Region:Middle East

Author(s):Dev

Product Code:KRAB1985

Pages:89

Published On:January 2026

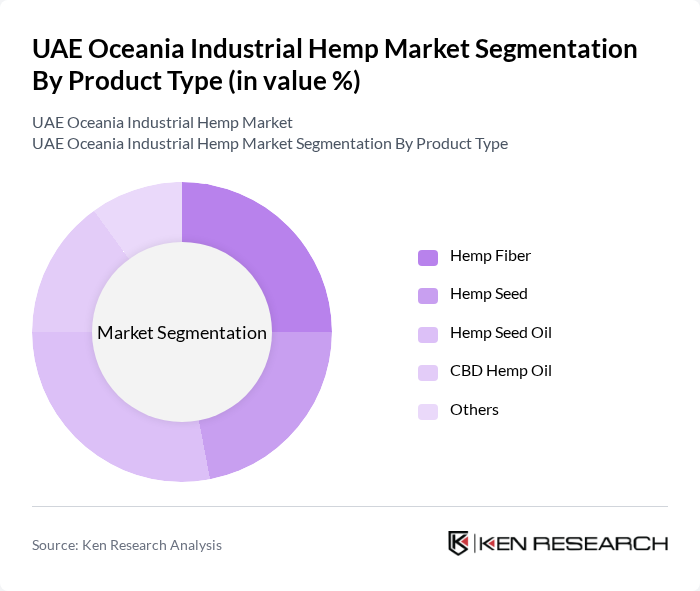

By Product Type:The product type segmentation includes Hemp Fiber, Hemp Seed, Hemp Seed Oil, CBD Hemp Oil, and Others. Hemp Seed and Hemp Seed Oil together account for a major share of industrial hemp revenues in the wider Middle East & Africa and global markets, reflecting strong adoption in food, beverages, and dietary supplements. Among these, Hemp Seed Oil is currently one of the leading product categories in value terms in many markets due to its extensive use in functional foods, salad oils, nutraceuticals, and cosmetics, driven by consumer demand for clean-label, plant-based, and omega-rich products. Hemp Fiber is also gaining traction, particularly in the textile, paper, automotive composites, and construction sectors, as industries seek sustainable alternatives with lower water and chemical footprints compared to conventional fibers and insulation materials. The growing trend towards health and wellness, sports nutrition, and stress-relief products is further propelling the demand for Hemp Seed and CBD Hemp Oil, making them significant contributors to market growth through applications in supplements, tinctures, and functional consumer packaged goods.

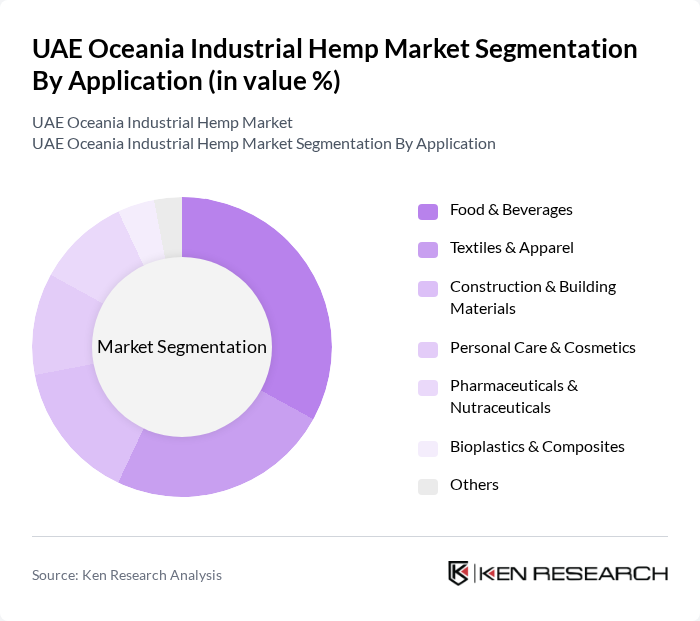

By Application:The application segmentation encompasses Food & Beverages, Textiles & Apparel, Construction & Building Materials, Personal Care & Cosmetics, Pharmaceuticals & Nutraceuticals, Bioplastics & Composites, and Others. In the broader Middle East & Africa industrial hemp market, seeds for food and beverages represent the largest revenue-generating product segment, supporting the view that Food & Beverages is among the leading application areas in value. The Food & Beverages segment is leading the market, driven by the increasing incorporation of hemp seeds, protein powders, and oils in plant-based milks, bakery products, snacks, and fortified beverages. The Textiles & Apparel segment is also witnessing significant growth as manufacturers shift towards sustainable materials and utilize hemp fiber blends in apparel, technical textiles, and eco-friendly fabrics. Personal Care & Cosmetics is emerging as a strong contender, with consumers increasingly favoring natural oils, cannabinoid-infused skincare, and clean-beauty formulations, supported by hemp seed oil’s emollient and antioxidant properties.

The UAE Oceania Industrial Hemp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canopy Growth Corporation, Aurora Cannabis Inc., Charlotte's Web Holdings, Inc., HempMeds, Elixinol Wellness Limited, Medterra CBD, CV Sciences, Inc., Green Roads, HempFusion Wellness Inc., 4 Corners Cannabis, Joy Organics, Pure Hemp Botanicals, Endoca, NuLeaf Naturals, Koi CBD contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE Oceania industrial hemp market appears promising, driven by increasing investments in research and development, particularly in sustainable applications. As consumer preferences shift towards eco-friendly products, the market is likely to see a surge in innovative hemp-based solutions. Additionally, collaborations between private enterprises and research institutions are expected to enhance product offerings, fostering a competitive landscape that could lead to significant advancements in the industry in future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hemp Fiber Hemp Seed Hemp Seed Oil CBD Hemp Oil Others |

| By Application | Food & Beverages Textiles & Apparel Construction & Building Materials Personal Care & Cosmetics Pharmaceuticals & Nutraceuticals Bioplastics & Composites Others |

| By Source | Conventional Organic |

| By End-Use Industry | Food & Beverage Manufacturers Textile & Fashion Manufacturers Construction & Real Estate Developers Personal Care & Wellness Brands Pharmaceutical & Healthcare Companies Automotive & Industrial Manufacturers Others |

| By Distribution Channel | B2B Direct Sales Distributors & Wholesalers Specialty Stores Online / E-commerce Platforms Others |

| By Region | UAE Australia New Zealand Rest of Oceania |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hemp Cultivation Practices | 100 | Agricultural Experts, Hemp Farmers |

| Hemp Product Manufacturing | 80 | Manufacturing Managers, Production Managers |

| Regulatory Compliance in Hemp Industry | 60 | Regulatory Officials, Compliance Officers |

| Market Demand for Hemp Products | 90 | Retailers, Market Analysts |

| Consumer Preferences for Hemp Products | 70 | End Consumers, Focus Group Participants |

The UAE Oceania Industrial Hemp Market is valued at approximately USD 1.4 billion, reflecting a significant growth trend driven by increasing consumer awareness of hemp's health benefits and demand for sustainable materials across various industries.