Region:Global

Author(s):Dev

Product Code:KRAD5078

Pages:97

Published On:December 2025

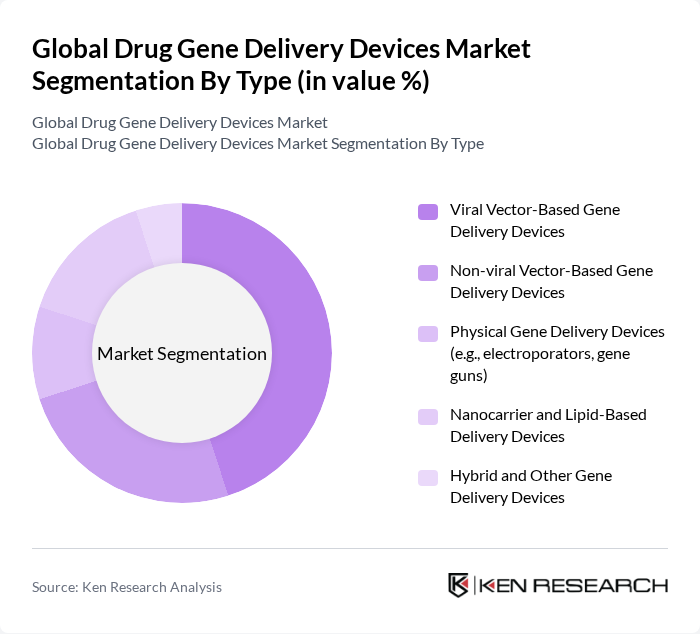

By Type:The market is segmented into various types of gene delivery devices, including viral vector-based, non-viral vector-based, physical gene delivery devices, nanocarrier and lipid-based delivery devices, and hybrid and other gene delivery devices. Viral vector-based gene delivery devices currently represent the largest share, reflecting the widespread use of adeno?associated virus (AAV) and lentiviral vectors in approved gene therapies and late-stage clinical trials due to their high transduction efficiency and sustained gene expression in target cells.

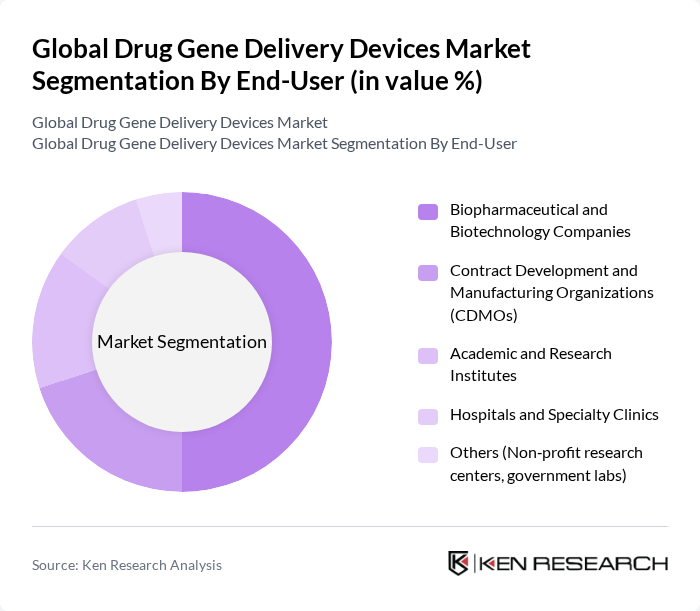

By End-User:The end-user segmentation includes biopharmaceutical and biotechnology companies, contract development and manufacturing organizations (CDMOs), academic and research institutes, hospitals and specialty clinics, and others such as non-profit research centers and government labs. Biopharmaceutical and biotechnology companies are the dominant end-users, driven by their leadership in advancing gene therapy pipelines, scaling vector manufacturing, and integrating specialized delivery platforms into clinical and commercial products.

The Global Drug Gene Delivery Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Lonza Group Ltd., Catalent, Inc., Danaher Corporation (Cytiva), Oxford Biomedica plc, ViroCell Biologics Ltd., Regenxbio Inc., Sarepta Therapeutics, Inc., Krystal Biotech, Inc., Bluebird Bio, Inc., Spark Therapeutics, Inc., Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd. contribute to innovation, geographic expansion, and service delivery in this space, particularly in areas such as vector production, gene therapy development, and specialized delivery platforms.

The future of the drug gene delivery devices market appears promising, driven by ongoing advancements in technology and increasing demand for personalized medicine. As the integration of artificial intelligence and machine learning enhances gene delivery systems, the market is expected to witness significant growth. Additionally, the focus on rare diseases and the development of novel delivery methods will create new opportunities for innovation, ultimately improving patient outcomes and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Viral Vector-Based Gene Delivery Devices Non-viral Vector-Based Gene Delivery Devices Physical Gene Delivery Devices (e.g., electroporators, gene guns) Nanocarrier and Lipid-Based Delivery Devices Hybrid and Other Gene Delivery Devices |

| By End-User | Biopharmaceutical and Biotechnology Companies Contract Development and Manufacturing Organizations (CDMOs) Academic and Research Institutes Hospitals and Specialty Clinics Others (Non?profit research centers, government labs) |

| By Application | Gene Therapy for Oncology Gene Therapy for Inherited Genetic Disorders Infectious Disease Vaccines and Therapies Regenerative Medicine and Cell Therapy Support Other Therapeutic and Research Applications |

| By Delivery Method | In Vivo Delivery Ex Vivo Delivery Systemic Delivery Local/Targeted Delivery Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Viral Vector Technologies (AAV, lentiviral, adenoviral, others) Non-viral Physical Technologies (electroporation, microinjection, etc.) Lipid Nanoparticle (LNP) and Polymer-Based Technologies Genome Editing-Enabled Delivery (CRISPR/Cas, TALEN, ZFN) Other Emerging Gene Delivery Platforms |

| By Regulatory Status | Commercially Approved Gene Delivery Products Products in Phase III Clinical Trials Products in Phase I/II Clinical Trials Preclinical and Research-Use-Only Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Product Development Managers, Regulatory Affairs Specialists |

| Healthcare Providers | 110 | Clinicians, Pharmacists, Healthcare Administrators |

| Research Institutions | 90 | Research Scientists, Lab Managers |

| Medical Device Companies | 80 | Marketing Directors, Sales Managers |

| Regulatory Bodies | 60 | Policy Makers, Compliance Officers |

The Global Drug Gene Delivery Devices Market is valued at approximately USD 6.0 billion, driven by advancements in gene delivery technologies and increasing prevalence of genetic disorders, alongside rising investments in research and development by biopharmaceutical companies.