Region:Asia

Author(s):Geetanshi

Product Code:KRAE1920

Pages:95

Published On:February 2026

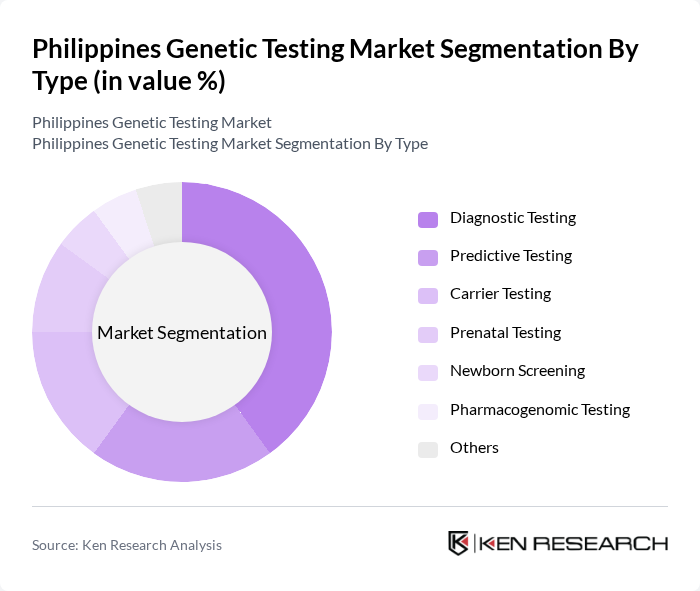

By Type:The genetic testing market can be segmented into various types, including diagnostic testing, predictive testing, carrier testing, prenatal testing, newborn screening, pharmacogenomic testing, and others. Among these, diagnostic testing is currently the leading sub-segment due to its critical role in identifying genetic disorders and guiding treatment decisions. The increasing prevalence of genetic diseases and the growing emphasis on preventive healthcare are driving the demand for diagnostic testing services.

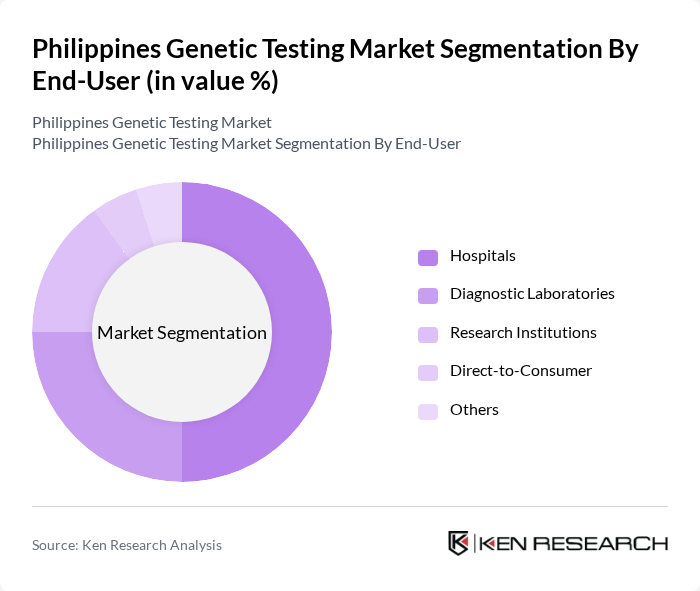

By End-User:The market can also be segmented based on end-users, which include hospitals, diagnostic laboratories, research institutions, direct-to-consumer services, and others. Hospitals are the dominant end-user segment, as they are the primary providers of genetic testing services. The increasing integration of genetic testing into routine clinical practice and the growing number of specialized genetic clinics within hospitals are contributing to this trend.

The Philippines Genetic Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philippine Genome Center, Genetika DNA Laboratories, HealthNow, GeneLife, MyGene, Genomics Philippines, LabX, Genomic Health, 23andMe, Gene by Gene, DNA Diagnostics, Life Technologies, Illumina, Quest Diagnostics, Eurofins Scientific contribute to innovation, geographic expansion, and service delivery in this space.

The future of the genetic testing market in the Philippines appears promising, driven by increasing healthcare investments and a growing emphasis on preventive care. The government is expected to enhance funding for genetic research, which will likely lead to more innovative testing solutions. Additionally, the integration of telemedicine is anticipated to improve access to genetic counseling and testing, particularly in underserved areas, fostering a more inclusive healthcare environment for all Filipinos.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Testing Predictive Testing Carrier Testing Prenatal Testing Newborn Screening Pharmacogenomic Testing Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Direct-to-Consumer Others |

| By Application | Oncology Cardiovascular Diseases Neurological Disorders Rare Diseases Others |

| By Technology | Next-Generation Sequencing Polymerase Chain Reaction (PCR) Microarray Technology Sanger Sequencing Others |

| By Region | Luzon Visayas Mindanao |

| By Investment Source | Private Investments Government Funding International Grants Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 150 | Genetic Counselors, Physicians, Laboratory Technicians |

| Patients Undergoing Genetic Testing | 100 | Individuals who have received genetic tests, Family Members |

| Insurance Companies | 80 | Health Insurance Underwriters, Policy Analysts |

| Regulatory Bodies | 50 | Health Policy Makers, Regulatory Affairs Specialists |

| Academic Institutions | 70 | Researchers, Professors in Genetics and Molecular Biology |

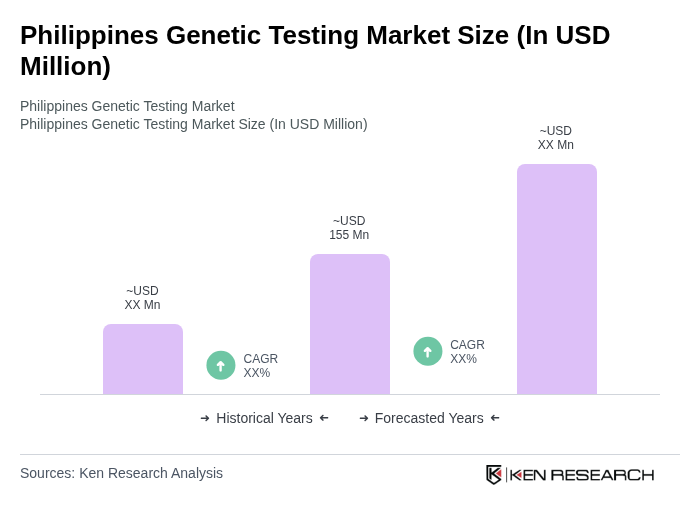

The Philippines Genetic Testing Market is valued at approximately USD 155 million, reflecting significant growth driven by increased awareness of genetic disorders, advancements in technology, and the rising demand for personalized medicine.