Region:Asia

Author(s):Geetanshi

Product Code:KRAB1652

Pages:88

Published On:January 2026

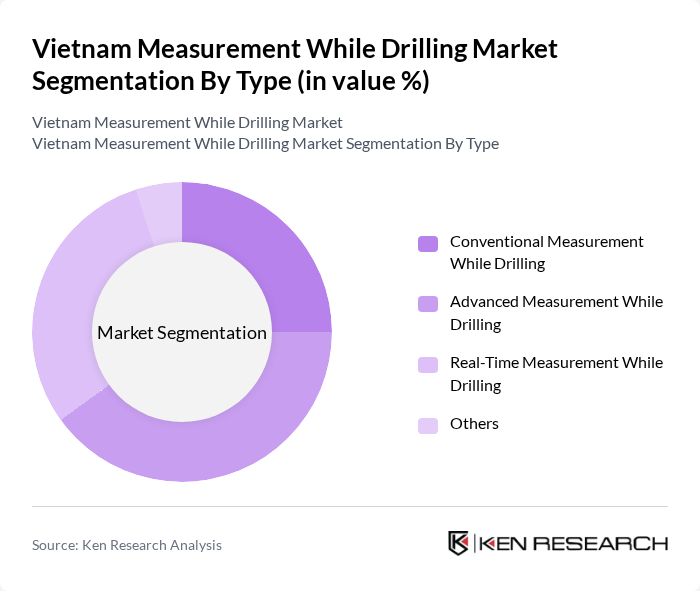

By Type:The market is segmented into various types, including Rotary Steerable Systems, Measurement While Drilling Tools, Logging While Drilling Tools, and Others. Among these, Measurement While Drilling Tools are currently leading the market due to their critical role in providing real-time data during drilling operations, which enhances decision-making and operational efficiency. The increasing complexity of drilling projects and the need for precise data are driving the demand for these tools.

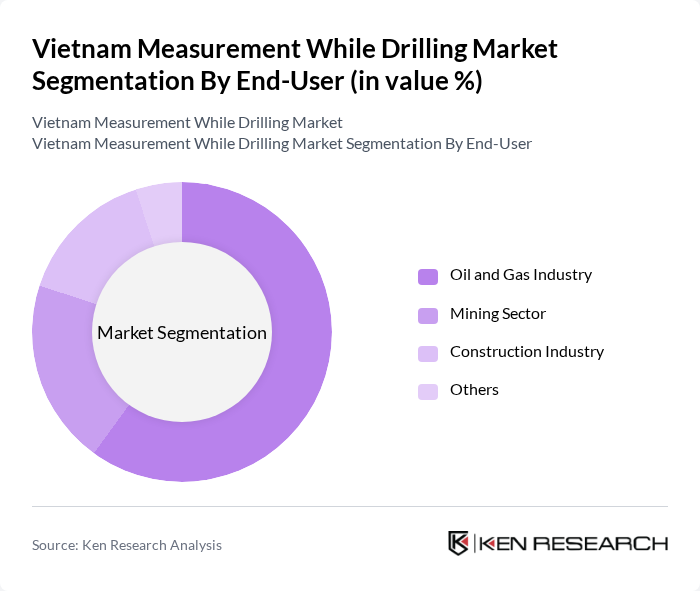

By End-User:The end-user segmentation includes Oil and Gas Exploration Companies, Mining Companies, Geothermal Energy Producers, and Others. Oil and Gas Exploration Companies dominate this segment, driven by the increasing exploration activities in Vietnam's offshore and onshore fields. The need for efficient drilling solutions to maximize resource extraction is propelling the demand for measurement while drilling technologies among these companies.

The Vietnam Measurement While Drilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger, Halliburton, Baker Hughes, Weatherford International, National Oilwell Varco, TechnipFMC, Aker Solutions, GE Oil & Gas, Eni S.p.A., PetroVietnam, CNOOC, TotalEnergies, Sinopec, Repsol, and PTT Exploration and Production contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam Measurement While Drilling market is poised for significant transformation, driven by technological advancements and increasing energy demands. As the government prioritizes energy independence, investments in offshore drilling and automation are expected to rise. Furthermore, the integration of renewable energy sources into traditional drilling operations will create new avenues for growth. Companies that adapt to these trends and invest in workforce development will likely gain a competitive edge in this evolving landscape, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rotary Steerable Systems Measurement While Drilling Tools Logging While Drilling Tools Others |

| By End-User | Oil and Gas Exploration Companies Mining Companies Geothermal Energy Producers Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam |

| By Technology | Conventional Drilling Technology Advanced Drilling Technology Hybrid Drilling Technology Others |

| By Application | Onshore Drilling Offshore Drilling Deepwater Drilling Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Drilling Operations | 120 | Drilling Engineers, Site Managers |

| Offshore Drilling Projects | 100 | Project Managers, Operations Supervisors |

| MWD Technology Providers | 80 | Product Development Managers, Sales Directors |

| Regulatory Compliance in Drilling | 60 | Compliance Officers, Legal Advisors |

| Environmental Impact Assessments | 90 | Environmental Engineers, Sustainability Managers |

The Vietnam Measurement While Drilling market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient drilling technologies in the oil and gas sector.