Region:Global

Author(s):Geetanshi

Product Code:KRAC3160

Pages:86

Published On:October 2025

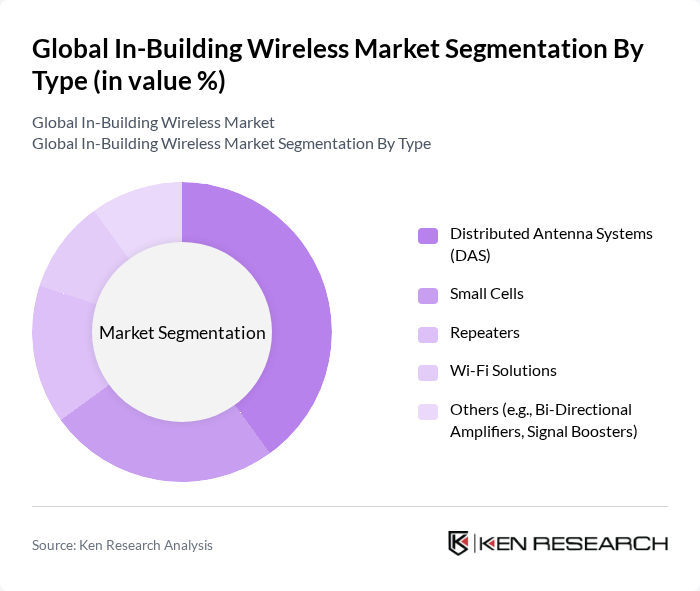

By Type:

The types of in-building wireless solutions include Distributed Antenna Systems (DAS), Small Cells, Repeaters, Wi-Fi Solutions, and Others (e.g., Bi-Directional Amplifiers, Signal Boosters). Among these,Distributed Antenna Systems (DAS)continue to lead the market due to their ability to provide extensive coverage and capacity in large buildings, such as stadiums and shopping malls. The increasing demand for high-quality mobile connectivity in public venues and commercial spaces drives the adoption of DAS, making it a preferred choice for enterprises seeking to enhance user experience. Small cells are also gaining traction, especially in environments requiring localized coverage and high data throughput, while Wi-Fi solutions and repeaters remain essential for supplementing cellular connectivity in specific use cases.

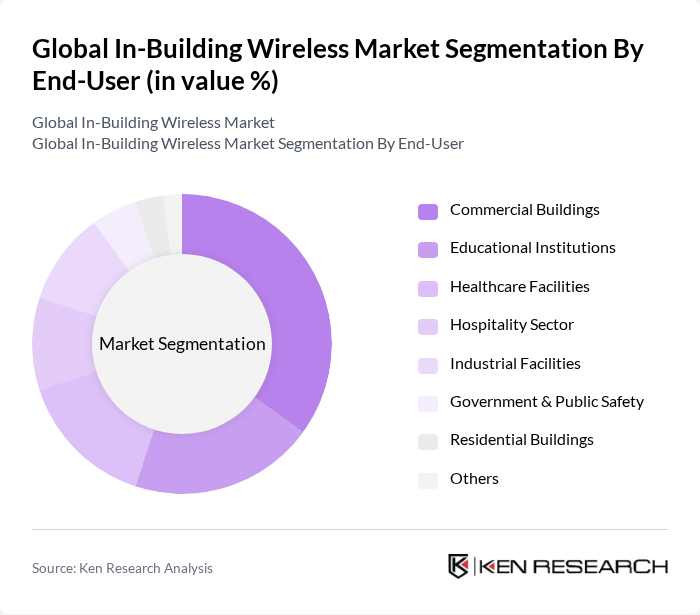

By End-User:

The end-users of in-building wireless solutions include Commercial Buildings, Educational Institutions, Healthcare Facilities, Hospitality Sector, Industrial Facilities, Government & Public Safety, Residential Buildings, and Others. TheCommercial Buildingssegment is the most significant contributor to the market, driven by the need for reliable connectivity in office spaces and retail environments. As businesses increasingly rely on digital communication, cloud-based services, and IoT devices, the demand for robust in-building wireless solutions continues to grow, making this segment a focal point for market players. Healthcare facilities and educational institutions are also experiencing rapid adoption due to the need for uninterrupted communication and data exchange.

The Global In-Building Wireless Market is characterized by a dynamic mix of regional and international players. Leading participants such as CommScope Holding Company, Inc., Corning Incorporated, SOLiD Technologies, Cisco Systems, Inc., Ericsson, Nokia Corporation, Huawei Technologies Co., Ltd., ZTE Corporation, Dali Wireless, Inc., JMA Wireless, Comba Telecom Systems Holdings Ltd., Airspan Networks Inc., Zinwave, Samsung Electronics Co., Ltd., American Tower Corporation, Crown Castle International Corp., AT&T Inc., Verizon Communications Inc., T-Mobile US, Inc., InfiniG, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the in-building wireless market appears promising, driven by technological advancements and increasing connectivity demands. As organizations prioritize digital transformation, the integration of advanced wireless solutions will become essential. The shift towards cloud-based services and the adoption of AI technologies will further enhance operational efficiencies. Additionally, the growing emphasis on energy-efficient solutions will likely shape the development of in-building wireless systems, ensuring they meet both performance and sustainability standards in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Distributed Antenna Systems (DAS) Small Cells Repeaters Wi-Fi Solutions Others (e.g., Bi-Directional Amplifiers, Signal Boosters) |

| By End-User | Commercial Buildings Educational Institutions Healthcare Facilities Hospitality Sector Industrial Facilities Government & Public Safety Residential Buildings Others |

| By Application | Public Venues (Stadiums, Arenas, Airports) Corporate Offices Retail Spaces Transportation Hubs Industrial Complexes Others |

| By Component | Hardware (Antennas, Cabling, Repeaters, DAS, Small Cells) Software (Network Management, Monitoring, Security) Services (Installation, Maintenance, Consulting) |

| By Sales Channel | Direct Sales Distributors/Value-Added Resellers (VARs) Online Sales |

| By Deployment Type | Indoor Outdoor/Indoor-Outdoor |

| By Business Model | Carrier/Operator Enterprise Neutral Host |

| By Building Size | Large Buildings Medium Buildings Small Buildings |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Wireless Solutions | 120 | Facility Managers, IT Directors |

| Residential Building Connectivity | 90 | Homeowners, Property Managers |

| Industrial Wireless Infrastructure | 60 | Operations Managers, Network Engineers |

| Healthcare Facility Wireless Needs | 50 | Healthcare Administrators, IT Managers |

| Retail Store Wireless Solutions | 60 | Store Managers, IT Support Staff |

The Global In-Building Wireless Market is valued at approximately USD 17.9 billion, driven by the increasing demand for seamless connectivity in both commercial and residential buildings, as well as the rise of smart building technologies.