Region:Middle East

Author(s):Shubham

Product Code:KRAA8536

Pages:94

Published On:November 2025

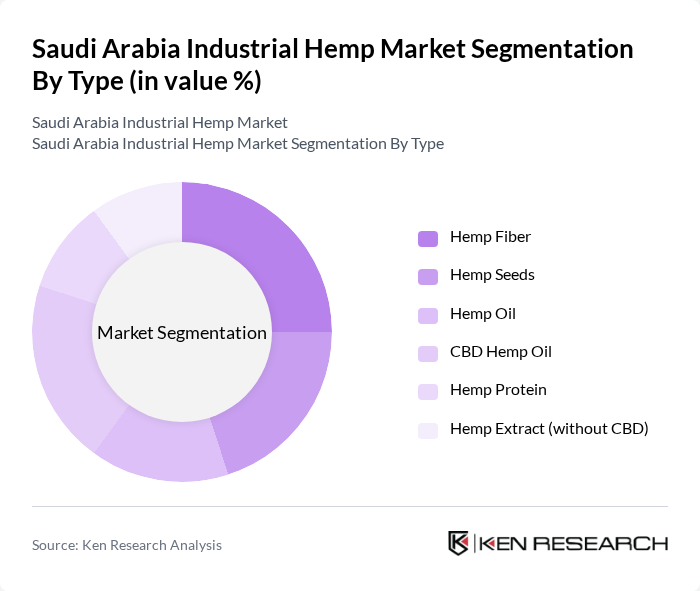

By Type:The market can be segmented into various types, including Hemp Fiber, Hemp Seeds, Hemp Oil, CBD Hemp Oil, Hemp Protein, and Hemp Extract (without CBD). Each of these subsegments plays a crucial role in the overall market dynamics, catering to different consumer needs and industry applications. Hemp Fiber is primarily used in textiles and construction, while Hemp Seeds and Oil are gaining traction in food and personal care. CBD Hemp Oil is increasingly utilized in wellness and pharmaceutical applications, reflecting global trends in therapeutic hemp product adoption .

By End-User Industry:The industrial hemp market is also segmented by end-user industries, which include the Food and Beverage Industry, Textile Industry, Construction Industry, Personal Care and Cosmetics, Pharmaceutical and Healthcare, Animal Feed, and Others. Each industry utilizes hemp products for various applications, contributing to the market's growth. The Food and Beverage Industry leads due to the nutritional benefits of hemp seeds and oil, while the Textile and Construction Industries are expanding their use of hemp fiber and hempcrete for sustainable solutions .

The Saudi Arabia Industrial Hemp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Fahim Group, Saudi Agricultural and Livestock Investment Company (SALIC), Al-Muhaidib Group, Al-Jazira Agricultural Company, Al-Hokair Group, Al-Faisaliah Group, Al-Suwaidi Industrial Services, Al-Babtain Group, Al-Mansour Group, Al-Rajhi Group, Al-Safi Danone, Al-Othaim Holding, Al-Khodari Sons Company, Herba Nutrition (Saudi Hemp Wellness Products), Green Arabia Agricultural Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial hemp market in Saudi Arabia appears promising, driven by increasing consumer demand for sustainable products and government initiatives supporting agricultural innovation. As regulatory frameworks become clearer, the market is likely to attract more investments, fostering growth in hemp cultivation and product development. Additionally, advancements in processing technologies will enhance product quality, making hemp a more competitive alternative in various industries, including textiles and health.

| Segment | Sub-Segments |

|---|---|

| By Type | Hemp Fiber Hemp Seeds Hemp Oil CBD Hemp Oil Hemp Protein Hemp Extract (without CBD) |

| By End-User Industry | Food and Beverage Industry Textile Industry Construction Industry Personal Care and Cosmetics Pharmaceutical and Healthcare Animal Feed Others |

| By Application | Functional Foods and Supplements Hempcrete and Building Materials Hemp Textiles and Fabrics CBD-based Nutraceuticals and Pharmaceuticals Biofuels and Bioplastics Automotive Composites Others |

| By Cultivation Method | Conventional Cultivation Organic Hemp Cultivation |

| By Distribution Channel | Direct Sales to Industries Wholesale and Distributors Online Retail Specialty Retail Stores Pharmacies and Health Stores |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region (Abha, Jizan) Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hemp Cultivation Practices | 100 | Agricultural Experts, Hemp Farmers |

| Hemp Processing and Manufacturing | 70 | Manufacturers, Production Managers |

| Regulatory Framework and Compliance | 50 | Policy Makers, Regulatory Officials |

| Market Demand for Hemp Products | 80 | Retailers, Product Development Managers |

| Consumer Awareness and Perception | 60 | End Consumers, Market Researchers |

The Saudi Arabia Industrial Hemp Market is valued at approximately USD 15 million, reflecting a growing interest in sustainable and eco-friendly products across various sectors, including textiles, food, and construction.