Region:Global

Author(s):Shubham

Product Code:KRAA2640

Pages:87

Published On:August 2025

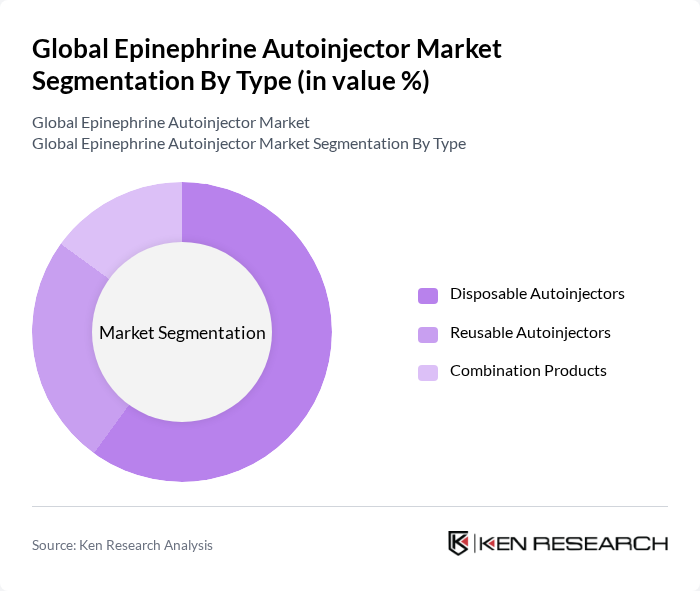

By Type:The market is segmented into three main types: Disposable Autoinjectors, Reusable Autoinjectors, and Combination Products. Disposable autoinjectors are gaining popularity due to their ease of use, convenience, and widespread adoption among patients requiring immediate treatment for allergic reactions. Reusable autoinjectors, while less common, appeal to users seeking cost-effective solutions over time. Combination products, which may include additional features such as integrated digital alerts or multiple medications, are also emerging as a preferred choice for select patient groups .

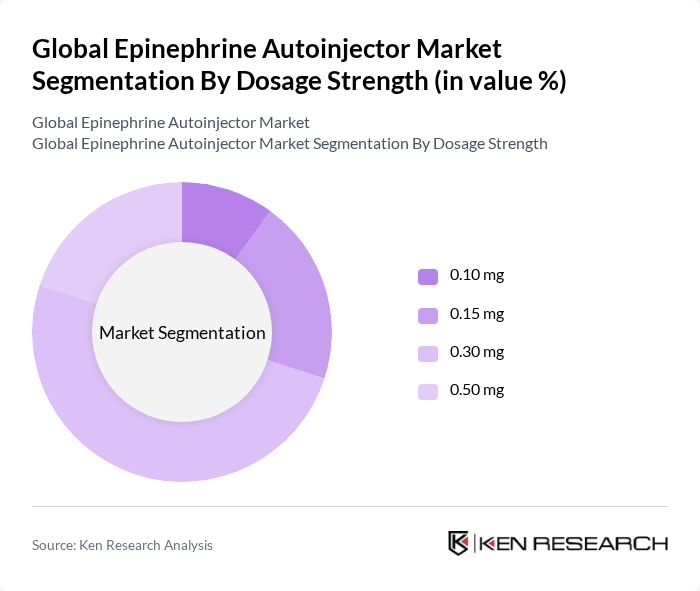

By Dosage Strength:The market is categorized by dosage strength into 0.10 mg, 0.15 mg, 0.30 mg, and 0.50 mg. The 0.30 mg dosage strength is the most widely used, as it is considered effective for a broad range of patients, including adolescents and adults. The 0.15 mg dosage is particularly popular among children, while the 0.10 mg and 0.50 mg dosages address specific patient needs, ensuring a suitable option for various demographics .

The Global Epinephrine Autoinjector Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viatris Inc. (formerly Mylan N.V.), Sanofi S.A., Teva Pharmaceutical Industries Ltd., Kaleo, Inc., Adamis Pharmaceuticals Corporation, Amedra Pharmaceuticals LLC, Pfizer Inc., Amgen Inc., Bausch Health Companies Inc., Sandoz Inc. (Novartis AG), ALK-Abelló A/S, Impax Laboratories, Inc., Emerade (Pharm Swedish AB), Lincoln Medical Ltd., Tianjin Jinyao Group Co., Ltd., Antares Pharma, Inc., Grand Pharma (China), Harvest Pharmaceuticals, Merit Pharmaceutical, Amphastar Pharmaceuticals, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the epinephrine autoinjector market appears promising, driven by increasing demand for user-friendly devices and the integration of digital health technologies. As healthcare providers emphasize personalized medicine, manufacturers are likely to focus on developing tailored solutions that meet individual patient needs. Additionally, the ongoing expansion into emerging markets presents significant growth potential, as awareness and access to these critical devices improve, ultimately enhancing patient outcomes and market penetration.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Autoinjectors Reusable Autoinjectors Combination Products |

| By Dosage Strength | mg mg mg mg |

| By End-User | Hospitals Clinics Homecare Individuals Schools & Universities Emergency Medical Services (EMS) |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Hospitals and Clinics |

| By Age Group | Pediatric (<6 Years) Children (6-12 Years) Adolescent/Adult (>12 Years) Geriatric |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (GCC, South Africa, Rest of Middle East & Africa) |

| By Packaging Type | Single Pack Multi-Pack |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Allergists, Emergency Medicine Specialists |

| Patients with Allergies | 80 | Individuals diagnosed with severe allergies |

| Caregivers and Parents | 60 | Parents of children with anaphylaxis risk |

| Pharmacists | 50 | Community and hospital pharmacists |

| Healthcare Administrators | 40 | Hospital administrators and policy makers |

The Global Epinephrine Autoinjector Market is valued at approximately USD 3.45 billion, reflecting significant growth driven by the increasing prevalence of severe allergic disorders and advancements in autoinjector technology.