Region:Global

Author(s):Shubham

Product Code:KRAA2662

Pages:97

Published On:August 2025

By Type:The market is segmented into various types, including Payment Solutions, Smart Contracts, Identity Management, Asset Management, Supply Chain Finance, Trading & Exchange Platforms, Compliance & Regulatory Technology (RegTech), and Others. Each of these segments plays a crucial role in the overall market dynamics, catering to different needs within the fintech ecosystem. Payment Solutions and Smart Contracts are particularly prominent due to their ability to streamline cross-border payments and automate complex financial agreements, while Identity Management and RegTech are gaining traction for their roles in compliance and fraud prevention .

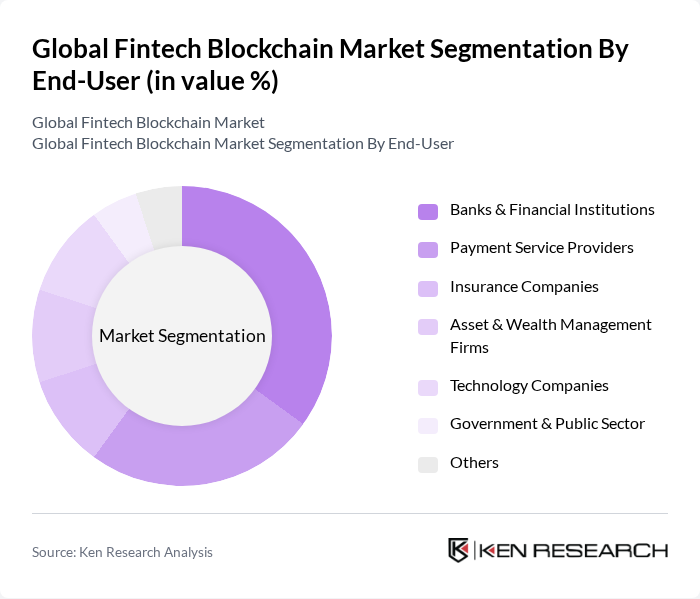

By End-User:The end-user segmentation includes Banks & Financial Institutions, Payment Service Providers, Insurance Companies, Asset & Wealth Management Firms, Technology Companies, Government & Public Sector, and Others. Each segment reflects the diverse applications of blockchain technology across various sectors, highlighting its versatility and adaptability. Banks and financial institutions are the largest adopters, leveraging blockchain for secure transactions and compliance, while payment service providers and technology companies are rapidly expanding their use of blockchain for innovative digital solutions .

The Global Fintech Blockchain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ripple Labs Inc., Chainalysis Inc., BitPay Inc., Coinbase Global Inc., BlockFi Inc., Binance Holdings Ltd., ConsenSys Software Inc., Circle Internet Financial Ltd., Kraken Digital Asset Exchange, Gemini Trust Company, LLC, Digital Asset Holdings LLC, R3 LLC, Hyperledger Foundation, Algorand Inc., Tezos Foundation, Fireblocks Inc., Paxos Trust Company, Ava Labs Inc., Stellar Development Foundation, Sygnum Bank AG contribute to innovation, geographic expansion, and service delivery in this space.

The fintech blockchain market is poised for transformative growth, driven by technological advancements and increasing consumer demand for secure, efficient financial solutions. As central banks explore digital currencies, the integration of blockchain in traditional finance is expected to accelerate. Additionally, the rise of decentralized finance (DeFi) platforms will reshape financial services, offering innovative alternatives to conventional banking. Companies that adapt to these trends will likely gain a competitive edge in the evolving landscape of financial technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Smart Contracts Identity Management Asset Management Supply Chain Finance Trading & Exchange Platforms Compliance & Regulatory Technology (RegTech) Others |

| By End-User | Banks & Financial Institutions Payment Service Providers Insurance Companies Asset & Wealth Management Firms Technology Companies Government & Public Sector Others |

| By Application | Cross-Border Payments & Remittances Trade Finance & Supply Chain Digital Identity Verification Asset Tokenization Lending & Credit Scoring Compliance & KYC/AML Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Investment Source | Venture Capital Private Equity Corporate Investment Government Grants Crowdfunding Others |

| By Policy Support | Government Incentives Tax Breaks Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain Payment Solutions | 120 | Payment Processors, Fintech Founders |

| Decentralized Finance (DeFi) Platforms | 90 | DeFi Developers, Financial Analysts |

| Smart Contract Applications | 60 | Blockchain Engineers, Legal Advisors |

| Regulatory Compliance in Fintech | 50 | Compliance Officers, Risk Management Executives |

| Investment in Blockchain Startups | 70 | Venture Capitalists, Angel Investors |

The Global Fintech Blockchain Market is valued at approximately USD 3.4 billion, driven by the increasing adoption of blockchain technology in financial services, enhancing transaction transparency, security, and efficiency.