Region:Global

Author(s):Dev

Product Code:KRAA3014

Pages:90

Published On:August 2025

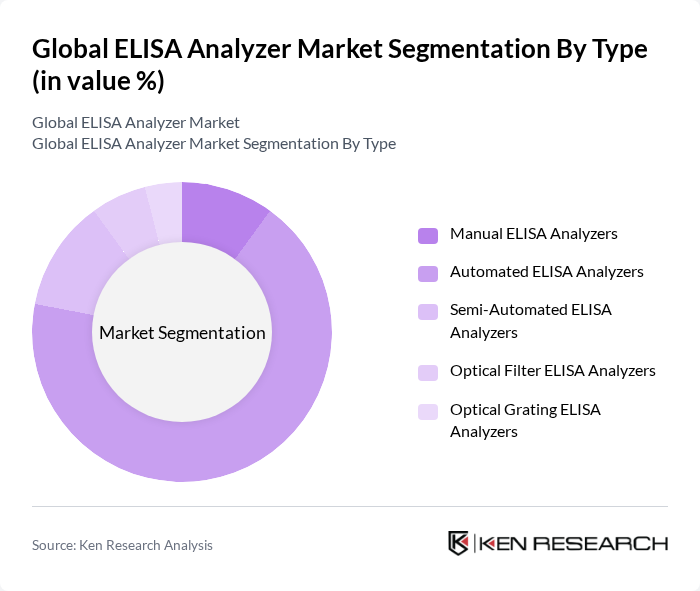

By Type:The ELISA Analyzer market is segmented into Manual ELISA Analyzers, Automated ELISA Analyzers, Semi-Automated ELISA Analyzers, Optical Filter ELISA Analyzers, and Optical Grating ELISA Analyzers. Automated ELISA Analyzers hold the largest market share, driven by their efficiency, high throughput, and ability to address staffing shortages in clinical laboratories. Automation is increasingly favored as laboratories seek to minimize manual intervention and improve traceability and compliance .

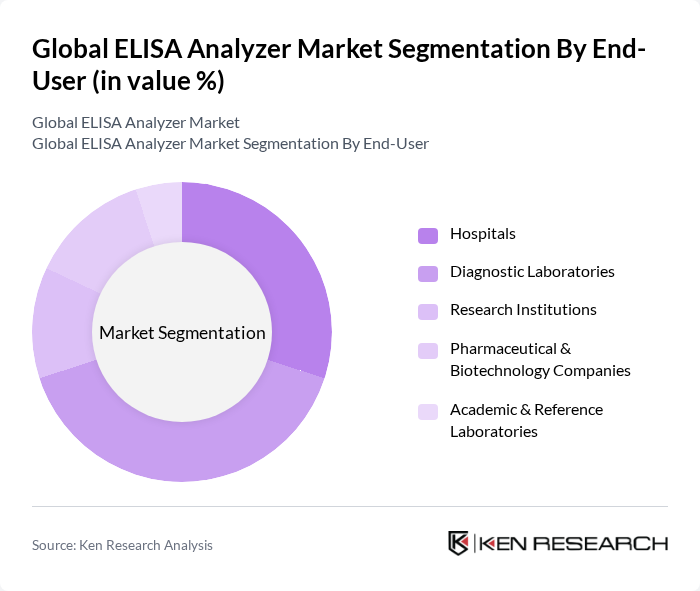

By End-User:The market is further segmented by end-users, including Hospitals, Diagnostic Laboratories, Research Institutions, Pharmaceutical & Biotechnology Companies, and Academic & Reference Laboratories. Diagnostic Laboratories represent the largest end-user segment, reflecting the high volume of routine and specialized testing performed in these settings. Hospitals and pharmaceutical companies are also significant contributors, driven by the need for rapid, reliable diagnostics and drug development support .

The Global ELISA Analyzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Abbott Laboratories, Siemens Healthineers, Roche Diagnostics, PerkinElmer, Inc., Ortho Clinical Diagnostics, Agilent Technologies, Inc., Beckman Coulter, Inc., Becton, Dickinson and Company, Mindray Medical International Limited, Eppendorf AG, DiaSorin S.p.A., Fujirebio Inc., GenWay Biotech, Inc., Awareness Technology, Inc., EUROIMMUN AG, Trinity Biotech plc, Erba Mannheim, BioTek Instruments, Inc., Berthold Technologies GmbH & Co. KG, Dynex Technologies, Inc., Gold Standard Diagnostics Corp., Robimes, R-Biopharm AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ELISA analyzer market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As healthcare systems worldwide prioritize early diagnosis and personalized medicine, the demand for efficient and accurate diagnostic tools will continue to rise. Furthermore, the integration of automation and digital health solutions is expected to enhance testing capabilities, making ELISA analyzers more accessible and efficient in various clinical settings, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual ELISA Analyzers Automated ELISA Analyzers Semi-Automated ELISA Analyzers Optical Filter ELISA Analyzers Optical Grating ELISA Analyzers |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Pharmaceutical & Biotechnology Companies Academic & Reference Laboratories |

| By Application | Infectious Disease Testing Hormone Testing Allergy Testing Cancer Biomarker Testing Drug Development & Pharmacokinetics Food Safety & Environmental Testing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Traditional ELISA Enhanced ELISA Multiplex ELISA Chemiluminescence ELISA Fluorescence ELISA Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Directors, Quality Control Managers |

| Research Institutions | 70 | Principal Investigators, Research Scientists |

| Diagnostic Companies | 50 | Product Managers, R&D Directors |

| Healthcare Providers | 40 | Clinical Pathologists, Medical Technologists |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Global ELISA Analyzer Market is valued at approximately USD 1.1 billion, driven by the increasing prevalence of chronic and infectious diseases, demand for automated diagnostic solutions, and advancements in ELISA technology that enhance assay sensitivity and integration with laboratory systems.