce Hosting Solutions | 90 | Operations Managers, Digital Strategy Leads |

| Telecommunications Data Management | 70 | Network Engineers, Service Delivery Managers |

| Government and Public Sector Data Centers | 60 | IT Policy Makers, Infrastructure Managers |

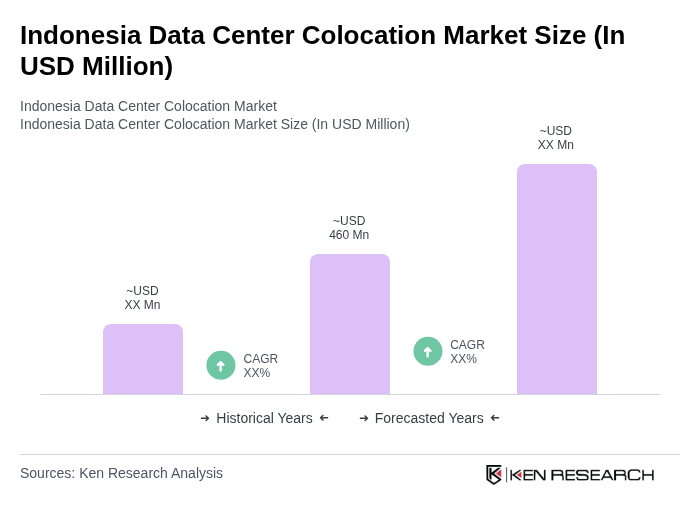

The Indonesia Data Center Colocation Market is valued at approximately USD 460 million, reflecting significant growth driven by digitalization, cloud storage demand, and enhanced infrastructure, particularly among micro, small, and medium enterprises (MSMEs).