Region:Global

Author(s):Dev

Product Code:KRAA3077

Pages:86

Published On:August 2025

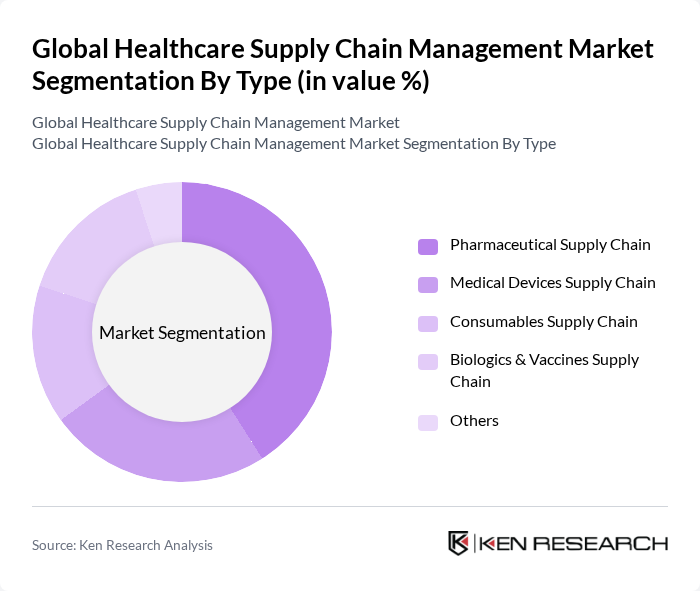

By Type:The market is segmented into various types, including Pharmaceutical Supply Chain, Medical Devices Supply Chain, Consumables Supply Chain, Biologics & Vaccines Supply Chain, and Others. Each of these segments plays a crucial role in the overall healthcare supply chain, catering to different needs and requirements.

ThePharmaceutical Supply Chainsegment is the largest, driven by the increasing demand for medications, the rise in chronic diseases, and the aging population. These factors have led to a surge in pharmaceutical consumption, necessitating robust supply chain solutions. Advancements in technology, such as blockchain, IoT, and predictive analytics, are enhancing transparency, traceability, and efficiency in pharmaceutical logistics, making this segment a leader in the market.

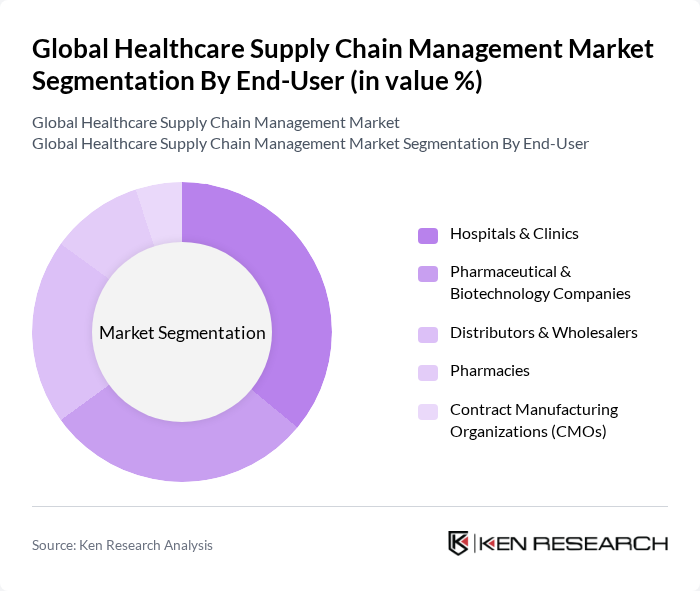

By End-User:The market is categorized by end-users, including Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Distributors & Wholesalers, Pharmacies, Contract Manufacturing Organizations (CMOs), and Others. Each end-user segment has unique requirements and contributes differently to the healthcare supply chain.

TheHospitals & Clinicssegment leads the market, primarily due to the increasing number of healthcare facilities and the rising demand for efficient patient care. Hospitals require a steady supply of medical products and pharmaceuticals to ensure optimal patient outcomes, driving the need for advanced supply chain management solutions. The integration of technology in hospital supply chains is also enhancing inventory management, real-time tracking, and reducing operational costs, further solidifying this segment's dominance.

The Global Healthcare Supply Chain Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKesson Corporation, Cardinal Health, Inc., Owens & Minor, Inc., AmerisourceBergen Corporation (now Cencora, Inc.), C.H. Robinson Worldwide, Inc., DHL Supply Chain, Oracle Corporation, SAP SE, Infor, Inc., Tecsys Inc., Manhattan Associates, Inc., GE Healthcare, Siemens Healthineers, Johnson & Johnson, Baxter International Inc., Medline Industries, LP, VWR International, LLC (Avantor, Inc.), Henry Schein, Inc., SYMPLR, GHX (Global Healthcare Exchange, LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare supply chain management market is poised for transformation, driven by technological advancements and evolving consumer expectations. As healthcare providers increasingly adopt digital solutions, the focus will shift towards enhancing operational efficiency and patient care. The integration of AI and real-time data analytics will enable organizations to make informed decisions, while sustainability initiatives will gain traction, aligning with global efforts to reduce environmental impact. These trends will shape the landscape of healthcare supply chains in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Supply Chain Medical Devices Supply Chain Consumables Supply Chain Biologics & Vaccines Supply Chain Others |

| By End-User | Hospitals & Clinics Pharmaceutical & Biotechnology Companies Distributors & Wholesalers Pharmacies Contract Manufacturing Organizations (CMOs) Others |

| By Distribution Channel | Direct Sales Third-Party Logistics (3PL) Providers Distributors Online Sales/E-commerce Others |

| By Component | Software Solutions Hardware Solutions Services |

| By Application | Inventory Management Order Management Logistics & Transportation Management Procurement & Sourcing Supplier Management Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Supply Chain Management | 100 | Supply Chain Managers, Operations Directors |

| Hospital Logistics and Inventory Management | 90 | Logistics Coordinators, Procurement Officers |

| Medical Device Distribution Networks | 60 | Distribution Managers, Regulatory Affairs Specialists |

| Healthcare Technology Integration | 50 | IT Managers, Healthcare Analysts |

| Telehealth Supply Chain Solutions | 40 | Telehealth Coordinators, Healthcare Analysts |

The Global Healthcare Supply Chain Management Market is valued at approximately USD 3.9 billion, reflecting a significant growth trend driven by the demand for efficient healthcare delivery systems and advancements in technology such as automation and data analytics.