Region:Global

Author(s):Dev

Product Code:KRAA3000

Pages:86

Published On:August 2025

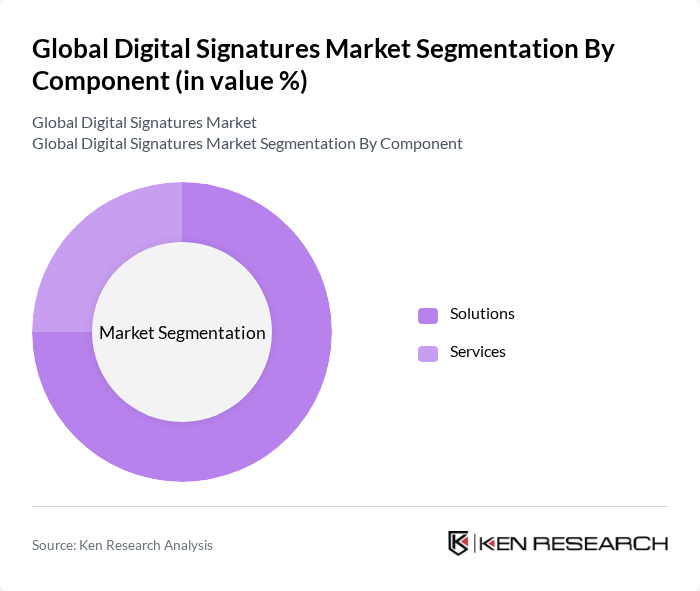

By Component:The digital signatures market is segmented into Solutions and Services.Solutionsinclude software and platforms for creating, managing, and verifying digital signatures, whileServicesencompass implementation support, consulting, and maintenance. The Solutions segment is currently leading the market, driven by the demand for automated, secure, and scalable document management systems, particularly in regulated industries such as banking, healthcare, and government .

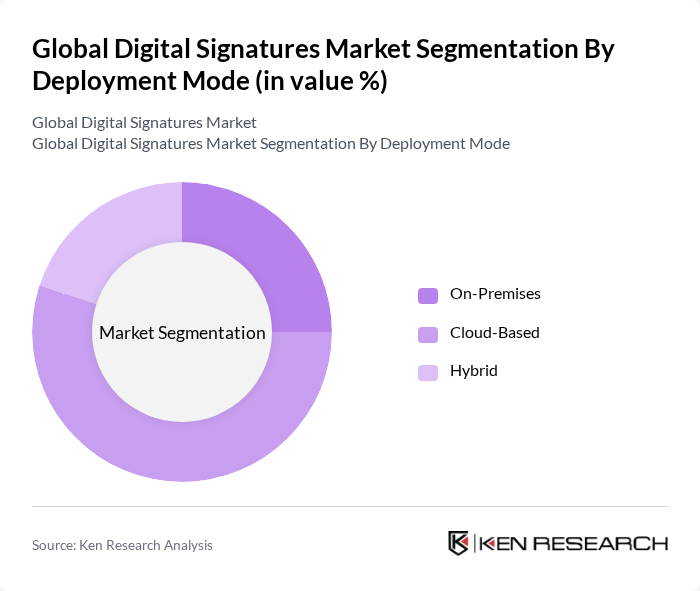

By Deployment Mode:The market is segmented into On-Premises, Cloud-Based, and Hybrid solutions.Cloud-Baseddeployment is leading, favored for its flexibility, scalability, and cost-effectiveness. The surge in remote work, the need for secure access to documents from multiple locations, and the shift toward SaaS models are key factors driving adoption of cloud-based digital signature solutions. On-Premises solutions remain relevant for organizations with strict data control requirements, while Hybrid models offer a balance of security and flexibility .

The Global Digital Signatures Market is characterized by a dynamic mix of regional and international players. Leading participants such as DocuSign, Inc., Adobe Inc., Dropbox, Inc. (HelloSign), airSlate, Inc. (SignNow), OneSpan Inc., Glykka LLC (SignEasy), DigiCert, Inc., GMO GlobalSign Holdings K.K., RPost Communications Ltd., OneSpan Sign (formerly eSignLive by VASCO), Signicat AS, Sertifi, Inc., Zoho Corporation (Zoho Sign), Citrix Systems, Inc. (RightSignature), Nintex (AssureSign) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital signatures market appears promising, driven by technological advancements and increasing digitalization across industries. As organizations continue to embrace remote work and digital workflows, the demand for efficient signing solutions is expected to rise. Furthermore, the integration of artificial intelligence and machine learning into digital signature platforms will enhance security and user experience, making these solutions more attractive to businesses. The focus on regulatory compliance will also drive innovation in this sector, ensuring that digital signatures meet evolving legal standards.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Services |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Organization Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By End-User Industry | BFSI Healthcare Government Legal Education Retail Manufacturing IT & Telecom Others |

| By Application | Contract Management Document Management Workflow Automation User Authentication Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct Sales Online Sales Distributors Others |

| By Pricing Model | Subscription-based Pay-per-use One-time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Adoption | 60 | Compliance Officers, IT Managers |

| Healthcare Sector Implementation | 40 | Healthcare Administrators, IT Directors |

| Government Digital Signature Use | 50 | Policy Makers, IT Security Managers |

| Legal Industry Adoption | 45 | Law Firm Partners, Legal Technology Specialists |

| SME Digital Signature Solutions | 55 | Small Business Owners, Operations Managers |

The Global Digital Signatures Market is valued at approximately USD 7.5 billion, driven by the increasing need for secure online transactions and the rapid expansion of remote work and digital transformation initiatives across various industries.