Region:Global

Author(s):Rebecca

Product Code:KRAA2387

Pages:100

Published On:August 2025

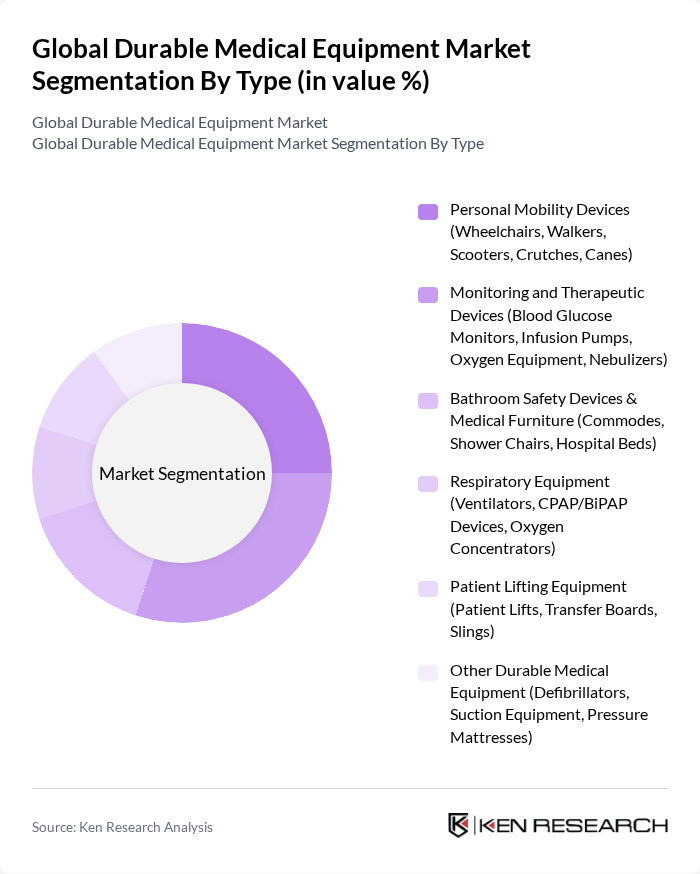

By Type:The market can be segmented into various types of durable medical equipment, including personal mobility devices, monitoring and therapeutic devices, bathroom safety devices and medical furniture, respiratory equipment, patient lifting equipment, and other durable medical equipment. Each of these subsegments plays a crucial role in enhancing patient care and improving the quality of life for individuals with medical needs. Personal mobility devices (such as wheelchairs and walkers) are essential for individuals with mobility impairments, while monitoring and therapeutic devices (like blood glucose monitors and infusion pumps) are critical for chronic disease management. Bathroom safety devices and medical furniture support patient safety and comfort, respiratory equipment addresses pulmonary conditions, and patient lifting equipment facilitates safe transfers. Other durable medical equipment includes specialized devices for emergency and long-term care .

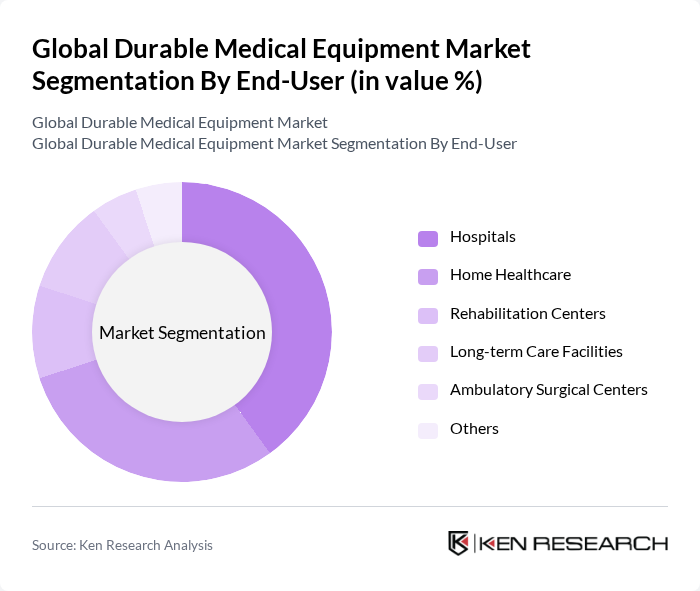

By End-User:The durable medical equipment market is segmented by end-users, which include hospitals, home healthcare, rehabilitation centers, long-term care facilities, ambulatory surgical centers, and others. Hospitals remain the largest end-user segment due to their broad range of patient needs and high volume of equipment usage. Home healthcare is rapidly growing, driven by patient preference for in-home treatment and the expansion of remote monitoring technologies. Rehabilitation centers and long-term care facilities require specialized equipment for patient recovery and chronic care, while ambulatory surgical centers focus on outpatient procedures. Other end-users include clinics and specialty care providers .

The Global Durable Medical Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (including DePuy Synthes), Siemens Healthineers AG, Philips Healthcare (Koninklijke Philips N.V.), GE HealthCare Technologies Inc., Baxter International Inc., Stryker Corporation, B. Braun Melsungen AG, Hillrom (now part of Baxter International Inc.), 3M Company, Fresenius Medical Care AG & Co. KGaA, Abbott Laboratories, Zimmer Biomet Holdings, Inc., Canon Medical Systems Corporation, Terumo Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the durable medical equipment market appears promising, driven by technological advancements and an increasing focus on patient-centric care. As healthcare systems evolve, the integration of telehealth and remote monitoring solutions will likely enhance patient engagement and accessibility. Additionally, the ongoing expansion of healthcare infrastructure in emerging markets will create new avenues for growth, enabling manufacturers to tap into previously underserved populations and meet rising demand for innovative medical solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Mobility Devices (Wheelchairs, Walkers, Scooters, Crutches, Canes) Monitoring and Therapeutic Devices (Blood Glucose Monitors, Infusion Pumps, Oxygen Equipment, Nebulizers) Bathroom Safety Devices & Medical Furniture (Commodes, Shower Chairs, Hospital Beds) Respiratory Equipment (Ventilators, CPAP/BiPAP Devices, Oxygen Concentrators) Patient Lifting Equipment (Patient Lifts, Transfer Boards, Slings) Other Durable Medical Equipment (Defibrillators, Suction Equipment, Pressure Mattresses) |

| By End-User | Hospitals Home Healthcare Rehabilitation Centers Long-term Care Facilities Ambulatory Surgical Centers Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Application | Rehabilitation Diagnostics Treatment Monitoring Others |

| By Component | Equipment Accessories Software Services Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Equipment Procurement | 100 | Procurement Managers, Hospital Administrators |

| Home Healthcare Devices | 60 | Home Care Providers, Patients |

| Rehabilitation Equipment | 50 | Physical Therapists, Rehabilitation Center Managers |

| Long-term Care Facilities | 40 | Facility Managers, Nursing Staff |

| Durable Medical Equipment Distributors | 45 | Sales Representatives, Distribution Managers |

The Global Durable Medical Equipment Market is valued at approximately USD 230 billion, driven by factors such as the increasing prevalence of chronic diseases, an aging population, and advancements in technology that enhance medical equipment accessibility and functionality.