Region:Global

Author(s):Rebecca

Product Code:KRAA2873

Pages:93

Published On:August 2025

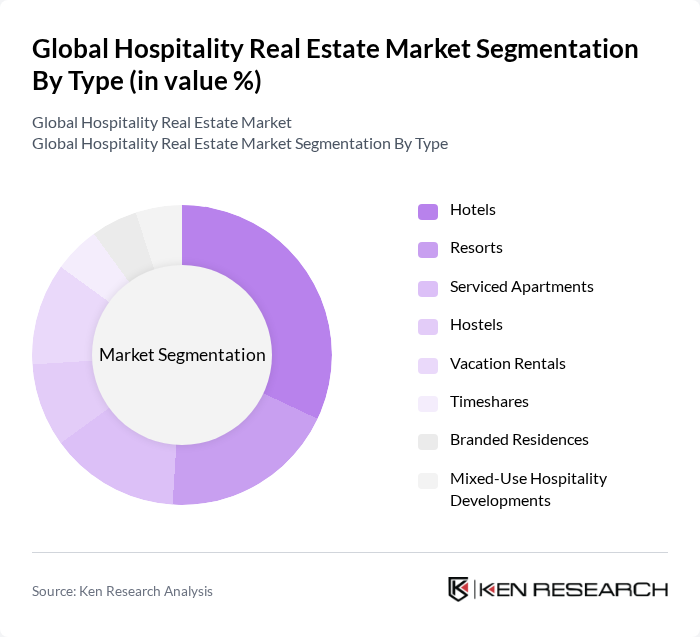

By Type:The hospitality real estate market is segmented into hotels, resorts, serviced apartments, hostels, vacation rentals, timeshares, branded residences, and mixed-use hospitality developments. Hotels remain the dominant segment, driven by business and leisure demand, while resorts and serviced apartments are gaining traction due to rising interest in wellness, extended stays, and flexible accommodation. Hostels and vacation rentals cater to budget-conscious and experiential travelers, while branded residences and mixed-use developments address the demand for integrated living and hospitality experiences .

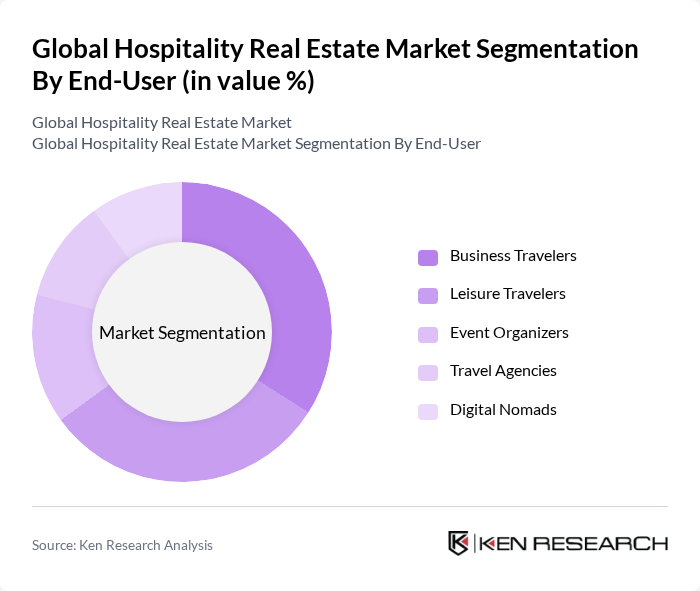

By End-User:The end-user segmentation of the hospitality real estate market includes business travelers, leisure travelers, event organizers, travel agencies, and digital nomads. Business travelers continue to drive demand for urban hotels and serviced apartments, while leisure travelers increasingly seek resorts, vacation rentals, and wellness-focused properties. Event organizers and travel agencies influence group bookings and destination selection, and digital nomads are fueling demand for flexible, long-stay, and co-living accommodations .

The Global Hospitality Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marriott International, Inc., Hilton Worldwide Holdings Inc., InterContinental Hotels Group PLC, Hyatt Hotels Corporation, Accor S.A., Wyndham Hotels & Resorts, Inc., Choice Hotels International, Inc., Radisson Hotel Group, Best Western International, Inc., Four Seasons Hotels and Resorts, Mandarin Oriental Hotel Group, Shangri-La International Hotel Management Ltd., The Leading Hotels of the World, Ltd., Rosewood Hotel Group, Meliá Hotels International S.A., Jin Jiang International Holdings Co., Ltd., Minor International PCL, RIU Hotels & Resorts, Louvre Hotels Group, OYO Hotels & Homes contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hospitality real estate market appears promising, driven by ongoing trends in tourism and urbanization. As cities expand and tourism continues to grow, the demand for innovative and sustainable hospitality solutions will increase. The integration of technology in guest experiences and operations will also play a crucial role in shaping the market. Stakeholders must adapt to these changes to remain competitive and capitalize on emerging opportunities in the evolving landscape of hospitality real estate.

| Segment | Sub-Segments |

|---|---|

| By Type | Hotels Resorts Serviced Apartments Hostels Vacation Rentals Timeshares Branded Residences Mixed-Use Hospitality Developments |

| By End-User | Business Travelers Leisure Travelers Event Organizers Travel Agencies Digital Nomads |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Equity Institutional Investors Crowdfunding Government Funding Real Estate Investment Trusts (REITs) |

| By Property Class | Luxury Upper Upscale Upscale Upper Midscale Midscale Economy |

| By Sales Channel | Direct Sales Online Travel Agencies Corporate Contracts Travel Agents |

| By Customer Segment | Individual Travelers Corporate Clients Group Bookings Event Planners Long-Stay Guests |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Development | 60 | Real Estate Developers, Investment Analysts |

| Midscale Hotel Operations | 55 | Hotel Managers, Operations Directors |

| Resort Property Investments | 45 | Property Investors, Financial Advisors |

| Hospitality Market Trends | 50 | Market Researchers, Industry Consultants |

| Short-term Rental Market | 40 | Property Managers, Rental Platform Executives |

The Global Hospitality Real Estate Market is valued at approximately USD 1.1 trillion, driven by factors such as the resurgence of travel and tourism, increased disposable income, and a growing preference for experiential travel.