Global Infrastructure Managed Services Market Overview

- The Global Infrastructure Managed Services Market is valued at USD 335 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for IT infrastructure management, the rise of cloud computing, and the need for enhanced security measures. Organizations are increasingly outsourcing their infrastructure management to focus on core business activities, leading to a significant uptick in managed services adoption. The market is further propelled by the adoption of automation, artificial intelligence, and the Internet of Things (IoT), which enable more efficient and scalable service delivery. Additionally, the complexity of IT systems and the growing emphasis on cost optimization and operational efficiency are key market drivers .

- Key players in this market include theUnited States, Germany, and the United Kingdom, which dominate due to their advanced technological infrastructure, high levels of investment in IT services, and a strong presence of leading managed service providers. The concentration of large enterprises and a robust startup ecosystem in these regions further contribute to their market leadership .

- In 2023, the European Union implemented theDigital Services Act (Regulation (EU) 2022/2065) issued by the European Parliament and Council, which mandates stricter regulations on data privacy and security for managed service providers. This regulation aims to enhance consumer protection and ensure that service providers maintain high standards of data management and security, thereby influencing the operational frameworks of companies in the managed services sector. The Act requires managed service providers to implement robust risk management, transparency, and reporting mechanisms, particularly for very large online platforms and services .

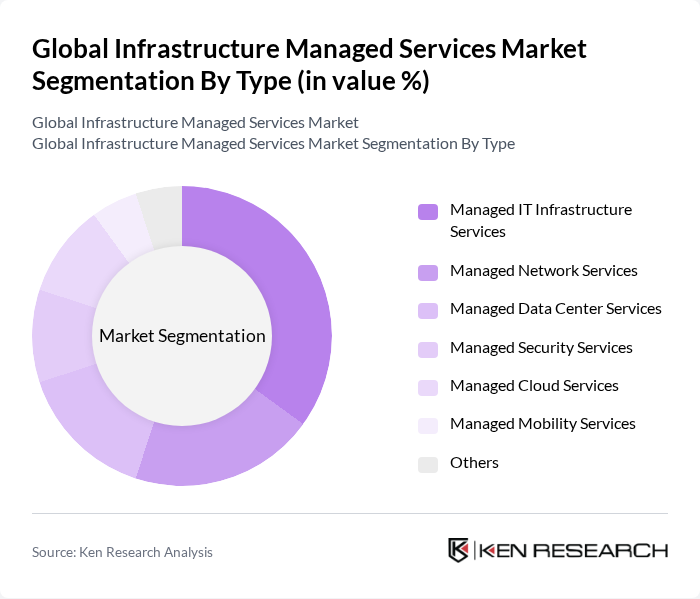

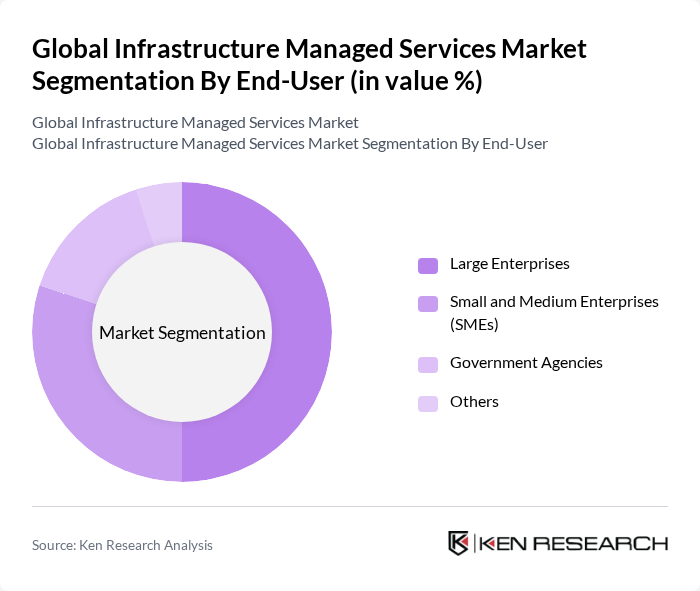

Global Infrastructure Managed Services Market Segmentation

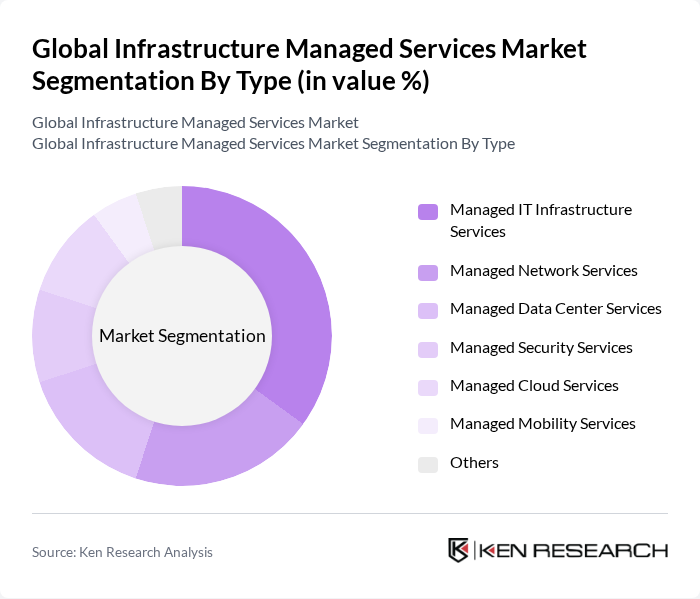

By Type:The market is segmented into various types of managed services, including Managed IT Infrastructure Services, Managed Network Services, Managed Data Center Services, Managed Security Services, Managed Cloud Services, Managed Mobility Services, and Others. Each of these segments caters to specific needs of businesses, with Managed IT Infrastructure Services being the most prominent due to the increasing reliance on IT systems and the need for continuous uptime, proactive monitoring, and rapid incident response. Managed Security Services are also experiencing rapid growth, driven by escalating cybersecurity threats and regulatory requirements .

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Enterprises (SMEs), Government Agencies, and Others. Large Enterprises dominate the market due to their extensive IT infrastructure needs and higher budgets for managed services, while SMEs are increasingly adopting these services to enhance operational efficiency without significant capital investment. Government agencies are also expanding their use of managed services to modernize legacy systems and improve cybersecurity posture .

Global Infrastructure Managed Services Market Competitive Landscape

The Global Infrastructure Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Accenture plc, Cisco Systems, Inc., Hewlett Packard Enterprise, Dell Technologies Inc., Fujitsu Limited, Atos SE, Capgemini SE, Wipro Limited, Tata Consultancy Services (TCS), Infosys Limited, NTT DATA Corporation, DXC Technology Company, Rackspace Technology, Inc., Dimension Data (NTT Ltd.), Cognizant Technology Solutions, HCL Technologies Limited, Tech Mahindra Limited, Orange Business Services, AT&T Inc., and Ericsson contribute to innovation, geographic expansion, and service delivery in this space.

Global Infrastructure Managed Services Market Industry Analysis

Growth Drivers

- Increasing Demand for Cloud-Based Solutions:The global cloud computing market is projected to reach $832.1 billion by 2025, driven by a 17% annual growth rate. This surge is fueled by businesses seeking scalable and flexible IT solutions. In future, the adoption of cloud services is expected to increase by 20%, as organizations prioritize remote work capabilities and digital collaboration tools. This trend significantly boosts the demand for managed services that facilitate cloud integration and management.

- Rising Need for Cost-Effective IT Management:Companies are increasingly pressured to optimize IT expenditures, with IT budgets expected to grow by 3.6% in future, reaching $4.5 trillion globally. Managed services offer a cost-effective alternative, allowing businesses to reduce operational costs by up to 30%. This financial incentive drives organizations to outsource IT management, enabling them to focus on core business functions while leveraging expert services for infrastructure management.

- Growing Focus on Digital Transformation:The digital transformation market is anticipated to reach $3.2 trillion in future, with a significant portion allocated to infrastructure upgrades. In future, 70% of organizations are expected to prioritize digital initiatives, enhancing their operational efficiency and customer engagement. This shift necessitates robust managed services to support the integration of new technologies, ensuring seamless transitions and minimizing disruptions during the transformation process.

Market Challenges

- Data Security and Privacy Concerns:With cybercrime projected to cost businesses $10.5 trillion annually in future, data security remains a critical challenge for managed services. In future, 60% of organizations will prioritize cybersecurity investments, yet many lack the necessary expertise to implement effective measures. This gap creates vulnerabilities, deterring potential clients from adopting managed services due to fears of data breaches and compliance failures.

- High Initial Investment Costs:The upfront costs associated with transitioning to managed services can be substantial, often exceeding $100,000 for mid-sized enterprises. In future, many organizations will struggle to justify these expenses, especially in uncertain economic climates. This financial barrier can hinder the adoption of managed services, as companies weigh the immediate costs against long-term benefits, leading to slower market growth.

Global Infrastructure Managed Services Market Future Outlook

The future of the infrastructure managed services market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid IT environments, the demand for integrated solutions will rise. Additionally, the emphasis on sustainability will push service providers to innovate eco-friendly practices. Companies will also focus on enhancing customer experience, leading to tailored service offerings that meet specific client needs, ultimately fostering market growth and resilience in a competitive landscape.

Market Opportunities

- Adoption of AI and Machine Learning:The AI market is expected to reach $190 billion in future, presenting significant opportunities for managed services. By integrating AI-driven solutions, service providers can enhance operational efficiency and predictive analytics, allowing businesses to make data-informed decisions. This technological integration can lead to improved service delivery and customer satisfaction, positioning providers as leaders in the market.

- Growth in Emerging Markets:Emerging markets are projected to experience a 15% increase in IT spending in future, driven by digitalization efforts. This growth presents a lucrative opportunity for managed service providers to expand their offerings in these regions. By tailoring services to local needs and leveraging cost advantages, providers can capture significant market share and drive revenue growth in previously underserved areas.