Region:Asia

Author(s):Geetanshi

Product Code:KRAE1924

Pages:90

Published On:February 2026

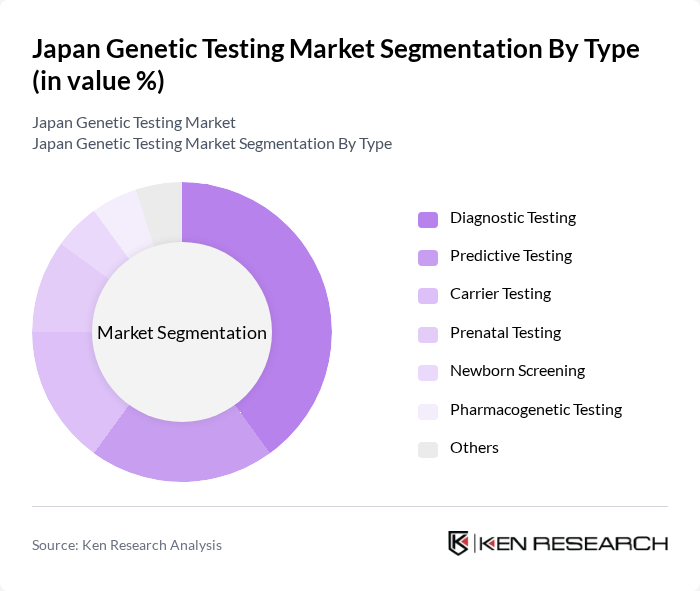

By Type:The genetic testing market can be segmented into various types, including diagnostic testing, predictive and presymptomatic testing, carrier testing, prenatal and newborn testing, pharmacogenomic testing, and others. Each of these subsegments plays a crucial role in addressing specific healthcare needs, with diagnostic testing being particularly prominent due to its direct application in disease identification and management.

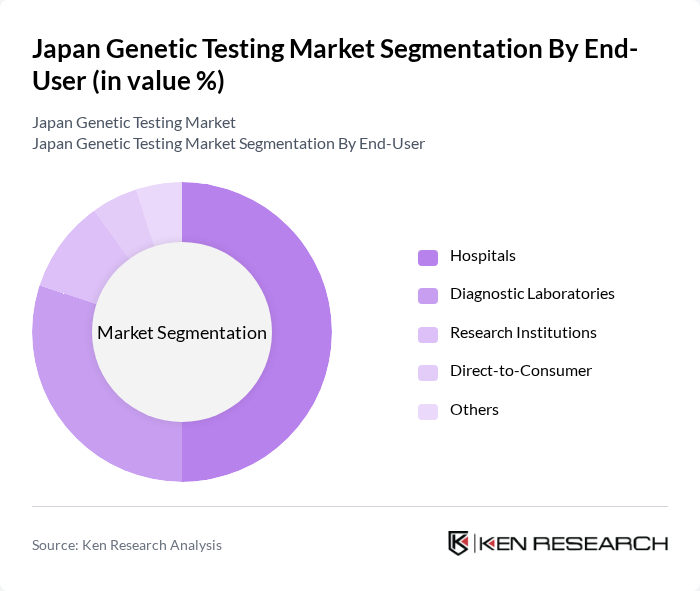

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, research institutions, direct-to-consumer services, and others. Hospitals are the primary end-users, as they utilize genetic testing for patient diagnosis and treatment planning, while diagnostic laboratories play a significant role in processing and analyzing genetic tests.

The Japan Genetic Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fujirebio, GeneTech, RIKEN Genesis, Takara Bio, Sysmex Corporation, Chugai Pharmaceutical, Astellas Pharma, Hitachi High-Technologies, Roche Diagnostics, Illumina, Agilent Technologies, QIAGEN, Bio-Rad Laboratories, Thermo Fisher Scientific, MedGenome contribute to innovation, geographic expansion, and service delivery in this space.

The future of the genetic testing market in Japan appears promising, driven by technological advancements and increasing consumer awareness. As the healthcare system embraces personalized medicine, the integration of genetic insights into clinical practice will become more prevalent. Additionally, the expansion of direct-to-consumer testing options will empower individuals to take charge of their health. Collaborations between genetic testing companies and healthcare providers will further enhance service delivery, ensuring that patients receive timely and accurate testing for better health outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Testing Predictive Testing Carrier Testing Prenatal Testing Newborn Screening Pharmacogenetic Testing Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Direct-to-Consumer Others |

| By Application | Oncology Cardiovascular Diseases Neurological Disorders Infectious Diseases Others |

| By Technology | Next-Generation Sequencing Polymerase Chain Reaction (PCR) Microarray Sanger Sequencing Others |

| By Sample Type | Blood Samples Saliva Samples Tissue Samples Others |

| By Distribution Channel | Online Sales Offline Sales Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Genetic Testing | 100 | Oncologists, Genetic Counselors |

| Prenatal Genetic Testing | 80 | Obstetricians, Expectant Parents |

| Pharmacogenomics Services | 70 | Pharmacists, Healthcare Providers |

| Direct-to-Consumer Genetic Testing | 90 | Consumers, Marketing Managers |

| Genetic Testing Laboratories | 60 | Laboratory Managers, Quality Assurance Officers |

The Japan Genetic Testing Market is valued at approximately USD 650 million, driven by advancements in technology, increased awareness of genetic disorders, and a growing demand for personalized medicine.