Region:Asia

Author(s):Rebecca

Product Code:KRAE0828

Pages:95

Published On:December 2025

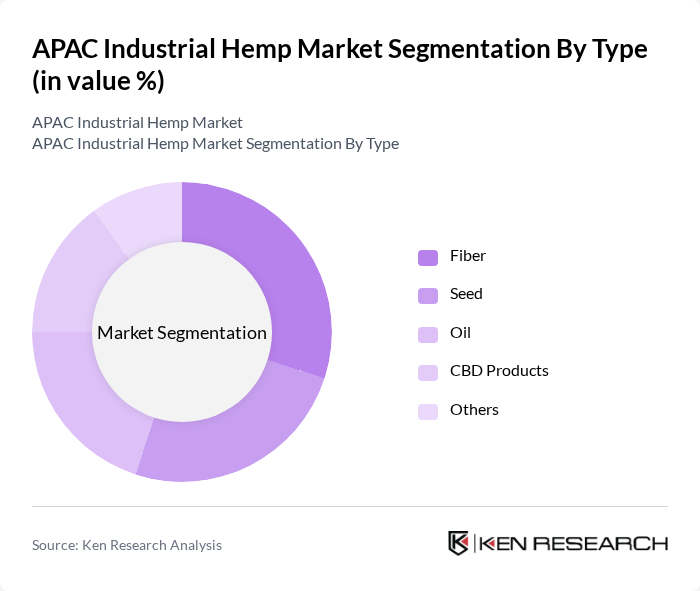

By Type:The market is segmented into various types, including Fiber, Seed, Oil, CBD Products, and Others. Each sub-segment plays a crucial role in the overall market dynamics, with specific applications and consumer preferences driving their demand.

The Fiber sub-segment is currently dominating the market due to its extensive use in textiles and construction materials. The increasing consumer preference for sustainable and biodegradable materials has led to a surge in demand for hemp fiber, which is known for its strength and durability. Additionally, the growing awareness of environmental issues has prompted industries to shift towards eco-friendly alternatives, further boosting the fiber segment's growth.

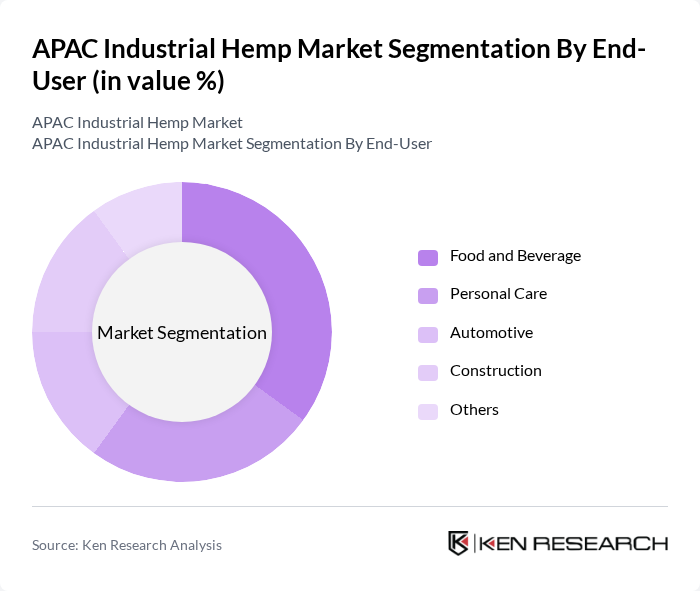

By End-User:The market is categorized based on end-users, including Food and Beverage, Personal Care, Automotive, Construction, and Others. Each end-user segment has unique requirements and applications for industrial hemp products.

The Food and Beverage segment is leading the market, driven by the rising trend of health-conscious consumers seeking natural and organic products. Hemp seeds and oils are increasingly being incorporated into various food products due to their nutritional benefits, including high protein and omega fatty acid content. This trend is further supported by the growing popularity of plant-based diets, making the food and beverage sector a significant contributor to the industrial hemp market.

The APAC Industrial Hemp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canopy Growth Corporation, Aurora Cannabis Inc., HempFlax, Tilray, Inc., Charlotte's Web Holdings, Inc., Elixinol Global Limited, Hempco Food and Fiber Inc., The Hemp Company, Ecofibre Limited, Green Thumb Industries Inc., AgriLife, Hemptown USA, Pure Hemp Technology, American Hemp LLC, HempMeds contribute to innovation, geographic expansion, and service delivery in this space.

The APAC industrial hemp market is poised for significant growth, driven by increasing investments in research and development, particularly in processing technologies. As consumer preferences shift towards sustainable and health-oriented products, the market is expected to expand into new geographical areas, enhancing accessibility. Additionally, collaborations between industry players and research institutions are likely to foster innovation, leading to the development of new applications and products that cater to evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber Seed Oil CBD Products Others |

| By End-User | Food and Beverage Personal Care Automotive Construction Others |

| By Region | China India Australia Japan |

| By Application | Textiles Building Materials Bioplastics Health Supplements Others |

| By Investment Source | Private Investments Government Grants Crowdfunding Venture Capital Others |

| By Policy Support | Subsidies Tax Incentives Research Grants Regulatory Support Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hemp Cultivation Practices | 100 | Farmers, Agricultural Consultants |

| Hemp Processing Technologies | 80 | Plant Managers, Process Engineers |

| Hemp Product Manufacturing | 75 | Product Managers, Quality Assurance Specialists |

| Consumer Preferences for Hemp Products | 90 | Retail Buyers, Marketing Executives |

| Regulatory Impact on Hemp Market | 60 | Policy Makers, Legal Advisors |

The APAC Industrial Hemp Market is valued at approximately USD 1.2 billion, driven by increasing demand for sustainable products and the rising acceptance of hemp-derived products across various industries, including textiles, food, and personal care.