Region:Global

Author(s):Dev

Product Code:KRAB1899

Pages:99

Published On:January 2026

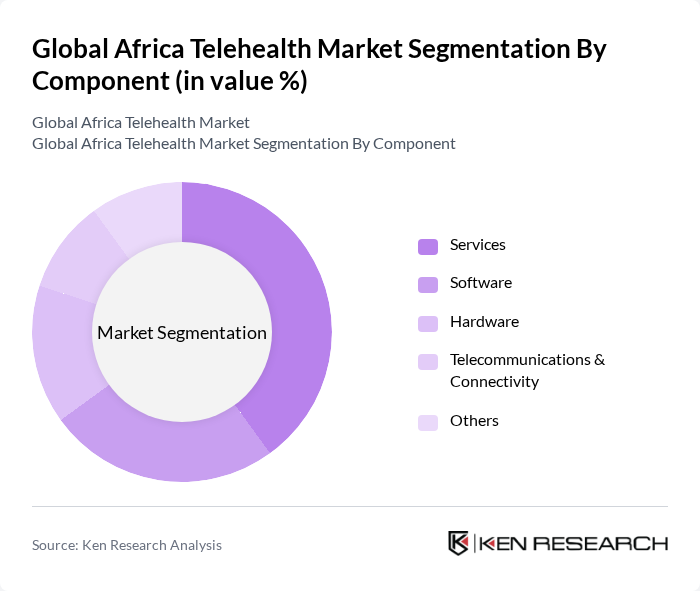

By Component:The telehealth market can be segmented into various components, including services, software, hardware, telecommunications & connectivity, and others. Each of these components plays a crucial role in delivering telehealth solutions to patients and healthcare providers.

The services segment is currently dominating the market, driven by the increasing demand for virtual consultations and remote patient monitoring, in line with regional data where services account for the largest revenue share in telehealth offerings. Patients are increasingly opting for teleconsultations due to their convenience and accessibility, especially in rural areas where healthcare facilities are limited. The trend towards preventive care and chronic disease management, together with wider use of remote monitoring devices and integrated digital platforms, is also contributing to the growth of this segment, as healthcare providers seek to offer continuous care through telehealth programs. As a result, services are expected to maintain their leadership position in the telehealth market.

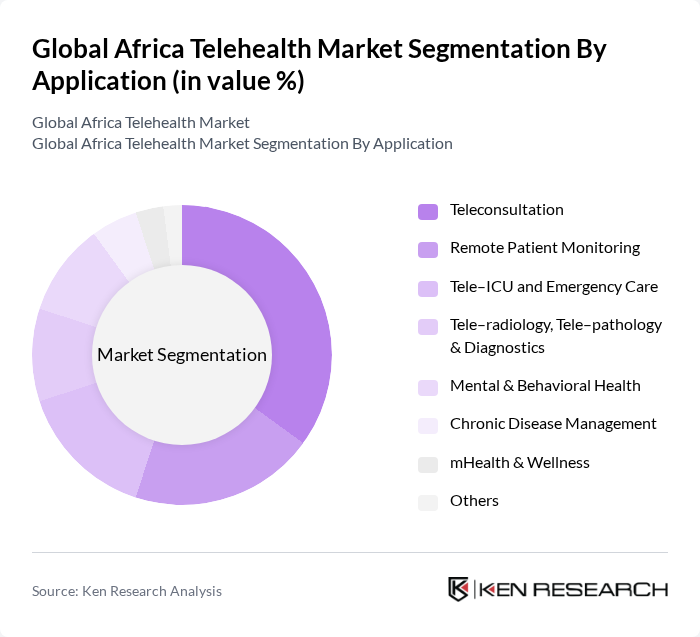

By Application:The telehealth market can also be segmented by application, which includes teleconsultation, remote patient monitoring, tele-ICU and emergency care, tele-radiology, tele-pathology & diagnostics, mental & behavioral health, chronic disease management, mHealth & wellness, and others. Each application addresses specific healthcare needs and enhances patient care.

Among the applications, teleconsultation is the leading segment, as it allows patients to consult healthcare professionals remotely, reducing the need for in-person visits and helping to alleviate pressure on hospital infrastructure. The convenience of accessing healthcare from home, coupled with the growing acceptance of telehealth by both patients and providers and wider promotion of virtual care platforms by governments and health systems, has significantly boosted the popularity of teleconsultation services. Additionally, the rise in chronic diseases and the need for ongoing patient monitoring, supported by real-time data collection and integrated digital records, have further solidified teleconsultation's position as a dominant application in the telehealth market.

The Global Africa Telehealth Market is characterized by a dynamic mix of regional and international players. Leading participants such as Teladoc Health, Amwell, Babylon Health, Doctor On Demand, MDLive, HealthTap, mPharma, LifeQ, Vezeeta, Helium Health, RelianceHMO, Rocket Health, MYDAWA, Telemedico, and other emerging regional players contribute to innovation, geographic expansion, and service delivery in this space.

The future of telehealth in Africa appears promising, driven by technological advancements and increasing healthcare demands. In future, the integration of artificial intelligence in telehealth solutions is expected to enhance diagnostic accuracy and patient engagement. Additionally, the rise of mobile health applications will facilitate better access to healthcare services, particularly in remote areas. As governments continue to invest in digital health infrastructure, the telehealth market is likely to experience significant growth, improving healthcare delivery across the continent.

| Segment | Sub-Segments |

|---|---|

| By Component | Services Software Hardware Telecommunications & Connectivity Others |

| By Application | Teleconsultation Remote Patient Monitoring Tele–ICU and Emergency Care Tele–radiology, Tele–pathology & Diagnostics Mental & Behavioral Health Chronic Disease Management mHealth & Wellness Others |

| By Delivery Mode | Web?based Cloud?based On?premises Hybrid |

| By End User | Hospitals & Health Systems Clinics & Physician Practices Homecare & Patients Employers & Corporate Health Programs NGOs, Donor?funded & Community Health Programs Payers & Health Insurers Others |

| By Technology | Video Conferencing & Virtual Visit Platforms Mobile Health (mHealth) Applications Remote Patient Monitoring Devices & Wearables Cloud & Data Analytics Platforms AI?enabled Decision Support & Triage Tools Others |

| By Clinical Specialty | Primary Care & Family Medicine Mental & Behavioral Health Cardiology Diabetes & Endocrinology Maternal, Neonatal & Child Health Infectious Diseases & HIV/TB Programs Dermatology Others |

| By Payment & Reimbursement Model | Out?of?pocket / Self?pay Private Insurance & Health Plans Government & Donor?funded Programs Employer?sponsored Programs Subscription & Capitation Models Pay?per?visit / Fee?for?service Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Doctors, Telehealth Coordinators |

| Patients Using Telehealth Services | 140 | Telehealth Users, Patient Advocates |

| Healthcare Policymakers | 90 | Health Ministry Officials, Regulatory Bodies |

| Telehealth Technology Providers | 80 | Product Managers, Technical Leads |

| Insurance Companies | 70 | Underwriters, Claims Managers |

The Global Africa Telehealth Market is valued at approximately USD 1.6 billion, reflecting the region's share of the global telehealth market and recent benchmarks, driven by increased demand for remote healthcare services, especially during the COVID-19 pandemic.