Region:Global

Author(s):Dev

Product Code:KRAA9479

Pages:88

Published On:November 2025

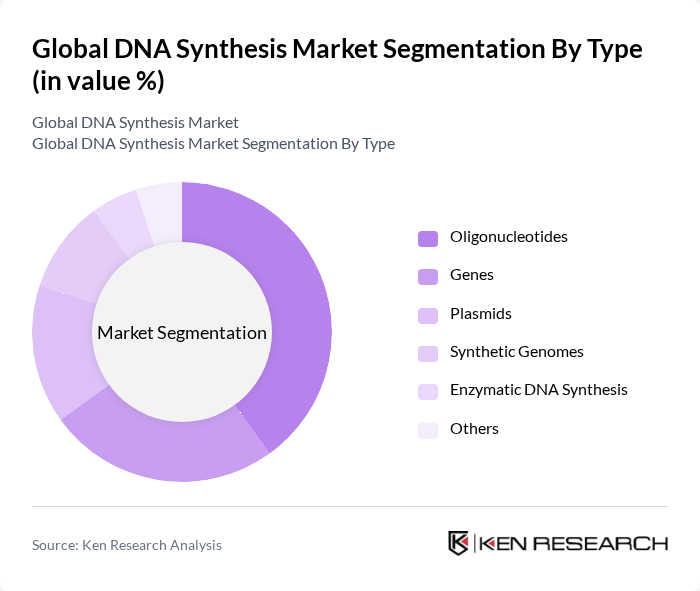

By Type:The DNA synthesis market can be segmented into Oligonucleotides, Genes, Plasmids, Synthetic Genomes, Enzymatic DNA Synthesis, and Others. Among these, Oligonucleotides are currently dominating the market due to their extensive applications in diagnostics, therapeutics, and research. The increasing demand for personalized medicine, rapid growth in gene editing technologies such as CRISPR, and the versatility of oligonucleotides in applications like PCR and gene synthesis are key drivers for this segment.

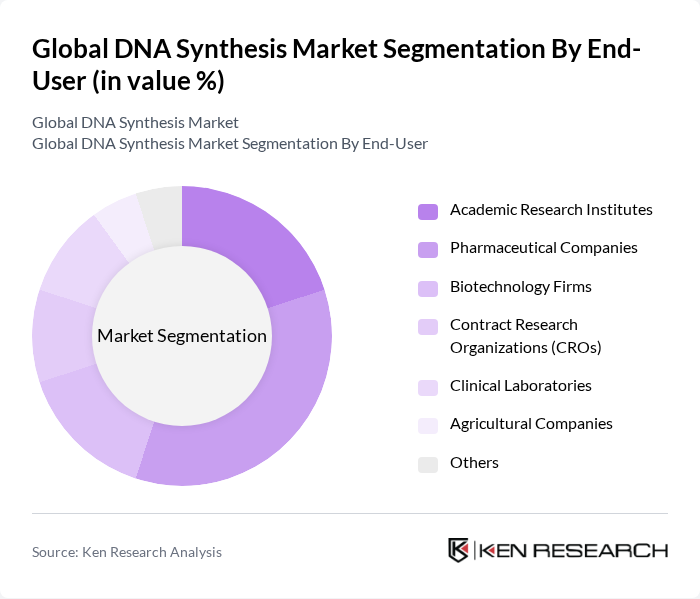

By End-User:The end-user segmentation includes Academic Research Institutes, Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations (CROs), Clinical Laboratories, Agricultural Companies, and Others. Pharmaceutical Companies are leading this segment, driven by the increasing need for novel drug development, personalized therapies, and the adoption of synthetic biology in drug discovery. The rise in chronic diseases and genetic disorders has led to a surge in demand for DNA synthesis services, particularly in drug discovery and development processes.

The Global DNA Synthesis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific, Integrated DNA Technologies (IDT), GenScript Biotech Corporation, Eurofins Genomics, Twist Bioscience Corporation, Synthetic Genomics, Inc., Bioneer Corporation, DNA Script, ATUM, Bio Basic Inc., LGC Biosearch Technologies, Roche Diagnostics, Illumina, Inc., Agilent Technologies, Inc., QIAGEN N.V., ProteoGenix, Quintara Biosciences, Synbio Technologies, IBA Lifesciences GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the DNA synthesis market is poised for significant transformation, driven by technological advancements and increasing demand for personalized medicine. As automation and artificial intelligence become integral to genomic research, the efficiency and accuracy of DNA synthesis processes will improve. Furthermore, the focus on sustainable practices in biotechnology will likely lead to innovative solutions that address environmental concerns, fostering a more responsible approach to genetic engineering and expanding the market's potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Oligonucleotides Genes Plasmids Synthetic Genomes Enzymatic DNA Synthesis Others |

| By End-User | Academic Research Institutes Pharmaceutical Companies Biotechnology Firms Contract Research Organizations (CROs) Clinical Laboratories Agricultural Companies Others |

| By Application | Drug Development Genetic Engineering Diagnostics Agricultural Biotechnology Vaccine Development Synthetic Biology Personalized Medicine Others |

| By Technology | Polymerase Chain Reaction (PCR) Next-Generation Sequencing (NGS) CRISPR Technology Microarray Technology Enzymatic DNA Synthesis Automation & Robotics Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Others |

| By Policy Support | Research Grants Tax Incentives Regulatory Support Public Awareness Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | Biotech Researchers, Drug Development Managers |

| Academic Research Institutions | 60 | University Professors, Lab Directors |

| Agricultural Biotechnology | 50 | Agronomists, Crop Scientists |

| Clinical Diagnostics | 70 | Clinical Lab Managers, Diagnostic Product Developers |

| Synthetic Biology Startups | 40 | Founders, Product Development Leads |

The Global DNA Synthesis Market is valued at approximately USD 5.4 billion, driven by advancements in gene editing technologies, synthetic biology demand, and the rising prevalence of genetic disorders requiring innovative therapeutic solutions.