Region:Global

Author(s):Dev

Product Code:KRAA8367

Pages:98

Published On:November 2025

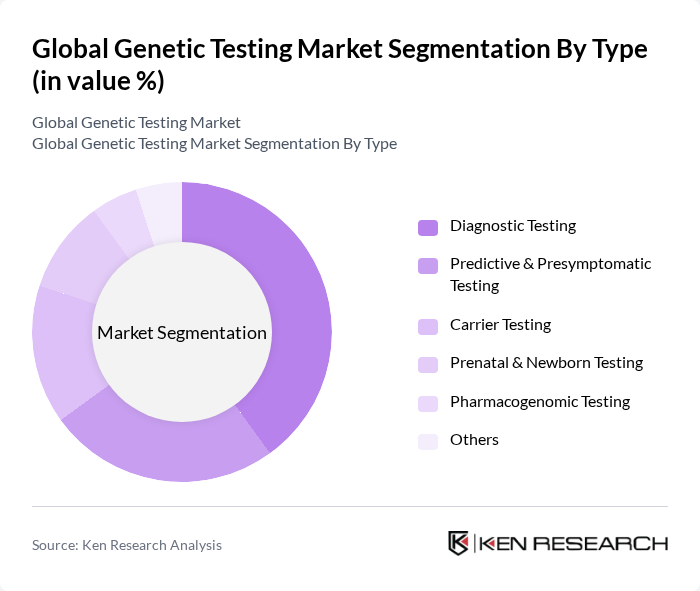

By Type:The market is segmented into various types of genetic testing, including diagnostic testing, predictive & presymptomatic testing, carrier testing, prenatal & newborn testing, pharmacogenomic testing, and others. Diagnostic testing remains the largest segment, driven by its critical role in identifying inherited disorders and guiding treatment decisions. Predictive & presymptomatic testing is expanding as consumers seek proactive health management, while carrier and prenatal testing are increasingly adopted for family planning and early intervention. Pharmacogenomic testing is gaining traction in personalized medicine, optimizing drug therapies based on genetic profiles.

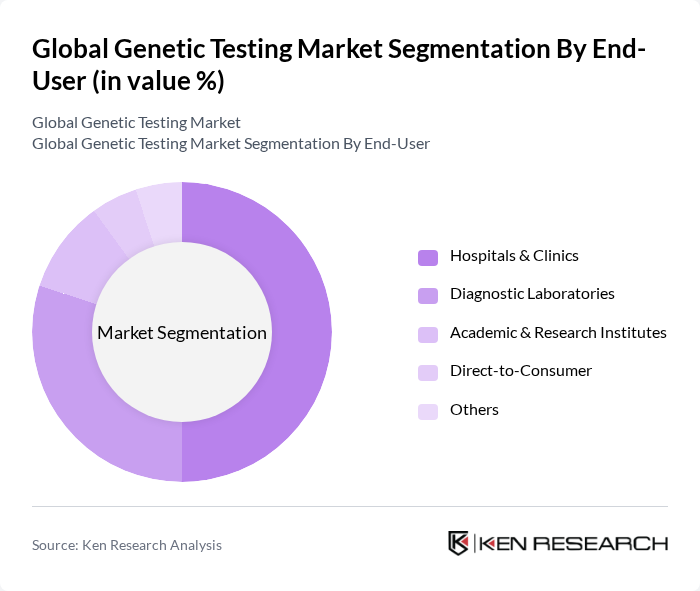

By End-User:The market is further segmented by end-users, which include hospitals & clinics, diagnostic laboratories, academic & research institutes, direct-to-consumer, and others. Hospitals & clinics represent the largest end-user segment, reflecting the integration of genetic testing into mainstream clinical workflows. Diagnostic laboratories play a central role in processing and analyzing genetic samples. Academic & research institutes drive innovation and validation of new testing methodologies. The direct-to-consumer segment is expanding rapidly, supported by increasing consumer interest in ancestry, wellness, and health risk assessments.

The Global Genetic Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., Myriad Genetics, Inc., Quest Diagnostics Incorporated, Genomic Health, Inc. (Exact Sciences Corporation), 23andMe Holding Co., Ambry Genetics Corporation, Fulgent Genetics, Inc., Color Health, Inc., Laboratory Corporation of America Holdings (LabCorp), Eurofins Scientific SE, BGI Genomics Co., Ltd., PerkinElmer, Inc. (now Revvity, Inc.), Agilent Technologies, Inc., Roche Diagnostics (F. Hoffmann-La Roche Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the genetic testing market appears promising, driven by technological advancements and increasing consumer awareness. As genomic technologies continue to evolve, the integration of artificial intelligence in genetic analysis is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of direct-to-consumer genetic testing will empower individuals to take charge of their health, further propelling market growth. Collaborative efforts between genetic testing companies and healthcare providers will also play a crucial role in shaping the future landscape of this industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Testing Predictive & Presymptomatic Testing Carrier Testing Prenatal & Newborn Testing Pharmacogenomic Testing Others |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Academic & Research Institutes Direct-to-Consumer Others |

| By Application | Oncology Neurology Cardiology Rare Diseases Reproductive Health Infectious Diseases Others |

| By Technology | Next-Generation Sequencing (NGS) Polymerase Chain Reaction (PCR) Microarray Sanger Sequencing Cytogenetic Testing Biochemical Testing Others |

| By Sample Type | Blood Samples Saliva Samples Tissue Samples Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Genetic Testing | 60 | Oncologists, Pathologists |

| Prenatal Genetic Testing | 50 | Obstetricians, Genetic Counselors |

| Rare Disease Testing | 40 | Pediatricians, Geneticists |

| Direct-to-Consumer Genetic Testing | 45 | Marketing Managers, Product Development Leads |

| Pharmacogenomics Testing | 42 | Clinical Pharmacists, Healthcare Administrators |

The Global Genetic Testing Market is valued at approximately USD 14 billion, driven by advancements in next-generation sequencing, increased applications in oncology and prenatal diagnostics, and rising consumer awareness regarding personalized medicine.