Region:Global

Author(s):Rebecca

Product Code:KRAA2430

Pages:99

Published On:August 2025

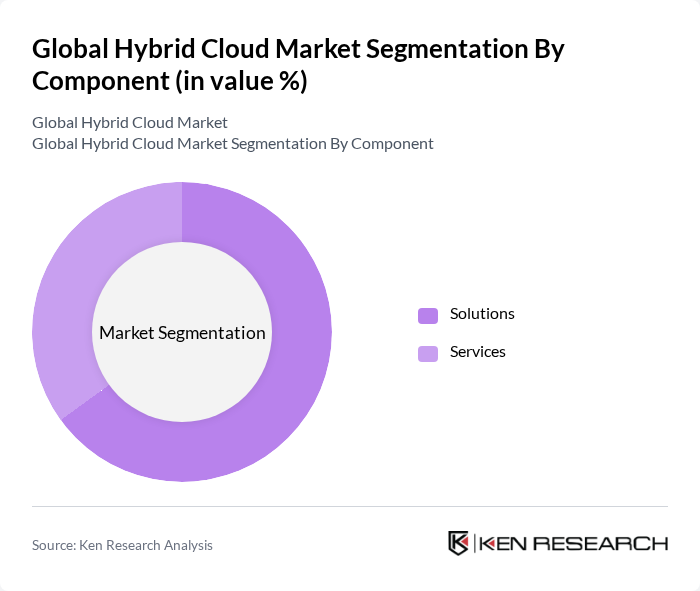

By Component:The hybrid cloud market is segmented into solutions and services. Solutions encompass various software and hardware offerings that facilitate hybrid cloud deployment, while services include consulting, integration, and management services that support organizations in their hybrid cloud journey. The solutions segment is currently leading the market due to the increasing demand for advanced cloud technologies that enable seamless integration and management of hybrid environments. The adoption of AI-driven tools and automation within solutions is further accelerating growth in this segment .

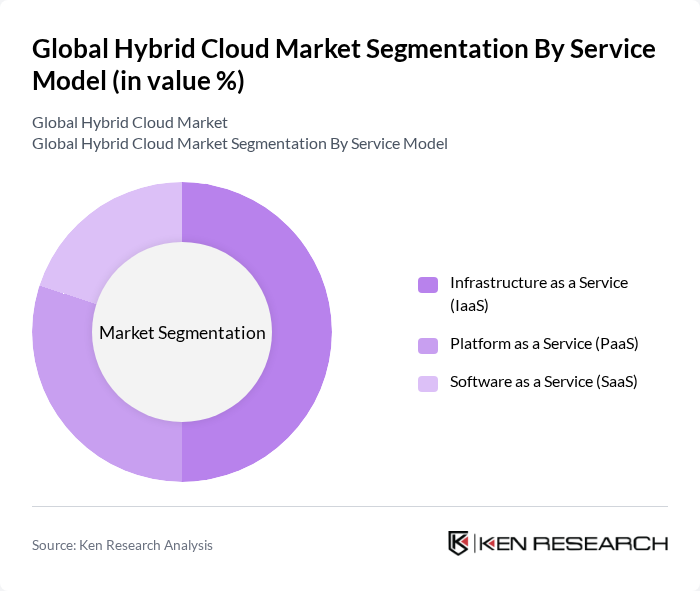

By Service Model:The hybrid cloud market is further categorized into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). IaaS is the dominant segment, driven by the growing need for scalable infrastructure solutions that allow businesses to manage their resources efficiently. PaaS and SaaS are also gaining traction as organizations seek to leverage cloud-based platforms for application development and software delivery. The increasing adoption of cloud-native application development and the need for rapid deployment are key trends supporting growth across all service models .

The Global Hybrid Cloud Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Web Services, Inc., Microsoft Corporation, Google LLC (Google Cloud Platform), IBM Corporation, Oracle Corporation, VMware, Inc., Dell Technologies Inc., Cisco Systems, Inc., Hewlett Packard Enterprise Company, Alibaba Cloud (Alibaba Group Holding Limited), Rackspace Technology, Inc., Salesforce, Inc., DigitalOcean Holdings, Inc., Red Hat, Inc. (an IBM Company), Nutanix, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hybrid cloud market is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid IT environments, the demand for managed hybrid cloud services is expected to rise, facilitating smoother transitions and operational efficiencies. Additionally, the emphasis on sustainability will shape cloud solutions, with companies seeking eco-friendly practices. This shift will likely lead to innovative cloud offerings that prioritize energy efficiency and reduced carbon footprints, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions Services |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) |

| By Deployment Model | On-Premises Off-Premises Hybrid Deployment |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By End-User Industry | Government and Public Sector Healthcare and Life Sciences Banking, Financial Services and Insurance (BFSI) Retail and E-Commerce Information and Communication Technology and Telecom Manufacturing Media and Entertainment Others |

| By Region | North America United States Canada Mexico Europe United Kingdom Germany France Italy Spain Rest of Europe Asia-Pacific China Japan South Korea India Australia Rest of Asia-Pacific Latin America Brazil Argentina Rest of Latin America Middle East and Africa Saudi Arabia United Arab Emirates Turkey South Africa Nigeria Egypt Rest of Middle East and Africa |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Hybrid Cloud Adoption | 120 | IT Managers, Cloud Architects |

| SME Cloud Migration Strategies | 90 | Business Owners, IT Consultants |

| Public Sector Cloud Solutions | 60 | Government IT Officials, Policy Makers |

| Healthcare Cloud Implementations | 50 | Healthcare IT Directors, Compliance Officers |

| Financial Services Cloud Security | 70 | CIOs, Risk Management Officers |

The Global Hybrid Cloud Market is valued at approximately USD 130 billion, reflecting significant growth driven by the demand for flexible IT solutions, cost-effective cloud services, and digital transformation initiatives across various industries.