Region:Global

Author(s):Dev

Product Code:KRAA2583

Pages:97

Published On:August 2025

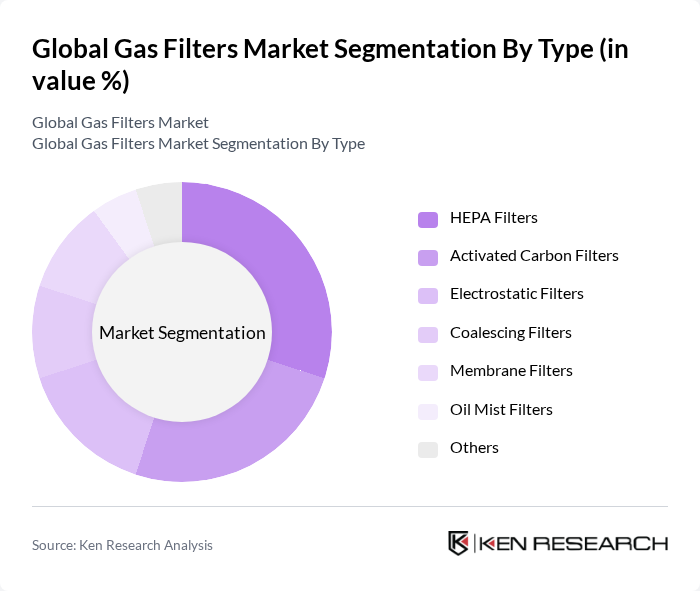

By Type:The market is segmented into various types of gas filters, each serving distinct applications and industries. The primary types include HEPA Filters, Activated Carbon Filters, Electrostatic Filters, Coalescing Filters, Membrane Filters, Oil Mist Filters, and Others. Among these, HEPA Filters are gaining significant traction due to their high efficiency in capturing airborne particles, making them essential in healthcare and cleanroom environments. Activated Carbon Filters are also popular for their ability to remove odors and volatile organic compounds (VOCs), particularly in the chemical processing and food industries. The adoption of membrane and coalescing filters is rising in electronics, oil & gas, and power generation, driven by the need for high-purity gas and operational reliability .

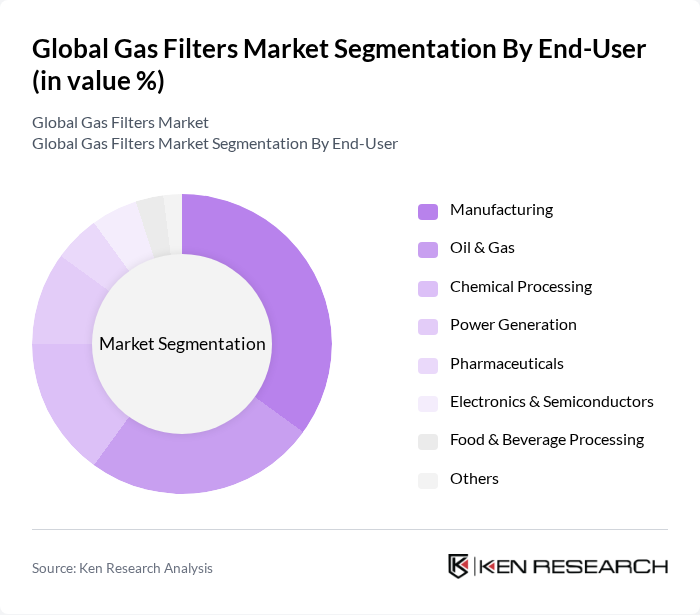

By End-User:The gas filters market is also categorized by end-user industries, which include Manufacturing, Oil & Gas, Chemical Processing, Power Generation, Pharmaceuticals, Electronics & Semiconductors, Food & Beverage Processing, and Others. The Manufacturing sector is the largest consumer of gas filters, driven by the need for maintaining air quality and compliance with environmental regulations. The Oil & Gas industry follows closely, where gas filters are crucial for ensuring the purity of gases used in various processes. The electronics and semiconductor sector is experiencing increased adoption of advanced filtration solutions due to the demand for ultra-clean environments .

The Global Gas Filters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Donaldson Company, Inc., Camfil AB, AAF International (Daikin Group), 3M Company, Parker Hannifin Corporation, Honeywell International Inc., Filtration Group Corporation, Eaton Corporation plc, MANN+HUMMEL Group, SMC Corporation, Graver Technologies, LLC, Air Products and Chemicals, Inc., Alfa Laval AB, GEA Group AG, Entegris, Inc., Mott Corporation, EFC Filtration B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gas filters market in None appears promising, driven by increasing environmental awareness and technological advancements. As industries continue to prioritize sustainability, the demand for innovative filtration solutions is expected to rise. Furthermore, the integration of smart technologies will enhance operational efficiency, allowing for real-time monitoring and maintenance. This trend, coupled with regulatory support for clean technologies, will likely create a conducive environment for market expansion and innovation in future.

| Segment | Sub-Segments |

|---|---|

| By Type | HEPA Filters Activated Carbon Filters Electrostatic Filters Coalescing Filters Membrane Filters Oil Mist Filters Others |

| By End-User | Manufacturing Oil & Gas Chemical Processing Power Generation Pharmaceuticals Electronics & Semiconductors Food & Beverage Processing Others |

| By Application | Air Filtration Gas Filtration Process Gas Purification Emission Control Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Technology | Conventional Filtration Advanced Filtration Technologies Hybrid Filtration Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Gas Filtration | 100 | Plant Managers, Environmental Compliance Officers |

| Commercial Air Filtration | 60 | Facility Managers, HVAC Engineers |

| Residential Gas Filters | 40 | Homeowners, HVAC Contractors |

| Oil & Gas Sector Filtration | 80 | Procurement Managers, Operations Directors |

| Power Generation Filtration | 50 | Energy Analysts, Plant Operations Managers |

The Global Gas Filters Market is valued at approximately USD 15.5 billion, driven by increasing industrial activities, stringent environmental regulations, and the demand for clean air and gas filtration solutions across various sectors.