Region:Asia

Author(s):Rebecca

Product Code:KRAE2615

Pages:98

Published On:February 2026

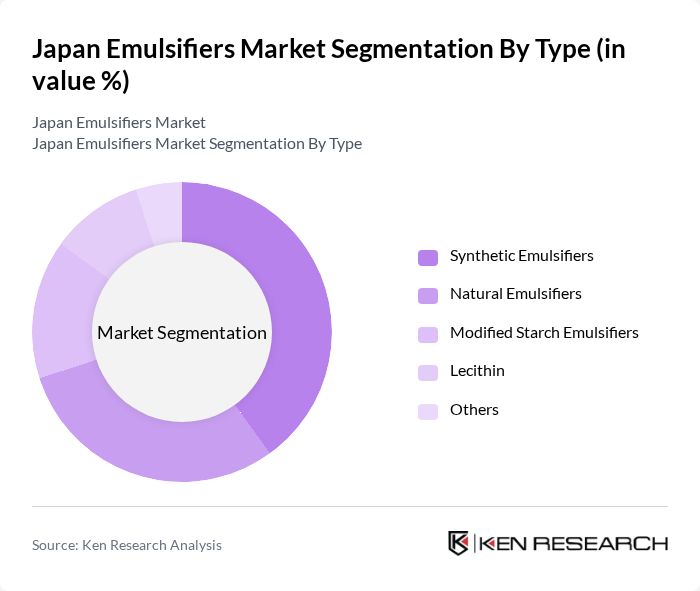

By Type:The emulsifiers market can be segmented into various types, including synthetic emulsifiers, natural emulsifiers, modified starch emulsifiers, lecithin, and others. Among these, synthetic emulsifiers are widely used due to their effectiveness and cost-efficiency, while natural emulsifiers are gaining traction due to the increasing consumer preference for clean-label products. Modified starch emulsifiers are also significant, particularly in the food industry, where they enhance texture and stability.

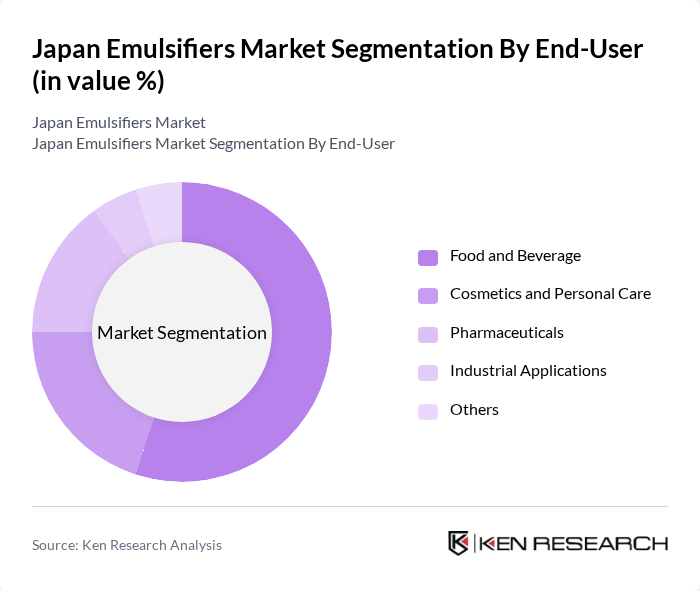

By End-User:The end-user segmentation includes food and beverage, cosmetics and personal care, pharmaceuticals, industrial applications, and others. The food and beverage sector is the largest consumer of emulsifiers, driven by the demand for processed foods and beverages. The cosmetics and personal care industry also significantly contributes to the market, utilizing emulsifiers for product stability and texture.

The Japan Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Cargill, Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group plc, Palsgaard A/S, Lonza Group AG, Evonik Industries AG, Clariant AG, Mitsubishi Chemical Corporation, Showa Denko K.K., Fuji Oil Company, Ltd., Sakamoto Yakuhin Kogyo Co., Ltd., Nisshin OilliO Group, Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan emulsifiers market appears promising, driven by increasing consumer demand for healthier and more sustainable products. Innovations in bio-based emulsifiers and a shift towards clean label products are expected to shape the market landscape. Additionally, the expansion of online distribution channels will facilitate greater accessibility for consumers, allowing manufacturers to reach a broader audience. As the market evolves, companies that adapt to these trends will likely gain a competitive edge and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Emulsifiers Natural Emulsifiers Modified Starch Emulsifiers Lecithin Others |

| By End-User | Food and Beverage Cosmetics and Personal Care Pharmaceuticals Industrial Applications Others |

| By Application | Emulsifiers in Bakery Products Emulsifiers in Dairy Products Emulsifiers in Sauces and Dressings Emulsifiers in Confectionery Others |

| By Source | Plant-based Emulsifiers Animal-based Emulsifiers Microbial Emulsifiers Others |

| By Formulation | Liquid Emulsifiers Powder Emulsifiers Granular Emulsifiers Others |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Others |

| By Region | Kanto Kansai Chubu Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Emulsifiers | 100 | Product Development Managers, Quality Assurance Specialists |

| Cosmetic Emulsifier Applications | 80 | Formulation Chemists, Brand Managers |

| Pharmaceutical Emulsifiers | 70 | Regulatory Affairs Managers, R&D Directors |

| Industrial Emulsifier Usage | 60 | Operations Managers, Supply Chain Coordinators |

| Market Trends and Innovations | 90 | Market Analysts, Industry Consultants |

The Japan Emulsifiers Market is valued at approximately USD 1.2 billion, reflecting a robust growth trajectory driven by the increasing demand for processed food products and a shift towards natural emulsifiers in response to consumer preferences for clean-label products.