Region:Global

Author(s):Dev

Product Code:KRAC8832

Pages:98

Published On:November 2025

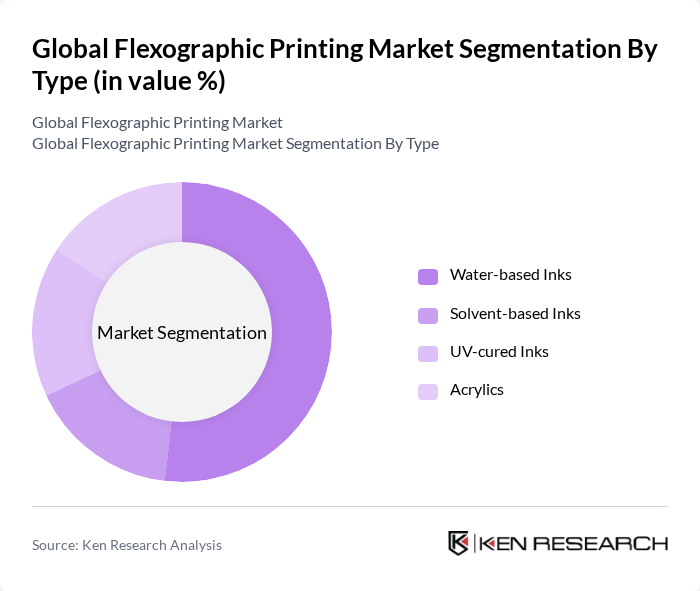

By Type:The flexographic printing market is segmented into various types, including Water-based Inks, Solvent-based Inks, UV-cured Inks, and Others. Water-based inks are gaining significant traction due to their eco-friendliness and compliance with stringent environmental regulations, commanding the largest technology segment share. Solvent-based inks remain popular for their versatility and performance in various applications, while UV-cured inks are favored for their quick drying times and high-quality finishes. The "Others" category includes specialty inks that cater to niche markets.

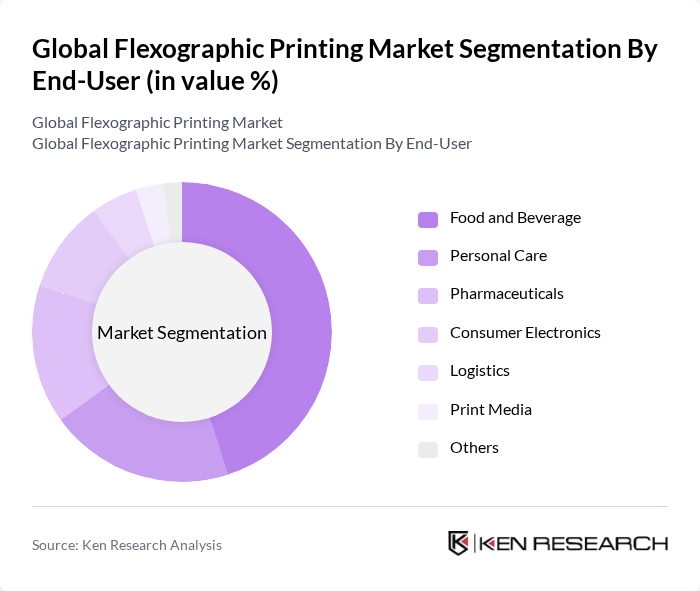

By End-User:The end-user segmentation of the flexographic printing market includes Food and Beverage, Personal Care, Pharmaceuticals, Consumer Electronics, Logistics, Print Media, and Others. The Food and Beverage sector is the largest consumer of flexographic printing services, driven by the need for attractive packaging and labeling. Personal care products also utilize flexographic printing for branding and product information. The Pharmaceuticals sector is increasingly adopting these printing solutions for compliance and safety labeling.

The Global Flexographic Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bobst Group SA, Mark Andy Inc., Flint Group, Sun Chemical Corporation, Siegwerk Druckfarben AG & Co. KGaA, Anderson & Vreeland, Inc., DuPont de Nemours, Inc., Trelleborg AB, UPM-Kymmene Corporation, Avery Dennison Corporation, Esko-Graphics, Koenig & Bauer AG, Heidelberger Druckmaschinen AG, Omet Srl, MPS Systems B.V., All4Labels Global Printing Group, HP Indigo (HP Inc.), Xeikon (Flint Group), Markem-Imaje (Avery Dennison), TC Transcontinental Inc., Mondi Group, Huhtamäki Oyj, Constantia Flexibles, Amcor plc, CCL Industries Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the flexographic printing market appears promising, driven by ongoing innovations and a growing emphasis on sustainability. As companies increasingly adopt automation and IoT technologies, operational efficiencies are expected to improve significantly. Furthermore, the demand for customized packaging solutions is likely to rise, aligning with consumer preferences for personalized products. These trends indicate a robust market evolution, positioning flexographic printing as a key player in the packaging industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based Inks Solvent-based Inks UV-cured Inks Others |

| By End-User | Food and Beverage Personal Care Pharmaceuticals Consumer Electronics Logistics Print Media Others |

| By Application | Labels Flexible Packaging Corrugated Boxes Folding Cartons Others |

| By Ink Type | Conventional Inks Digital Inks Specialty Inks Others |

| By Printing Process | Direct Printing Indirect Printing Hybrid Printing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Market Segment | Large Enterprises Small and Medium Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Production Managers, Quality Control Supervisors |

| Label Printing Sector | 60 | Sales Directors, Marketing Managers |

| Commercial Printing Applications | 50 | Operations Managers, Print Shop Owners |

| Flexographic Equipment Suppliers | 40 | Product Development Engineers, Sales Representatives |

| Sustainable Printing Practices | 40 | Sustainability Managers, R&D Directors |

The Global Flexographic Printing Market is valued at approximately USD 20 billion, driven by the increasing demand for flexible packaging solutions and the rise of e-commerce, alongside a focus on sustainable packaging options.