Region:Global

Author(s):Shubham

Product Code:KRAA3211

Pages:80

Published On:August 2025

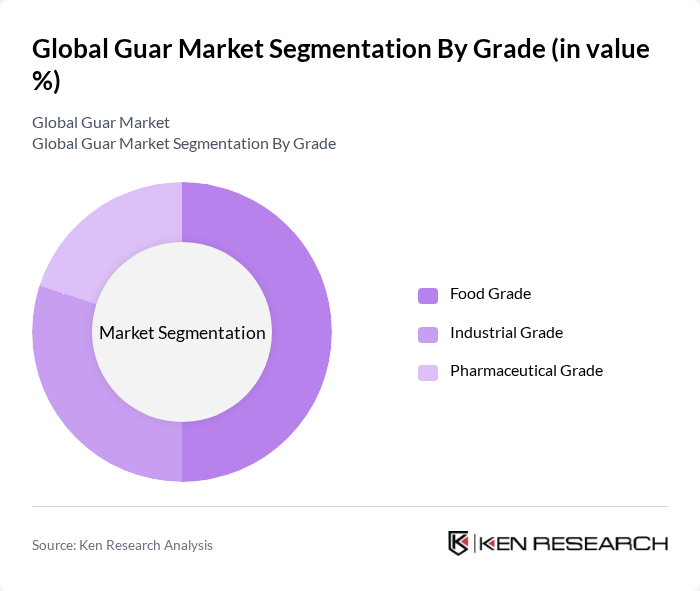

By Grade:The market is segmented into three grades: Food Grade, Industrial Grade, and Pharmaceutical Grade. Food Grade guar gum is primarily used in the food and beverage industry for its thickening and stabilizing properties. Industrial Grade is utilized in applications such as oil drilling fluids and textile processing, while Pharmaceutical Grade is used in the production of medicines and health supplements .

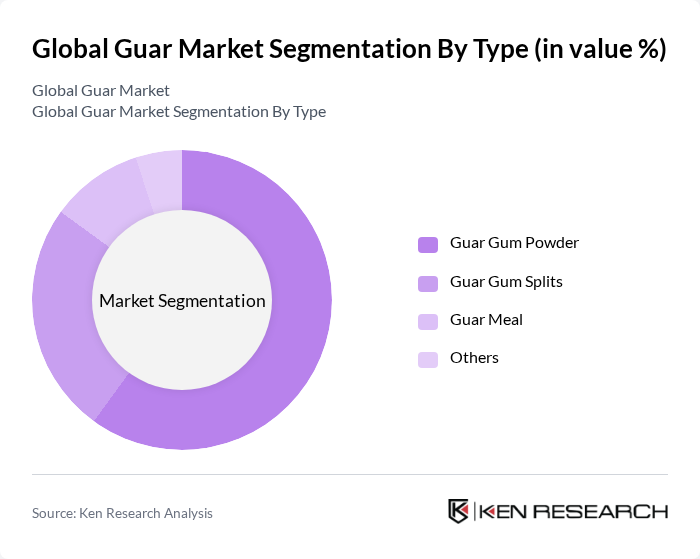

By Type:The market is categorized into Guar Gum Powder, Guar Gum Splits, Guar Meal, and Others. Guar Gum Powder is the most widely used form, especially in food and industrial applications. Guar Gum Splits are primarily used in the oil and gas sector, while Guar Meal is a by-product used in animal feed and other applications .

The Global Guar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ashland Global Holdings Inc., Hindustan Gum & Chemicals Ltd., Vikas WSP Ltd., Lucid Colloids Ltd., Neelkanth Polymers Pvt. Ltd., Cargill, Incorporated, Ingredion Incorporated, DuPont de Nemours, Inc., Tate & Lyle PLC, Rama Industries Ltd., Agro Gums, Soni Soya Products Ltd., S. M. S. Guar Gum Ltd., S. R. G. Guar Gum Ltd., S. S. G. Guar Gum Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the guar market appears promising, driven by a growing consumer preference for natural and organic products. As the food and beverage industry continues to innovate, the demand for guar gum in gluten-free and clean-label products is expected to rise. Additionally, advancements in extraction and processing technologies will likely enhance the efficiency of guar gum production, making it more competitive against synthetic alternatives. Overall, the market is poised for steady growth, supported by evolving consumer trends and industry developments.

| Segment | Sub-Segments |

|---|---|

| By Grade | Food Grade Industrial Grade Pharmaceutical Grade |

| By Type | Guar Gum Powder Guar Gum Splits Guar Meal Others |

| By Application | Oil & Gas (Hydraulic Fracturing, Drilling Fluids) Food & Beverage (Bakery, Dairy, Processed Foods) Pharmaceuticals & Cosmetics Animal Feed Others |

| By Function | Thickening Agent Stabilizer Emulsifier Binder Friction Reducer Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America (United States, Canada, Mexico) Europe (UK, France, Germany, Italy, Spain, Rest of Europe) Asia-Pacific (India, China, Japan, South Korea, Australia, Rest of APAC) Middle East & Africa South America |

| By Price Range | Low Price Medium Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Guar Gum in Food Industry | 100 | Product Development Managers, Quality Assurance Specialists |

| Guar Applications in Pharmaceuticals | 80 | R&D Managers, Regulatory Affairs Officers |

| Industrial Uses of Guar | 70 | Procurement Managers, Operations Managers |

| Guar Cultivation Practices | 50 | Agricultural Extension Officers, Farmers |

| Market Trends and Consumer Preferences | 90 | Market Analysts, Consumer Insights Managers |

The Global Guar Market is valued at approximately USD 1.3 billion, driven by increasing demand for guar gum across various industries, including food, pharmaceuticals, and oil & gas. This growth reflects a significant trend towards natural and organic ingredients in consumer products.