Region:Global

Author(s):Shubham

Product Code:KRAD3655

Pages:94

Published On:November 2025

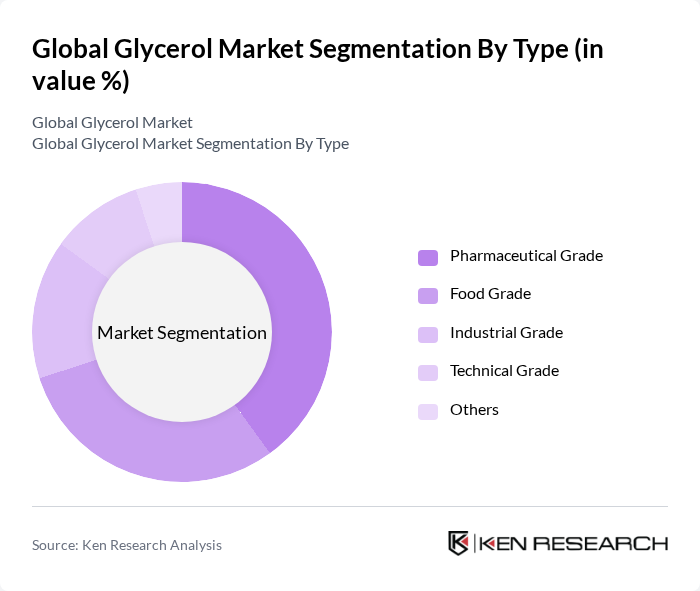

By Type:The glycerol market is segmented into Pharmaceutical Grade, Food Grade, Industrial Grade, Technical Grade, and Others. Among these, the Pharmaceutical Grade segment is currently leading due to its extensive use in the pharmaceutical industry as a solvent and excipient. The increasing demand for high-quality pharmaceutical products and the growing trend of natural ingredients in formulations are driving this segment's growth. The Food Grade segment is also significant, fueled by the rising consumer preference for natural food additives.

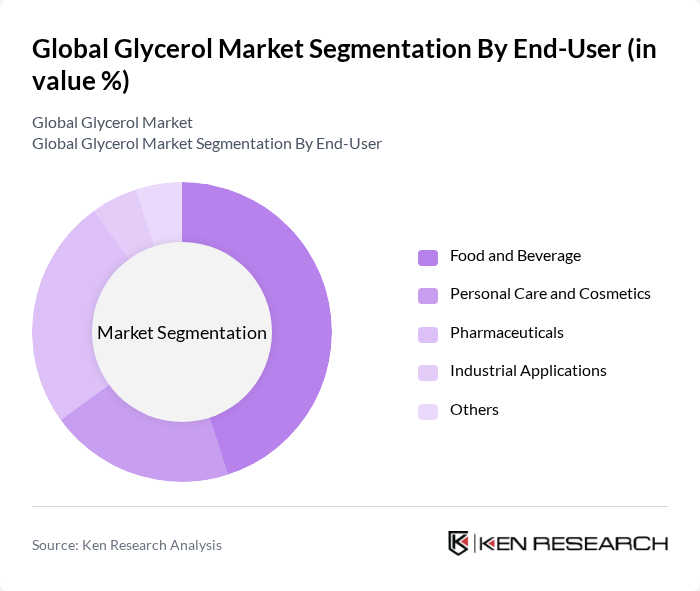

By End-User:The end-user segmentation includes Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Industrial Applications, and Others. The Food and Beverage segment is the largest consumer of glycerol, driven by its use as a sweetener and preservative. The increasing demand for processed foods and beverages, along with the trend towards healthier options, is propelling this segment. The Pharmaceuticals segment is also growing, as glycerol is widely used in drug formulations and as a humectant in various products.

The Global Glycerol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dow Chemical Company, BASF SE, Archer Daniels Midland Company, Cargill, Incorporated, Wilmar International Limited, IOI Group, EmulsiTech, Solvay S.A., Croda International Plc, KLK OLEO, Glycerin Resources, Green Biologics, P&G Chemicals, Vantage Specialty Chemicals, Natural Sourcing, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The glycerol market is poised for significant transformation, driven by increasing consumer demand for sustainable and natural products. Innovations in glycerol applications, particularly in bio-based and eco-friendly formulations, are expected to gain traction. Additionally, the expansion into emerging markets, where the demand for personal care and food products is rising, will create new growth avenues. Companies that invest in sustainable production methods and strategic partnerships will likely lead the market in the coming years, adapting to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Grade Food Grade Industrial Grade Technical Grade Others |

| By End-User | Food and Beverage Personal Care and Cosmetics Pharmaceuticals Industrial Applications Others |

| By Application | Solvent Humectant Emulsifier Plasticizer Others |

| By Source | Vegetable Oils Animal Fats Synthetic Sources Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Regulatory Compliance | FDA Regulations EU Regulations ISO Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Sector Utilization | 80 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetics and Personal Care Products | 70 | Formulation Chemists, Brand Managers |

| Industrial Applications and Biofuels | 60 | Operations Managers, Sustainability Officers |

| Market Trends and Consumer Insights | 90 | Market Researchers, Consumer Behavior Analysts |

The Global Glycerol Market is valued at approximately USD 5.2 billion. This growth is driven by increasing demand across various sectors, including food, pharmaceuticals, and personal care products, highlighting glycerol's versatility as a humectant, solvent, and emulsifier.