Region:Middle East

Author(s):Geetanshi

Product Code:KRAE1228

Pages:90

Published On:December 2025

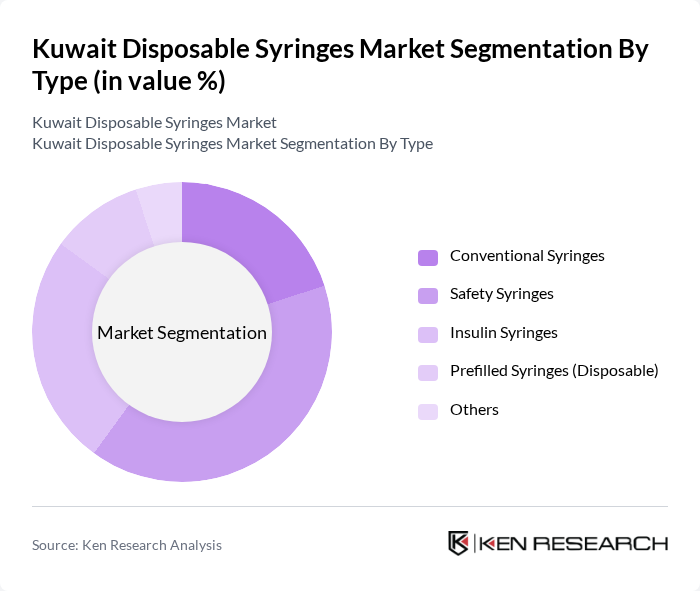

By Type:

The disposable syringes market can be segmented into several types, including Conventional Syringes, Safety Syringes, Insulin Syringes, Prefilled Syringes (Disposable), and Others. In Kuwait, Safety Syringes are currently the leading revenue-generating segment, reflecting the shift toward safety-engineered devices to reduce needlestick injuries and improve infection control in hospitals and clinics. The increasing focus on occupational safety regulations, adherence to standardized infection prevention protocols, and hospital accreditation requirements has led to a higher adoption rate of safety syringes. Additionally, the rise in diabetes prevalence in Kuwait and the promotion of self-administration for insulin therapy have boosted the demand for Insulin Syringes and related pen needles, further contributing to the market’s growth. Prefilled disposable syringes are also gaining traction, particularly for vaccines and chronic disease biologics, due to advantages in dosing accuracy and reduced contamination risk.

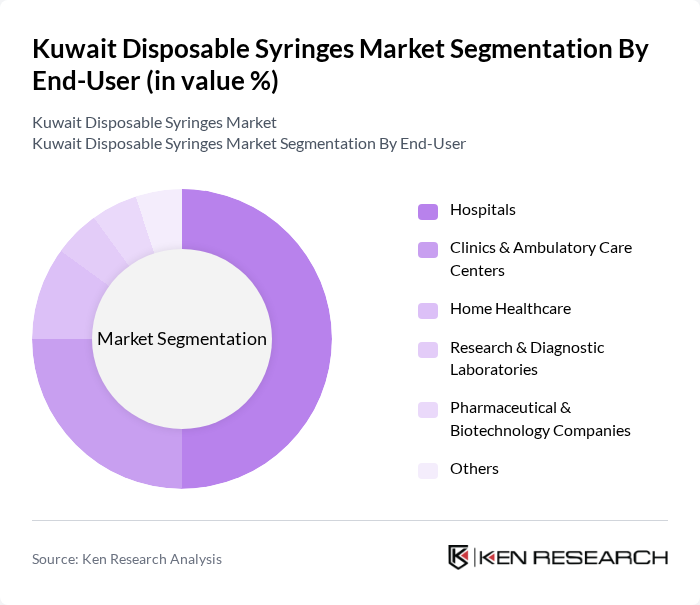

By End-User:

The end-user segmentation of the disposable syringes market includes Hospitals, Clinics & Ambulatory Care Centers, Home Healthcare, Research & Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, and Others. Hospitals are the leading end-user segment, driven by the high volume of inpatient and outpatient procedures requiring syringes for medication administration, vaccinations, anesthesia, and chronic disease management. The increasing number of day-care and ambulatory procedures, alongside ongoing public immunization and screening campaigns, is supporting demand from Clinics & Ambulatory Care Centers. Home Healthcare is expanding as patients with diabetes, renal disease, and other chronic conditions increasingly use syringes and related devices for self-administration and long-term therapy at home. Research & Diagnostic Laboratories and Pharmaceutical & Biotechnology Companies contribute through routine sample collection, testing, and the use of syringes in production, quality control, and clinical research activities, further reinforcing overall market demand.

The Kuwait Disposable Syringes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), B. Braun Melsungen AG, Terumo Corporation, Nipro Corporation, Medtronic plc (Including Covidien Brand), Smiths Medical (ICU Medical, Inc.), Fresenius Kabi AG, Gerresheimer AG, Cardinal Health, Inc., Hindustan Syringes & Medical Devices Ltd. (HMD), Amsino International, Inc., Al Mailem Medical & Healthcare Supplies Co. (Kuwait), United Medical Industries Co. (UMI – Gulf Investment, Kuwait/Saudi), Medline Industries, LP, AlMulla Health Care Co. (Al Mulla Group, Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait disposable syringes market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As healthcare providers increasingly prioritize patient safety, the demand for safety-engineered syringes is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate greater access to disposable syringes, allowing manufacturers to reach a broader audience. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional Syringes Safety Syringes Insulin Syringes Prefilled Syringes (Disposable) Others |

| By End-User | Hospitals Clinics & Ambulatory Care Centers Home Healthcare Research & Diagnostic Laboratories Pharmaceutical & Biotechnology Companies Others |

| By Material | Plastic Syringes Glass Syringes Others |

| By Capacity | ?1 ml Syringes –3 ml Syringes –5 ml Syringes –10 ml Syringes >10 ml Syringes |

| By Distribution Channel | Direct Institutional Tendering (MOH & Government Entities) Private Hospital & Clinic Procurement Local Medical Distributors & Importers Retail & Hospital Pharmacies Online & Other Channels |

| By Application | Vaccination & Immunization Blood & Specimen Collection Therapeutic Drug Delivery Diabetes & Other Self?Injection Others |

| By Region | Capital (Al Asimah) Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra Governorate Mubarak Al Kabeer Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Coordinators |

| Private Clinics and Practices | 90 | Clinic Owners, Medical Directors |

| Pharmaceutical Distributors | 60 | Sales Managers, Distribution Coordinators |

| Public Health Organizations | 50 | Health Policy Analysts, Program Managers |

| Manufacturers of Medical Supplies | 80 | Product Managers, Quality Assurance Officers |

The Kuwait Disposable Syringes Market is valued at approximately USD 16 million, reflecting a five-year historical analysis. This valuation is influenced by factors such as chronic disease prevalence and advancements in syringe technology.