Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8136

Pages:86

Published On:November 2025

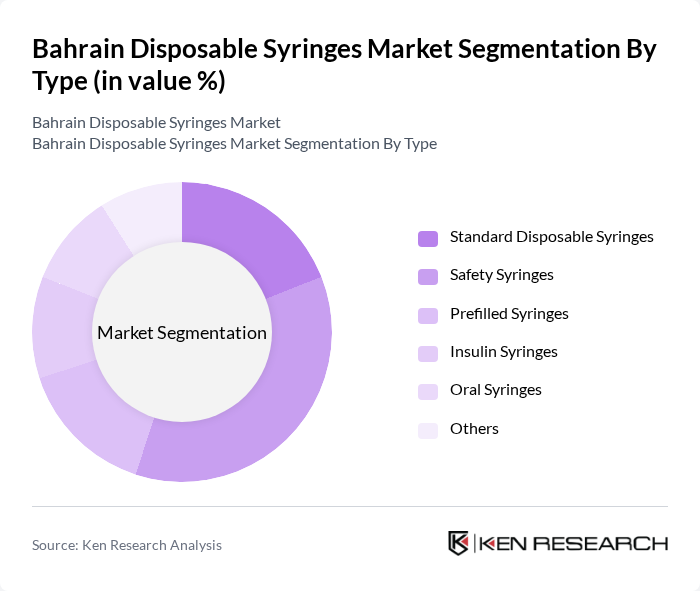

By Type:The market is segmented into Standard Disposable Syringes, Safety Syringes, Prefilled Syringes, Insulin Syringes, Oral Syringes, and Others. Safety Syringes are experiencing robust growth due to their effectiveness in preventing needlestick injuries, a critical concern in healthcare environments. The adoption of safety protocols and regulatory requirements is accelerating the demand for these syringes, positioning them as a leading sub-segment in the market .

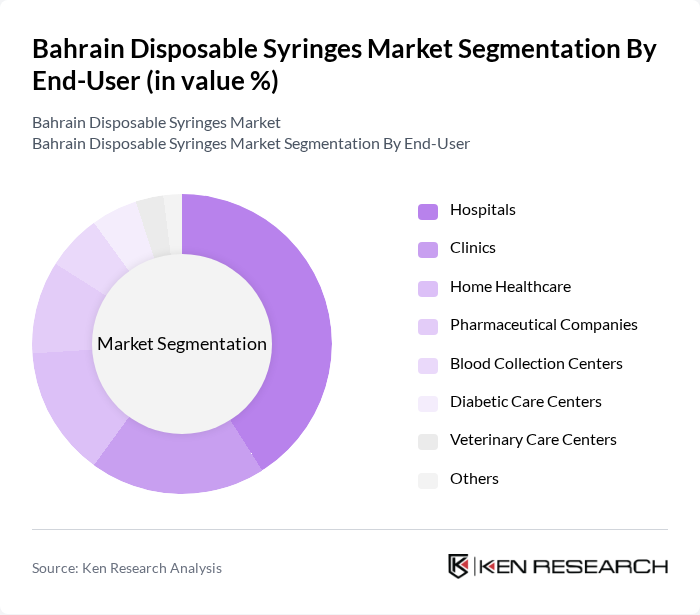

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Pharmaceutical Companies, Blood Collection Centers, Diabetic Care Centers, Veterinary Care Centers, and Others. Hospitals remain the dominant end-user segment, reflecting their high patient throughput and the volume of procedures requiring syringes. The expansion of hospital infrastructure and increased outpatient treatments are key factors driving demand in this sector .

The Bahrain Disposable Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Terumo Corporation, Smiths Medical (ICU Medical), Nipro Corporation, Medtronic plc, Fresenius Kabi AG, Gerresheimer AG, Hindustan Syringes & Medical Devices Ltd. (HMD), Amsino International, Inc., B. Braun Melsungen AG, Aesculap AG (B. Braun Group), Halyard Health, Inc., Medline Industries, LP, Poly Medicure Ltd., Shandong Weigao Group Medical Polymer Co., Ltd., Zhejiang Kindly Medical Devices Co., Ltd., Jiangsu Jichun Medical Devices Co., Ltd., Shanghai Kindly Medical Instruments Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain disposable syringes market is poised for significant transformation, driven by technological advancements and evolving healthcare needs. As the demand for safety-engineered syringes increases, manufacturers are likely to invest in innovative designs that enhance patient safety. Additionally, the expansion of e-commerce platforms for medical supplies will facilitate greater accessibility, allowing consumers and healthcare providers to procure syringes more efficiently. These trends indicate a dynamic market landscape that prioritizes safety and convenience in healthcare delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Disposable Syringes Safety Syringes Prefilled Syringes Insulin Syringes Oral Syringes Others |

| By End-User | Hospitals Clinics Home Healthcare Pharmaceutical Companies Blood Collection Centers Diabetic Care Centers Veterinary Care Centers Others |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Distributors Pharmacies Others |

| By Material | Polymer (Plastic) Glass Others |

| By Capacity | ml ml ml ml ml Others |

| By Application | Vaccination Blood Sampling Drug Delivery Insulin Administration Others |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Pharmaceutical Distributors | 50 | Sales Managers, Distribution Heads |

| Healthcare Professionals | 70 | Doctors, Nurses, Medical Technicians |

| Manufacturers of Medical Devices | 40 | Product Managers, Quality Assurance Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Bahrain Disposable Syringes Market is valued at approximately USD 28 million, reflecting a comprehensive analysis of healthcare expenditure and medical device import trends over the past five years.