Region:Global

Author(s):Dev

Product Code:KRAC2750

Pages:98

Published On:October 2025

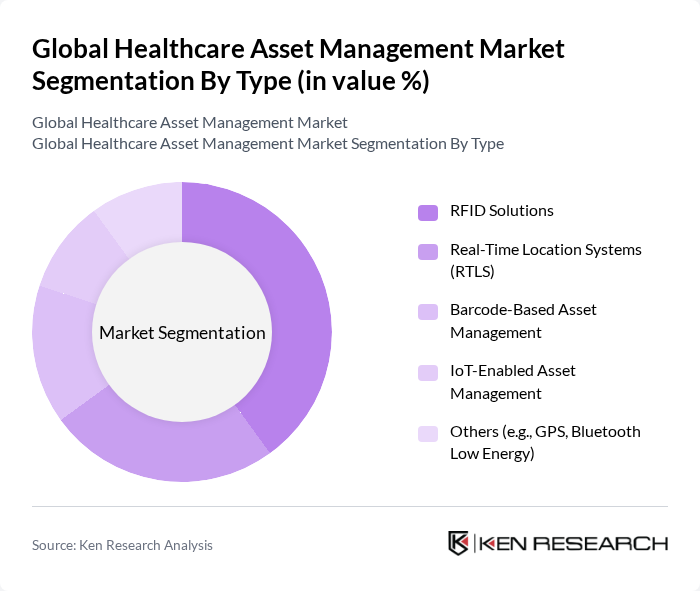

By Type:The market is segmented into various types, including RFID Solutions, Real-Time Location Systems (RTLS), Barcode-Based Asset Management, IoT-Enabled Asset Management, and Others (e.g., GPS, Bluetooth Low Energy). Among these, RFID Solutions are leading due to their ability to provide accurate and real-time tracking of assets, which is crucial for healthcare facilities aiming to enhance operational efficiency and reduce costs. RTLS is rapidly gaining traction as hospitals seek to optimize workflows and minimize equipment loss. IoT-enabled asset management is also expanding, enabling predictive maintenance and integration with cloud-based platforms for enhanced visibility and control .

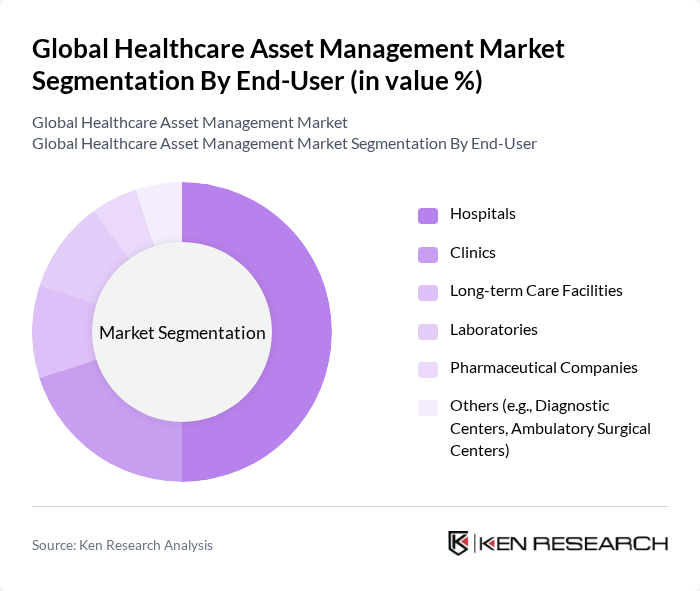

By End-User:The end-user segmentation includes Hospitals, Clinics, Long-term Care Facilities, Laboratories, Pharmaceutical Companies, and Others (e.g., Diagnostic Centers, Ambulatory Surgical Centers). Hospitals dominate this segment due to their large-scale operations and the critical need for efficient asset management to ensure patient safety and operational efficiency. Laboratories and pharmaceutical companies are also increasing adoption to comply with regulatory requirements and optimize inventory management. Diagnostic centers and ambulatory surgical centers are leveraging asset management solutions to streamline workflows and support high patient throughput .

The Global Healthcare Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE Healthcare, Siemens Healthineers, Philips Healthcare, IBM Watson Health, Oracle Corporation, SAP SE, Medtronic, Johnson & Johnson, Cardinal Health, McKesson Corporation, Cerner Corporation (now Oracle Health), Allscripts Healthcare Solutions (now Veradigm Inc.), Zebra Technologies, Stanley Healthcare (now part of Securitas Healthcare), CenTrak Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of healthcare asset management is poised for transformative growth, driven by technological advancements and evolving industry needs. As organizations increasingly adopt predictive maintenance strategies, the focus will shift towards leveraging data analytics for proactive decision-making. Additionally, the rise of telehealth and remote monitoring will necessitate more sophisticated asset management solutions, ensuring that healthcare providers can efficiently manage resources across diverse settings. This evolution will create a more integrated and responsive healthcare ecosystem, enhancing patient outcomes and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | RFID Solutions Real-Time Location Systems (RTLS) Barcode-Based Asset Management IoT-Enabled Asset Management Others (e.g., GPS, Bluetooth Low Energy) |

| By End-User | Hospitals Clinics Long-term Care Facilities Laboratories Pharmaceutical Companies Others (e.g., Diagnostic Centers, Ambulatory Surgical Centers) |

| By Component | Hardware (Tags, Readers, Sensors) Software (Asset Management Platforms, Analytics) Services (Implementation, Maintenance, Consulting) |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Application | Equipment Tracking & Management Patient Tracking Staff Management Supply Chain Management Compliance & Regulatory Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Asset Management | 150 | Healthcare Administrators, Asset Managers |

| Medical Equipment Procurement | 100 | Procurement Officers, Supply Chain Managers |

| Healthcare IT Systems | 80 | IT Directors, Health Information Managers |

| Logistics in Healthcare Facilities | 60 | Logistics Coordinators, Operations Managers |

| Asset Utilization Strategies | 90 | Clinical Engineers, Facility Managers |

The Global Healthcare Asset Management Market is valued at approximately USD 25 billion, driven by the increasing need for efficient asset tracking and management in healthcare facilities, along with the adoption of advanced technologies like RFID and IoT.