Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8243

Pages:85

Published On:December 2025

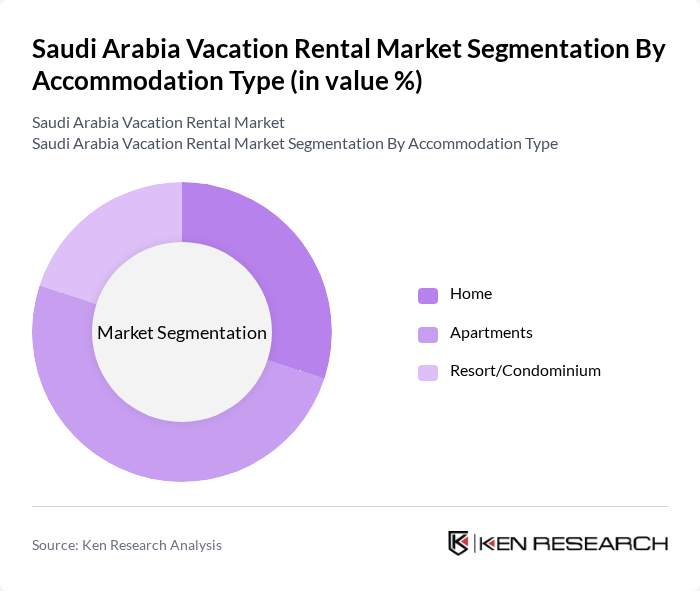

By Accommodation Type:The accommodation type segment includes various options catering to different traveler preferences. Homes/Villas are popular for families and groups seeking privacy and space. Apartments/Condominiums offer a blend of comfort and convenience, appealing to both leisure and business travelers. Resorts/Condominiums provide luxury experiences and represent the fastest-growing segment, while Guesthouses cater to budget-conscious travelers. Unique Stays, such as treehouses and yurts, attract adventurous tourists looking for distinctive experiences. The "Others" category includes various alternative accommodations.

The Homes/Villas sub-segment is currently dominating the market due to the increasing preference for spacious accommodations among families and groups. This trend is driven by the desire for privacy and the ability to cook meals, which is particularly appealing for longer stays. Additionally, the rise of platforms offering vacation rentals has made it easier for travelers to find and book these types of accommodations, further boosting their popularity. Resort/Condominium represents the most lucrative segment registering the fastest growth during the forecast period.

By Room Type:The room type segment encompasses various options that cater to different traveler needs. Entire Home/Apartment rentals are favored by families and groups seeking privacy. Private Rooms are popular among solo travelers and couples looking for budget-friendly options while still enjoying some privacy. Shared Rooms appeal to backpackers and budget travelers who prioritize cost savings and social interactions.

The Entire Home/Apartment sub-segment leads the market, driven by the growing trend of families and groups preferring to stay together in one space. This preference is fueled by the desire for a home-like environment, which allows for cooking and socializing, making it ideal for longer vacations. The convenience and flexibility offered by entire rentals further enhance their appeal, solidifying their position as the leading choice among travelers.

The Saudi Arabia Vacation Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbnb Inc., Booking Holdings Inc., Expedia Group Inc., Tripadvisor Inc., OYO Rooms, MakeMyTrip Ltd., Wyndham Destinations, 9flats, Novasol, Hotelplan Group contribute to innovation, geographic expansion, and service delivery in this space. Airbnb has emerged as a dominant player following the February 2023 regulatory reforms, with Riyadh alone recording a 39% average occupancy rate and an average daily rate of USD 86 as of December 2025.

The Saudi Arabia vacation rental market is poised for significant growth, driven by increasing tourism and evolving consumer preferences. As the government continues to invest in tourism infrastructure and promote the sector, the market is expected to expand. Additionally, the integration of technology, such as mobile booking apps and smart home features, will enhance guest experiences. This evolution will likely lead to a more competitive landscape, encouraging innovation and improved service standards across the industry.

| Segment | Sub-Segments |

|---|---|

| By Accommodation Type | Homes/Villas Apartments/Condominiums Resort/Condominium Guesthouses Unique Stays (Treehouses, Houseboats, Yurts) Others |

| By Room Type | Entire Home/Apartment Private Room Shared Room |

| By End-User | Leisure Travelers Business Travelers Families Digital Nomads Groups Others |

| By Location | Urban Areas Coastal Regions Desert Resorts Historical Sites (Medina, Mecca vicinity) Emerging Destinations (AlUla) Others |

| By Duration of Stay | Short-term Rentals (less than 30 days) Long-term Rentals (30 days or more) Seasonal Rentals Others |

| By Booking Channel | Online Travel Agencies (OTAs) Direct Bookings Property Management Companies Others |

| By Guest Capacity | 2 Guests 4 Guests 6 Guests + Guests |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vacation Rental Property Owners | 100 | Property Managers, Real Estate Investors |

| Travelers Who Used Vacation Rentals | 120 | Domestic and International Tourists |

| Local Tourism Experts | 50 | Tourism Board Officials, Hospitality Consultants |

| Vacation Rental Platform Representatives | 30 | Business Development Managers, Market Analysts |

| Real Estate Analysts | 40 | Market Researchers, Economic Analysts |

The Saudi Arabia vacation rental market is valued at approximately USD 1.82 billion, driven by increasing tourism and the popularity of alternative accommodations. This growth reflects a significant demand for vacation rentals, particularly in urban and tourist-centric areas.