Region:Global

Author(s):Geetanshi

Product Code:KRAA2289

Pages:90

Published On:August 2025

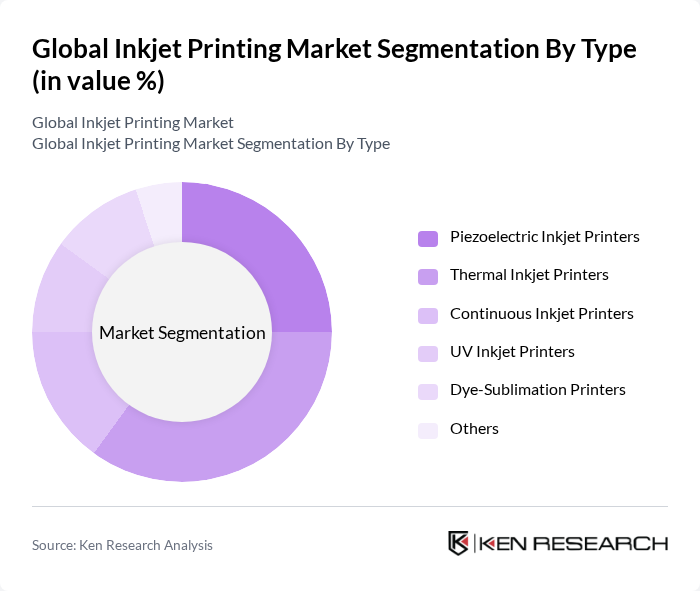

By Type:The inkjet printing market is segmented into Piezoelectric Inkjet Printers, Thermal Inkjet Printers, Continuous Inkjet Printers, UV Inkjet Printers, Dye-Sublimation Printers, and Others. Among these, Thermal Inkjet Printers remain popular for residential and small business applications due to their cost-effectiveness and ease of use. Piezoelectric Inkjet Printers are increasingly adopted in industrial and commercial settings, valued for their ability to handle a wide range of inks and substrates, as well as their superior print precision and durability .

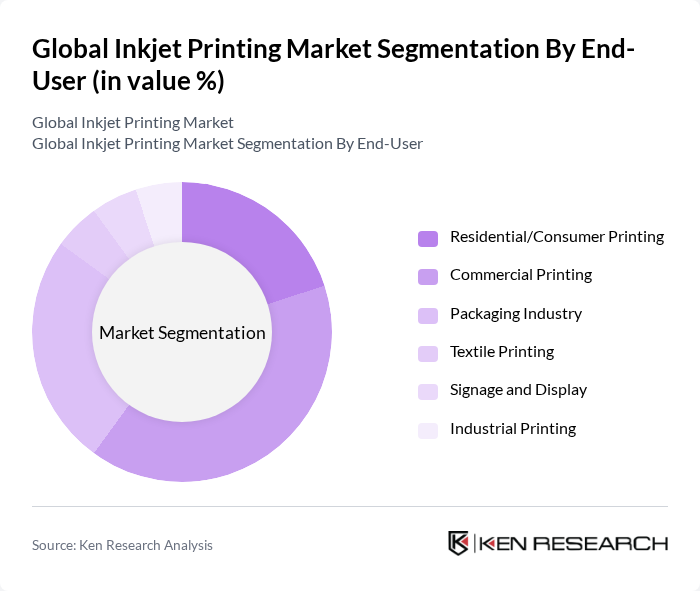

By End-User:The end-user segmentation includes Residential/Consumer Printing, Commercial Printing, Packaging Industry, Textile Printing, Signage and Display, and Industrial Printing. The Commercial Printing segment leads the market, driven by the increasing demand for high-quality, short-run, and customizable printed materials in advertising, marketing, and publishing. The Packaging Industry is also experiencing robust growth, propelled by the surge in e-commerce and the need for innovative, personalized packaging solutions across various sectors .

The Global Inkjet Printing Market is characterized by a dynamic mix of regional and international players. Leading participants such as HP Inc., Canon Inc., Seiko Epson Corporation, Ricoh Company, Ltd., Brother Industries, Ltd., Lexmark International, Inc., Xerox Holdings Corporation, Konica Minolta, Inc., Mimaki Engineering Co., Ltd., Durst Group AG, Roland DG Corporation, Agfa-Gevaert Group, Fujifilm Holdings Corporation, Eastman Kodak Company, Mark Andy Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inkjet printing market appears promising, driven by technological advancements and evolving consumer preferences. As industries increasingly prioritize sustainability, the demand for eco-friendly inks and sustainable printing practices is expected to rise. Furthermore, the integration of IoT technologies in printing solutions will enhance operational efficiency and customization capabilities, allowing businesses to meet specific consumer demands more effectively. These trends indicate a dynamic shift towards innovative and sustainable printing solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Piezoelectric Inkjet Printers Thermal Inkjet Printers Continuous Inkjet Printers UV Inkjet Printers Dye-Sublimation Printers Others |

| By End-User | Residential/Consumer Printing Commercial Printing Packaging Industry Textile Printing Signage and Display Industrial Printing |

| By Application | Books/Publishing Commercial Print Advertising Transaction Printing Labels Packaging Photo Printing Other Applications |

| By Distribution Channel | Direct Sales Online Retail Distributors and Resellers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Printers Mid-Range Printers High-End Printers |

| By Technology | Drop-On-Demand (DoD) Technology Continuous Inkjet (CIJ) Technology UV Inkjet Technology Hybrid Technology |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Printing Sector | 100 | Print Shop Owners, Production Managers |

| Packaging Industry | 80 | Packaging Designers, Operations Managers |

| Textile Printing | 60 | Textile Manufacturers, R&D Managers |

| Industrial Applications | 50 | Manufacturing Engineers, Quality Control Managers |

| Consumer Electronics Printing | 40 | Product Managers, Supply Chain Analysts |

The Global Inkjet Printing Market is valued at approximately USD 51 billion, driven by advancements in printing technology and increasing demand for high-quality printing solutions across various sectors, including textiles, signage, and commercial printing.