Region:Global

Author(s):Rebecca

Product Code:KRAA2907

Pages:90

Published On:August 2025

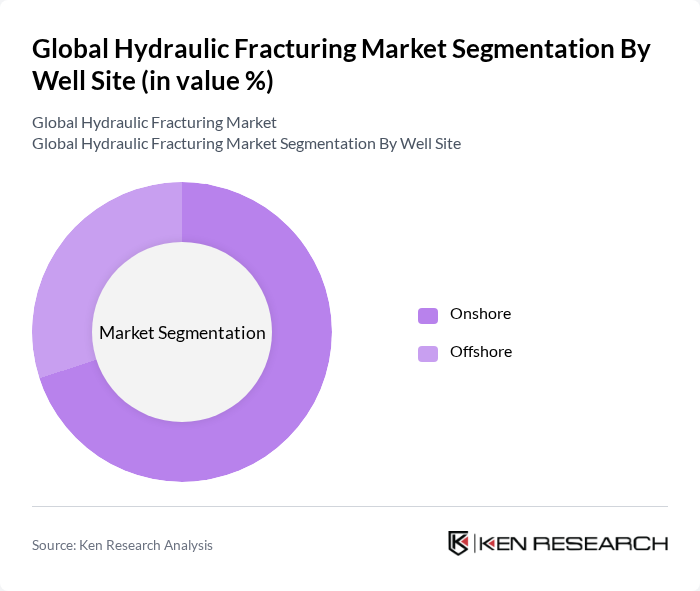

By Well Site:The hydraulic fracturing market can be segmented based on well site into onshore and offshore categories. Onshore hydraulic fracturing remains dominant due to lower operational costs, easier logistics, and the concentration of shale resources in land-based basins. Offshore fracturing, while more technically challenging and capital-intensive, is gaining momentum as operators target deepwater and ultra-deepwater reservoirs to unlock new hydrocarbon sources.

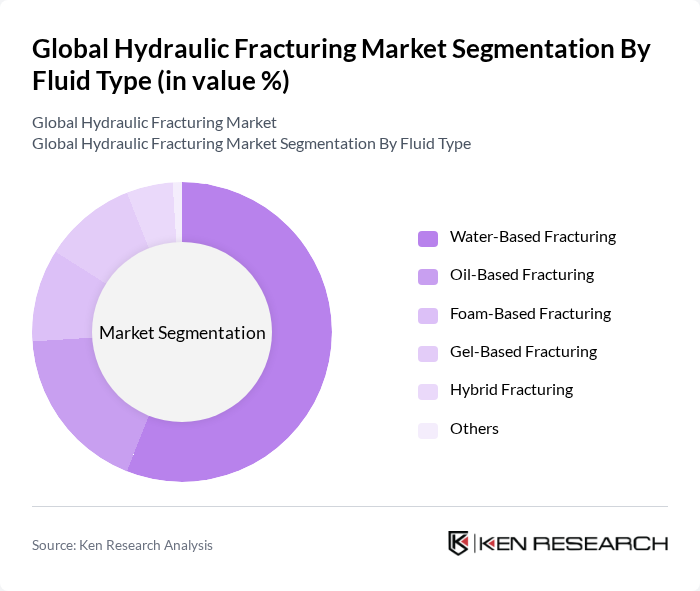

By Fluid Type:The market can also be segmented by fluid type, which includes water-based, oil-based, foam-based, gel-based, hybrid, and others. Water-based fracturing fluids, particularly slickwater formulations, dominate the market due to their cost-effectiveness, low viscosity, and operational efficiency in horizontal wells. Oil-based fluids are preferred for high-temperature, high-pressure applications, while foam-based and gel-based fluids are used for specialized reservoir conditions. Hybrid fluids and other novel formulations are being adopted for improved performance and environmental compliance.

The Global Hydraulic Fracturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton Company, Schlumberger Limited, Baker Hughes Company, National Oilwell Varco, Inc., Weatherford International plc, Superior Energy Services, Inc., Trican Well Service Ltd., Calfrac Well Services Ltd., Nabors Industries Ltd., Patterson-UTI Energy, Inc., Liberty Energy Inc., Ensign Energy Services Inc., Precision Drilling Corporation, Key Energy Services, Inc., FTS International, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The hydraulic fracturing market is poised for transformative changes driven by technological advancements and a shift towards sustainable practices. As companies increasingly adopt eco-friendly fracturing fluids and digital technologies, operational efficiencies are expected to improve significantly. Furthermore, the integration of automation and artificial intelligence in fracking operations will likely enhance productivity and reduce costs. These trends indicate a robust future for the industry, with a focus on balancing energy needs and environmental responsibilities.

| Segment | Sub-Segments |

|---|---|

| By Well Site | Onshore Offshore |

| By Fluid Type | Water-Based Fracturing Oil-Based Fracturing Foam-Based Fracturing Gel-Based Fracturing Hybrid Fracturing Others |

| By Well Type | Horizontal Wells Vertical Wells |

| By Application | Shale Gas Extraction Tight Gas Extraction Coalbed Methane Extraction Oil Recovery Others |

| By End-User | Oil & Gas Industry Mining Geothermal Energy Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Investment Source | Private Investments Public Funding Joint Ventures Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| By Technology | Conventional Fracturing Advanced Fracturing Techniques Real-Time Monitoring Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Hydraulic Fracturing Operations | 120 | Field Engineers, Operations Managers |

| Offshore Hydraulic Fracturing Techniques | 60 | Project Managers, Technical Directors |

| Environmental Impact Assessments | 50 | Environmental Scientists, Compliance Officers |

| Regulatory Compliance in Fracking | 40 | Legal Advisors, Regulatory Affairs Managers |

| Technological Innovations in Fracking | 70 | R&D Managers, Technology Officers |

The Global Hydraulic Fracturing Market is valued at approximately USD 50 billion, driven by increasing oil and gas demand, technological advancements, and the expansion of shale gas production. This valuation is based on a comprehensive five-year historical analysis.