Global Heavy Duty Trucks Market Overview

- The Global Heavy Duty Trucks Market is valued at approximatelyUSD 391 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for freight transportation, urbanization, and infrastructure development across various regions. The rise in e-commerce and logistics activities has further fueled the need for heavy-duty trucks, as they are essential for transporting goods over long distances efficiently .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust manufacturing capabilities, advanced technology, and significant investments in infrastructure. The United States leads in innovation and technology, Germany is recognized for its engineering excellence, and China, with its vast market and production capacity, plays a crucial role in the global supply chain of heavy-duty trucks .

- In 2023, the European Union implemented stringent emissions regulations aimed at reducing greenhouse gas emissions from heavy-duty vehicles. This regulation mandates that all new heavy-duty trucks must comply with Euro 6 standards, which significantly limit nitrogen oxide and particulate matter emissions. The initiative is part of the EU's broader strategy to promote sustainable transport and reduce the environmental impact of the logistics sector, as specified in Regulation (EU) 2019/1242 issued by the European Parliament and the Council .

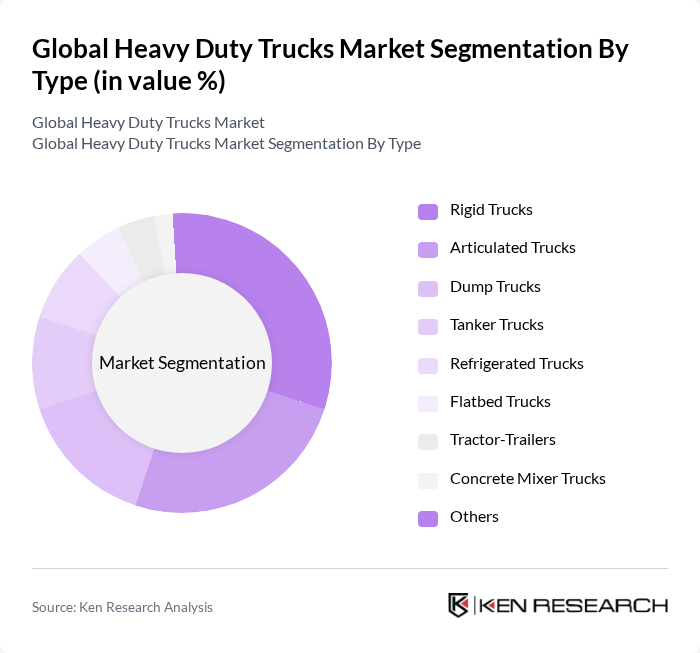

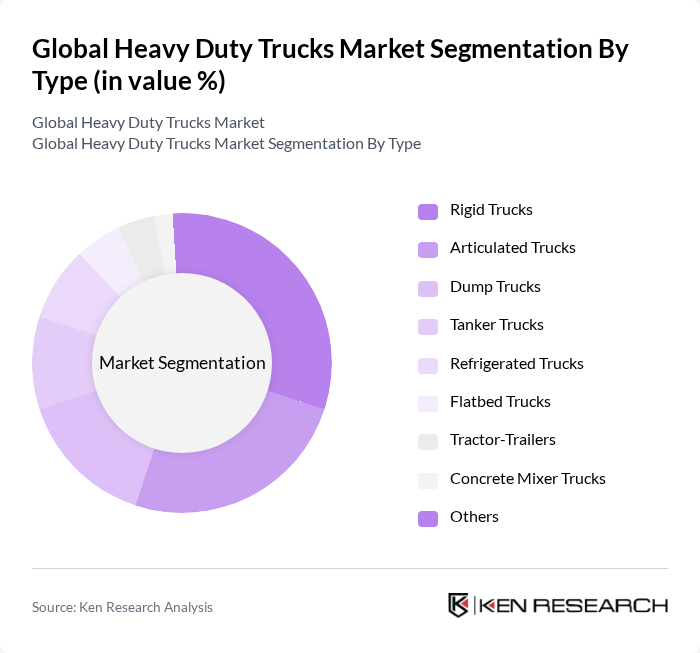

Global Heavy Duty Trucks Market Segmentation

By Type:The heavy-duty trucks market is segmented into various types, including Rigid Trucks, Articulated Trucks, Dump Trucks, Tanker Trucks, Refrigerated Trucks, Flatbed Trucks, Tractor-Trailers, Concrete Mixer Trucks, and Others. Among these,Rigid TrucksandArticulated Trucksare the most prominent due to their versatility and ability to handle various payloads. Rigid Trucks are favored for short-distance deliveries, while Articulated Trucks are preferred for long-haul transportation, making them essential in logistics and freight sectors .

By End-User:The heavy-duty trucks market serves various end-users, including Construction, Logistics and Transportation, Mining, Agriculture, Retail and Distribution, Government and Public Sector, and Others. TheLogistics and Transportationsector is the largest consumer of heavy-duty trucks, driven by the growth of e-commerce and the need for efficient freight solutions. The Construction sector also significantly contributes to demand, as heavy-duty trucks are essential for transporting materials and equipment to job sites .

Global Heavy Duty Trucks Market Competitive Landscape

The Global Heavy Duty Trucks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daimler Truck AG, Volvo Group, PACCAR Inc., Scania AB, MAN Truck & Bus SE, Navistar International Corporation, Iveco S.p.A., Hino Motors, Ltd., Isuzu Motors Ltd., Tata Motors Limited, Ashok Leyland Limited, FUSO Truck and Bus Corporation, Dongfeng Motor Corporation, BYD Company Limited, FAW Jiefang Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Heavy Duty Trucks Market Industry Analysis

Growth Drivers

- Increasing Demand for Freight Transportation:The global freight transportation market is projected to reach $6.5 trillion in future, driven by a surge in e-commerce and consumer demand. In recent periods, the volume of freight transported by road increased by approximately 4%, reflecting a robust need for heavy-duty trucks. This growth is further supported by the expansion of logistics networks, which are expected to require an additional 1.5 million heavy-duty trucks to meet rising demand, particularly in urban areas.

- Technological Advancements in Truck Manufacturing:The heavy-duty truck sector is witnessing significant technological innovations, with investments in automation and connectivity projected to exceed $10 billion in future. Advanced manufacturing techniques, such as 3D printing and robotics, are enhancing production efficiency, reducing costs, and improving vehicle performance. In recent periods, over 30% of new trucks incorporated smart technologies, indicating a shift towards more efficient and reliable transportation solutions.

- Rising Infrastructure Development Projects:Global infrastructure spending is expected to reach $4.5 trillion in future, with a significant portion allocated to transportation networks. In recent periods, the U.S. alone invested approximately $200 billion in road and bridge improvements, directly impacting the demand for heavy-duty trucks. This investment is anticipated to create a need for approximately 500,000 additional trucks to support construction and logistics operations, further driving market growth.

Market Challenges

- High Initial Investment Costs:The average cost of a new heavy-duty truck is approximately $150,000, which poses a significant barrier for small and medium-sized enterprises. In recent periods, nearly 40% of fleet operators cited high capital expenditure as a primary challenge in expanding their fleets. This financial strain is exacerbated by the need for additional investments in maintenance and compliance with regulatory standards, limiting market accessibility for many potential buyers.

- Stringent Emission Regulations:Governments worldwide are implementing stricter emission standards, with the European Union's Euro 7 regulations expected to be enforced in future. Compliance with these regulations often requires costly retrofitting or replacement of existing fleets. In recent periods, approximately 25% of heavy-duty trucks were found to be non-compliant with current emissions standards, leading to potential fines and increased operational costs for fleet operators, thereby hindering market growth.

Global Heavy Duty Trucks Market Future Outlook

The heavy-duty truck market is poised for transformative growth, driven by technological advancements and increasing demand for sustainable solutions. As electric and hybrid trucks gain traction, manufacturers are expected to invest heavily in R&D, with projections indicating a 20% increase in electric truck production in future. Additionally, the integration of IoT technologies in fleet management will enhance operational efficiency, reducing costs and improving service delivery. These trends will shape the market landscape, fostering innovation and competitiveness.

Market Opportunities

- Growth in E-commerce Logistics:The e-commerce sector is projected to grow to $6 trillion in future, creating substantial demand for heavy-duty trucks. This growth presents an opportunity for manufacturers to develop specialized vehicles tailored for last-mile delivery, enhancing efficiency and service quality in logistics operations.

- Expansion of Electric Heavy-Duty Trucks:With global electric vehicle sales expected to reach 30 million units in future, the heavy-duty truck segment is set to benefit significantly. Manufacturers can capitalize on this trend by investing in electric truck technology, which is anticipated to reduce operational costs by up to 30% compared to traditional diesel trucks, appealing to environmentally conscious consumers.