Region:Asia

Author(s):Geetanshi

Product Code:KRAE0656

Pages:87

Published On:December 2025

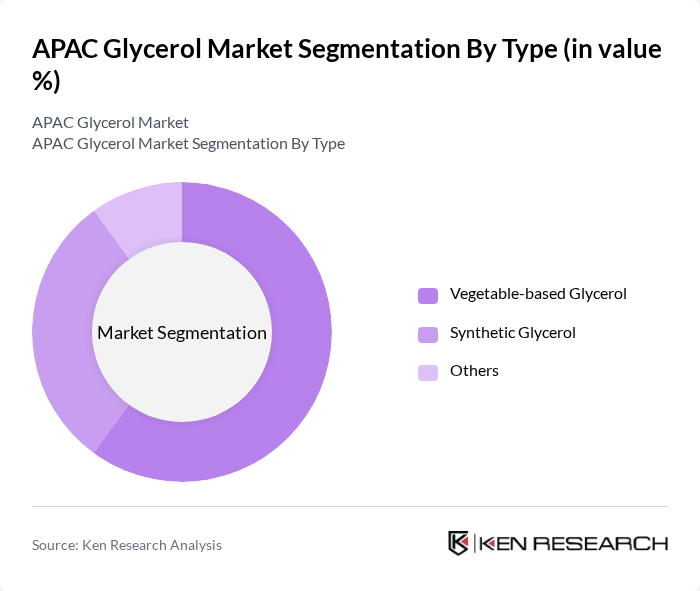

By Type:The glycerol market is segmented into three main types: Vegetable-based Glycerol, Synthetic Glycerol, and Others. Among these, Vegetable-based Glycerol is the dominant segment due to the increasing consumer preference for natural and sustainable products. This trend is particularly evident in the personal care and food industries, where consumers are gravitating towards products that are perceived as healthier and more environmentally friendly. Synthetic Glycerol, while significant, is often overshadowed by the growing demand for its vegetable-based counterpart.

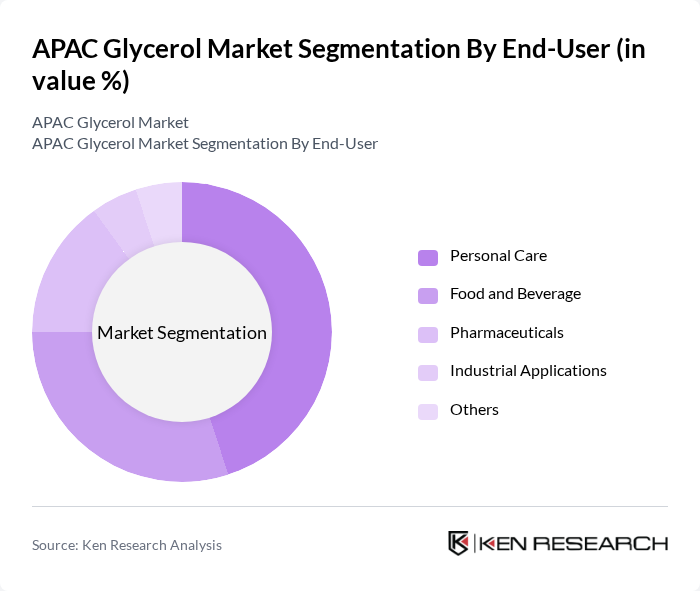

By End-User:The end-user segmentation includes Personal Care, Food and Beverage, Pharmaceuticals, Industrial Applications, and Others. The Personal Care segment leads the market, driven by the increasing use of glycerol in cosmetics and skincare products due to its moisturizing properties. The Food and Beverage sector also shows significant growth, as glycerol is utilized as a sweetener and humectant. Pharmaceuticals follow closely, with glycerol being a key ingredient in various medicinal formulations.

The APAC Glycerol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dow Chemical Company, BASF SE, Archer Daniels Midland Company, Cargill, Incorporated, Wilmar International Limited, IOI Group, Croda International Plc, Emulsifiers and Glycerol Company, K glycerin, Sakamoto Yakuhin Kogyo Co., Ltd., Glycerin Products, Inc., Glycerol Solutions, Glycerol Technologies, Green Glycerol, Kahl GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The APAC glycerol market is poised for significant growth, driven by increasing demand across various sectors, including biofuels, personal care, and food applications. Innovations in production technologies are expected to enhance efficiency and reduce costs, while the shift towards sustainable products will further bolster market expansion. As consumer preferences evolve, companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge in the coming years, fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vegetable-based Glycerol Synthetic Glycerol Others |

| By End-User | Personal Care Food and Beverage Pharmaceuticals Industrial Applications Others |

| By Region | North India South India East India West India |

| By Application | Food Additive Humectant Solvent Others |

| By Source | Renewable Sources Non-renewable Sources Others |

| By Distribution Channel | Online Sales Offline Retail Direct Sales Others |

| By Packaging Type | Bulk Packaging Retail Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Glycerol Usage | 100 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Applications of Glycerol | 80 | Regulatory Affairs Managers, R&D Scientists |

| Cosmetic and Personal Care Products | 90 | Formulation Chemists, Brand Managers |

| Industrial Applications and Biofuels | 70 | Operations Managers, Supply Chain Analysts |

| Market Trends and Consumer Insights | 85 | Market Research Analysts, Business Development Executives |

The APAC Glycerol Market is valued at approximately USD 2 billion, driven by the growth in biodiesel production and the rising demand for refined glycerol in the pharmaceutical and personal care sectors.