Region:Global

Author(s):Dev

Product Code:KRAA2571

Pages:99

Published On:August 2025

By Type:

The Claims Administration sub-segment is currently dominating the market due to the increasing volume of claims processed by insurance companies. This segment is essential for ensuring timely and accurate claims handling, which directly impacts customer satisfaction and retention. The rise in digital claims processing, automation, and AI-driven solutions has further enhanced the efficiency of claims administration, making it a critical focus area for third-party administrators. As a result, this sub-segment is expected to maintain its leadership position in the market .

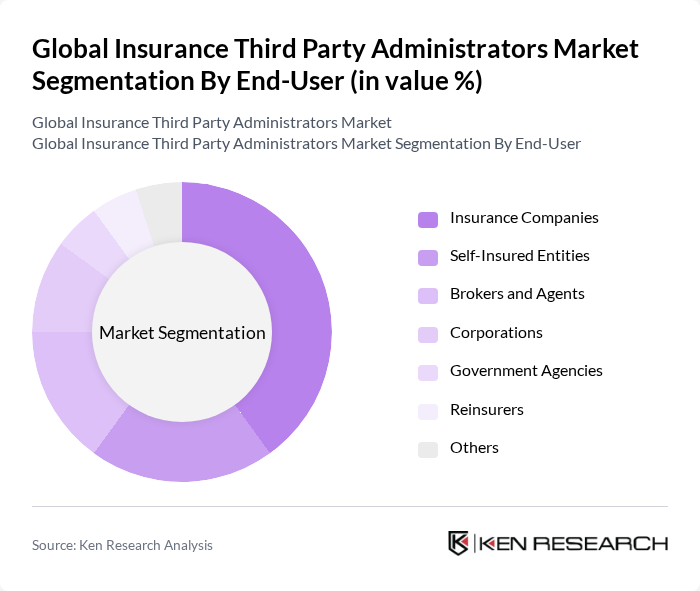

By End-User:

The Insurance Companies sub-segment is the largest end-user in the market, driven by the need for efficient claims processing and administrative support. As insurance companies face increasing pressure to improve customer service and reduce operational costs, they are increasingly outsourcing these functions to third-party administrators. This trend is expected to continue as insurers seek to leverage specialized expertise, regulatory compliance, and advanced technology solutions offered by TPAs, solidifying their position as the leading end-user segment .

The Global Insurance Third Party Administrators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sedgwick Claims Management Services, Inc., Crawford & Company, Genpact Limited, Gallagher Bassett Services, Inc., Broadspire Services, Inc., Zenith American Solutions, Inc., Meritain Health, Inc., Aon plc, The Hartford, AssuredPartners, Inc., AmTrust Financial Services, Inc., Chubb Limited, Munich Re, Allianz Global Corporate & Specialty, Liberty Mutual Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insurance TPA market appears promising, driven by ongoing digital transformation and the increasing adoption of advanced technologies. As insurers prioritize customer experience, TPAs will play a crucial role in enhancing service delivery through innovative solutions. Additionally, the focus on regulatory compliance will necessitate the development of robust frameworks, ensuring that TPAs can adapt to evolving market demands while maintaining operational efficiency and security.

| Segment | Sub-Segments |

|---|---|

| By Type | Claims Administration Policy Administration Risk Management Services Customer Service Management Compliance Management Data Analytics Services Fraud Detection & Prevention Services Provider Network Management Others |

| By End-User | Insurance Companies Self-Insured Entities Brokers and Agents Corporations Government Agencies Reinsurers Others |

| By Service Model | Full-Service TPA Specialized TPA Hybrid TPA Digital-First TPA Others |

| By Geographic Coverage | National Coverage Regional Coverage Global Coverage Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| By Claims Type | Health Insurance Claims Property & Casualty Insurance Claims Liability Insurance Claims Workers’ Compensation Claims Life Insurance Claims Others |

| By Distribution Channel | Direct Sales Online Platforms Brokers Insurtech Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance TPAs | 100 | TPA Executives, Health Insurance Managers |

| Property and Casualty TPAs | 80 | Claims Adjusters, Risk Managers |

| Life Insurance TPAs | 70 | Underwriters, Compliance Officers |

| Specialty Insurance TPAs | 50 | Product Development Managers, Actuaries |

| Global TPA Market Trends | 60 | Market Analysts, Insurance Consultants |

The Global Insurance Third Party Administrators Market is valued at approximately USD 430 billion, reflecting significant growth driven by the increasing complexity of insurance claims and the demand for efficient claims processing solutions.