Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7992

Pages:98

Published On:December 2025

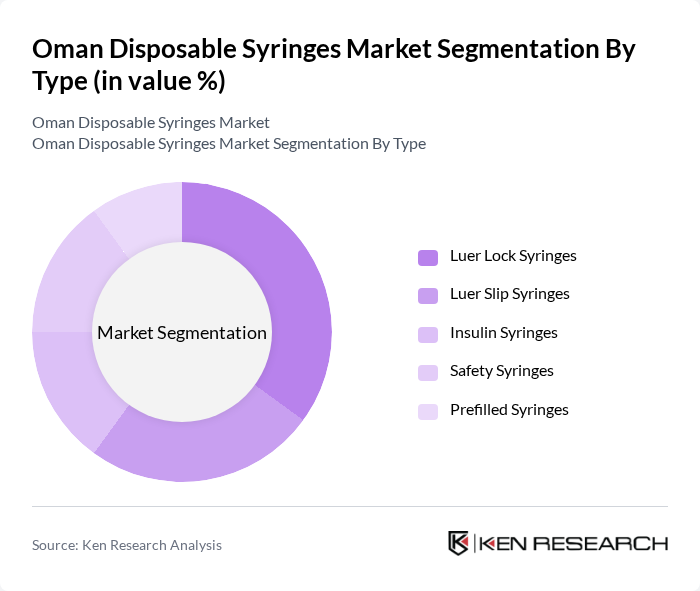

By Type:The market is segmented into various types of syringes, including Luer Lock Syringes, Luer Slip Syringes, Insulin Syringes, Safety Syringes, and Prefilled Syringes. Among these, Luer Lock Syringes are gaining traction due to their secure connection, which minimizes the risk of leakage and ensures accurate dosing. The increasing focus on patient safety and the rise in chronic diseases are propelling the demand for these syringes. Safety Syringes are also witnessing significant growth as healthcare facilities prioritize safety features to protect against needlestick injuries.

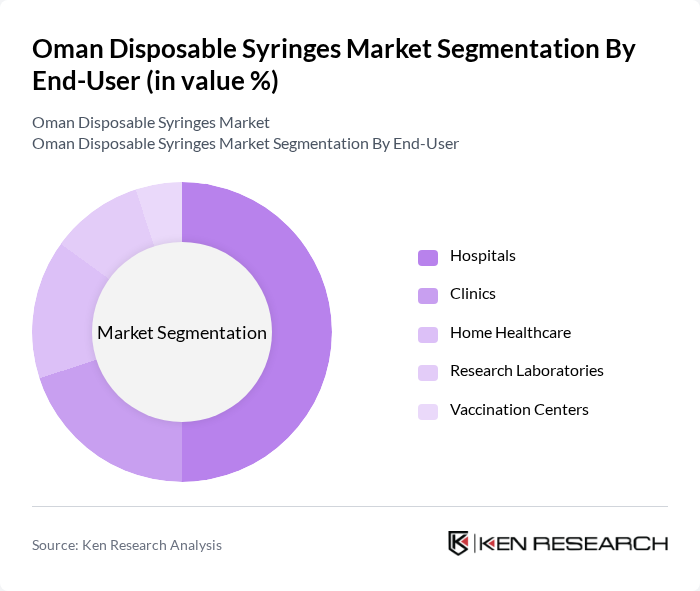

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Research Laboratories, and Vaccination Centers. Hospitals are the leading end-users due to their high volume of procedures requiring syringes, particularly for vaccinations and drug delivery. The increasing number of outpatient procedures and the growing trend of home healthcare are also contributing to the demand from clinics and home healthcare providers. Vaccination Centers have seen a surge in demand for disposable syringes, especially during vaccination drives.

The Oman Disposable Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as B. Braun Melsungen AG, Terumo Corporation, Smiths Medical, Becton, Dickinson and Company, Nipro Corporation, Fresenius Kabi AG, Medtronic plc, Gerresheimer AG, Cardinal Health, Inc., Hindustan Syringes & Medical Devices Limited (HMD), Amsino International, Inc., Unilife Corporation, Zephyrus Innovations, Stryker Corporation, Aesculap AG contribute to innovation, geographic expansion, and service delivery in this space.

The Oman disposable syringes market is poised for significant growth driven by increasing healthcare investments and a rising focus on patient safety. As the healthcare infrastructure expands, particularly in rural areas, the demand for disposable syringes will likely increase. Additionally, technological advancements in syringe design and materials will enhance product offerings, catering to evolving consumer preferences. The market is expected to adapt to these trends, ensuring a robust supply chain and improved access to medical supplies across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Luer Lock Syringes Luer Slip Syringes Insulin Syringes Safety Syringes Prefilled Syringes |

| By End-User | Hospitals Clinics Home Healthcare Research Laboratories Vaccination Centers |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Distributors Pharmacies Government Healthcare Procurement |

| By Material | Plastic Syringes Glass Syringes Biodegradable Syringes Stainless Steel Components |

| By Capacity | ml Syringes ml Syringes ml Syringes Larger Capacity Syringes (>10ml) |

| By Application | Vaccination Drug Delivery Blood Sampling Insulin Administration |

| By Region | Muscat Salalah Sohar Nizwa Other Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Clinics and Private Practices | 80 | General Practitioners, Clinic Administrators |

| Pharmaceutical Distributors | 70 | Sales Managers, Distribution Coordinators |

| Public Health Organizations | 60 | Health Policy Analysts, Program Managers |

| Medical Equipment Suppliers | 90 | Sales Representatives, Product Managers |

The Oman Disposable Syringes Market is valued at approximately USD 42 million, reflecting a significant growth trend driven by the increasing demand for safe medical practices and the rising prevalence of chronic diseases requiring regular medication.