Region:Global

Author(s):Shubham

Product Code:KRAB0758

Pages:81

Published On:August 2025

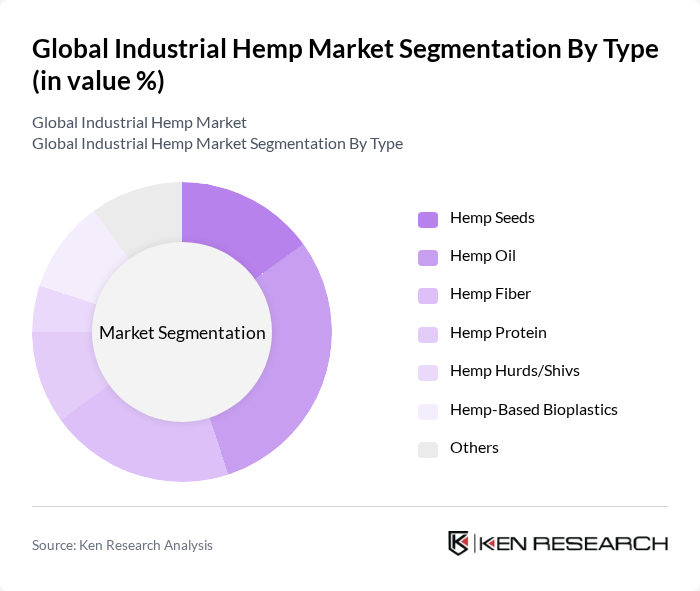

By Type:The industrial hemp market is segmented into various types, including Hemp Seeds, Hemp Oil, Hemp Fiber, Hemp Protein, Hemp Hurds/Shivs, Hemp-Based Bioplastics, and Others. Among these, Hemp Oil is currently the leading subsegment due to its extensive use in food products, cosmetics, and health supplements. The growing trend towards natural and organic products has significantly increased consumer demand for hemp oil, making it a preferred choice for manufacturers and consumers alike. Hemp fiber and seeds also show strong growth, supported by their applications in textiles and nutrition.

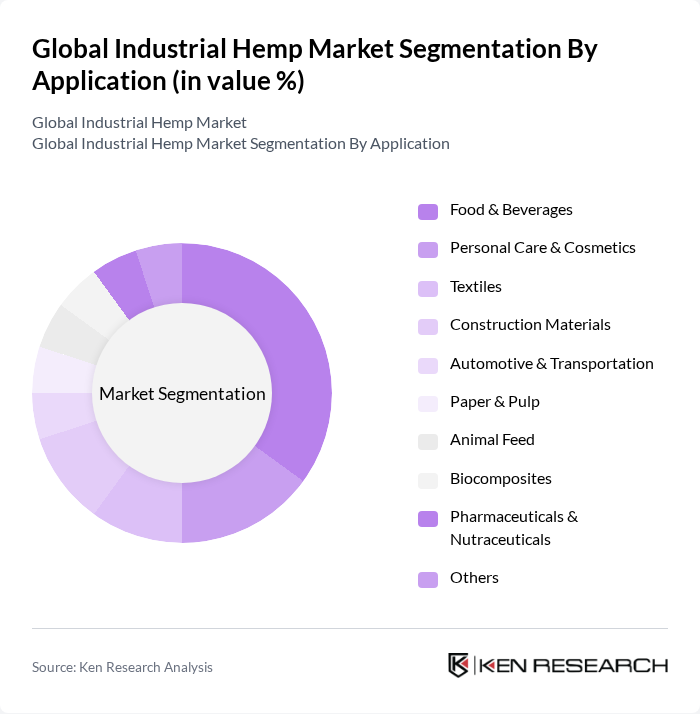

By Application:The industrial hemp market is also segmented by application, which includes Food & Beverages, Personal Care & Cosmetics, Textiles, Construction Materials, Automotive & Transportation, Paper & Pulp, Animal Feed, Biocomposites, Pharmaceuticals & Nutraceuticals, and Others. The Food & Beverages segment is the most dominant, driven by the increasing consumer preference for health-conscious and organic food options. This trend has led to a rise in the incorporation of hemp seeds and oil in various food products, enhancing the segment's growth. Personal care and cosmetics, as well as textiles, are also rapidly expanding segments due to the adoption of hemp-based ingredients and fibers.

The Global Industrial Hemp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canopy Growth Corporation, Aurora Cannabis Inc., Charlotte's Web Holdings, Inc., HempFlax Group B.V., Tilray, Inc., Hemp Inc., CV Sciences, Inc., HempMeds, Elixinol Global Limited, Hempco Food and Fiber Inc., Ecofibre Limited, GenCanna Global USA, Inc., Manitoba Harvest Hemp Foods, Konoplex Group, Dun Agro Hemp Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial hemp market appears promising, driven by increasing investments in research and development, particularly in processing technologies. As consumer awareness of hemp's benefits grows, the market is likely to see a surge in innovative applications, especially in sustainable materials. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential, as these regions begin to embrace hemp cultivation and its diverse applications in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Hemp Seeds Hemp Oil Hemp Fiber Hemp Protein Hemp Hurds/Shivs Hemp-Based Bioplastics Others |

| By Application | Food & Beverages Personal Care & Cosmetics Textiles Construction Materials Automotive & Transportation Paper & Pulp Animal Feed Biocomposites Pharmaceuticals & Nutraceuticals Others |

| By End-Use Industry | Food & Beverage Industry Textile Industry Construction Industry Personal Care Industry Pharmaceutical Industry Paper Industry Automotive Industry Animal Feed Industry Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Source | Conventional Organic |

| By Product Form | Raw Hemp Processed Hemp Hemp Extracts Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hemp Cultivation Practices | 60 | Farmers, Agricultural Consultants |

| Hemp Processing Technologies | 50 | Processing Plant Managers, Engineers |

| Consumer Preferences for Hemp Products | 90 | End Consumers, Retail Buyers |

| Market Trends in Hemp-Based Products | 70 | Product Managers, Marketing Executives |

| Regulatory Impact on Hemp Industry | 40 | Policy Makers, Legal Advisors |

The Global Industrial Hemp Market is valued at approximately USD 6.4 billion, reflecting a robust growth trajectory driven by increasing demand for sustainable products and the health benefits associated with hemp-derived goods.