Region:Global

Author(s):Rebecca

Product Code:KRAB0168

Pages:86

Published On:August 2025

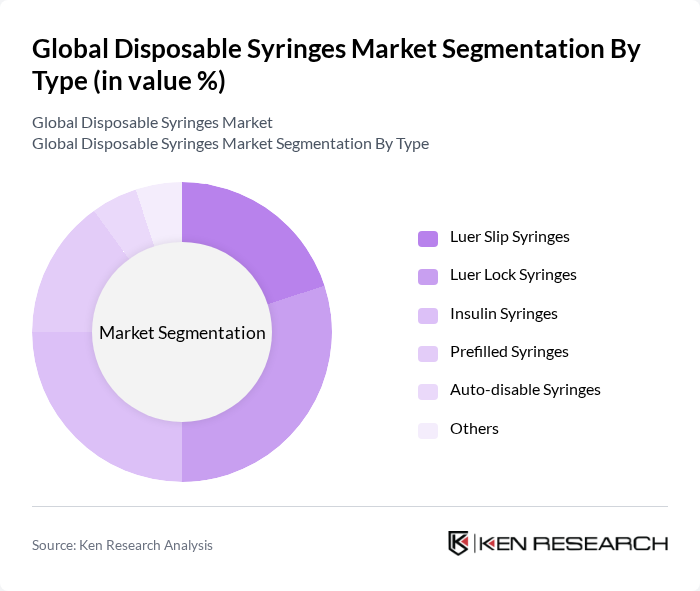

By Type:The market is segmented into various types of disposable syringes, including Luer Slip Syringes, Luer Lock Syringes, Insulin Syringes, Prefilled Syringes, Auto-disable Syringes, and Others. Among these, Luer Lock Syringes are gaining traction due to their secure connection, which minimizes the risk of leakage and ensures accurate dosing. The increasing prevalence of diabetes has also led to a rise in the demand for Insulin Syringes, as they are specifically designed for insulin delivery, catering to a growing patient population. Safety syringes, including auto-disable and retractable types, are experiencing the fastest adoption due to regulatory mandates and heightened focus on infection prevention .

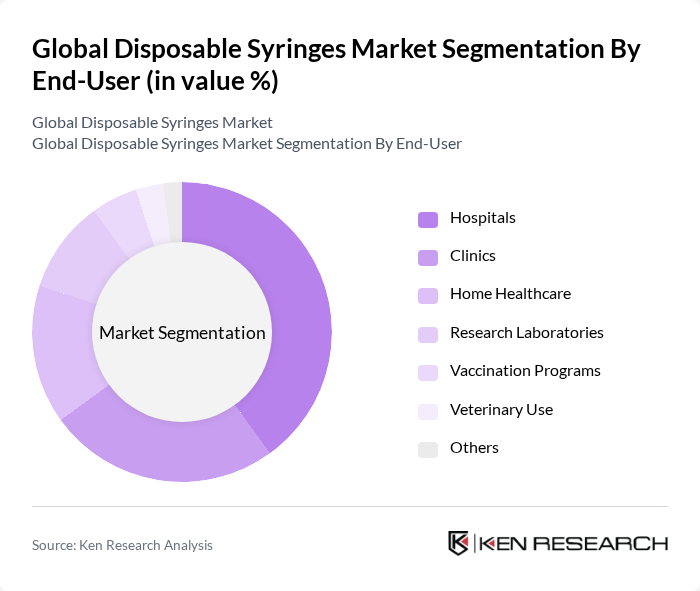

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Research Laboratories, Vaccination Programs, Veterinary Use, and Others. Hospitals are the leading end-users due to the high volume of procedures requiring syringes, including surgeries and vaccinations. The growing trend of home healthcare is also contributing to the demand for disposable syringes, as patients increasingly manage their health conditions at home, necessitating easy-to-use and safe injection devices. Vaccination programs and research laboratories also represent significant segments, especially in the context of global immunization drives and disease surveillance .

The Global Disposable Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company, Terumo Corporation, Medtronic plc (Covidien), Smiths Medical (ICU Medical, Inc.), Nipro Corporation, Fresenius Kabi AG, Gerresheimer AG, Baxter International Inc., Hindustan Syringes & Medical Devices Ltd. (HMD), SCHOTT AG, Medline Industries, LP, Amsino International, Inc., B. Braun Melsungen AG, Retractable Technologies, Inc., Jiangsu Jichun Medical Devices Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the disposable syringes market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the demand for eco-friendly materials rises, manufacturers are likely to innovate towards sustainable solutions. Additionally, the growth of telehealth services is expected to enhance the distribution of disposable syringes, making them more accessible. With global healthcare expenditure projected to approach approximately $9 trillion in future, the market is poised for significant expansion, particularly in emerging economies.

| Segment | Sub-Segments |

|---|---|

| By Type | Luer Slip Syringes Luer Lock Syringes Insulin Syringes Prefilled Syringes Auto-disable Syringes Others |

| By End-User | Hospitals Clinics Home Healthcare Research Laboratories Vaccination Programs Veterinary Use Others |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Distributors Pharmacies Others |

| By Material | Plastic (Polypropylene, Polyethylene) Glass Others |

| By Capacity | ml ml ml ml ml ml and above Others |

| By Safety Features | Safety Syringes (Retractable, Auto-disable) Non-Safety Syringes Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (Japan, China, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Pharmaceutical Companies | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 120 | Doctors, Nurses, Clinic Administrators |

| Research Institutions | 60 | Research Scientists, Lab Managers |

| Medical Device Distributors | 70 | Sales Managers, Distribution Coordinators |

The Global Disposable Syringes Market is valued at approximately USD 8.8 billion, driven by factors such as the increasing prevalence of chronic diseases, rising vaccination programs, and advancements in syringe technology, particularly safety-engineered designs.