Region:Global

Author(s):Shubham

Product Code:KRAA2646

Pages:95

Published On:August 2025

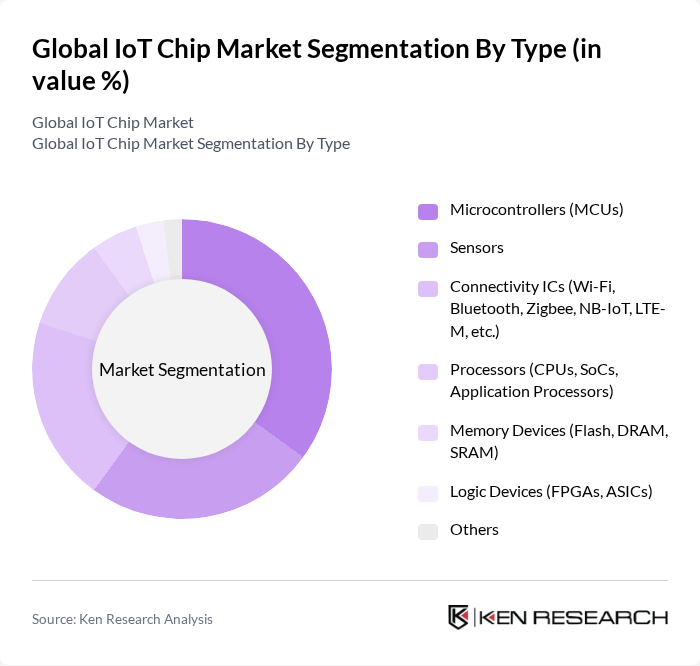

By Type:The IoT chip market is segmented into Microcontrollers (MCUs), Sensors, Connectivity ICs, Processors, Memory Devices, Logic Devices, and Others. Microcontrollers (MCUs) hold the largest share due to their versatility and essential function in enabling smart devices. MCUs are extensively used in consumer electronics, automotive systems, and industrial automation, driving substantial demand. Sensors and Connectivity ICs also represent significant segments, reflecting the growing need for real-time data acquisition and seamless device connectivity in IoT ecosystems.

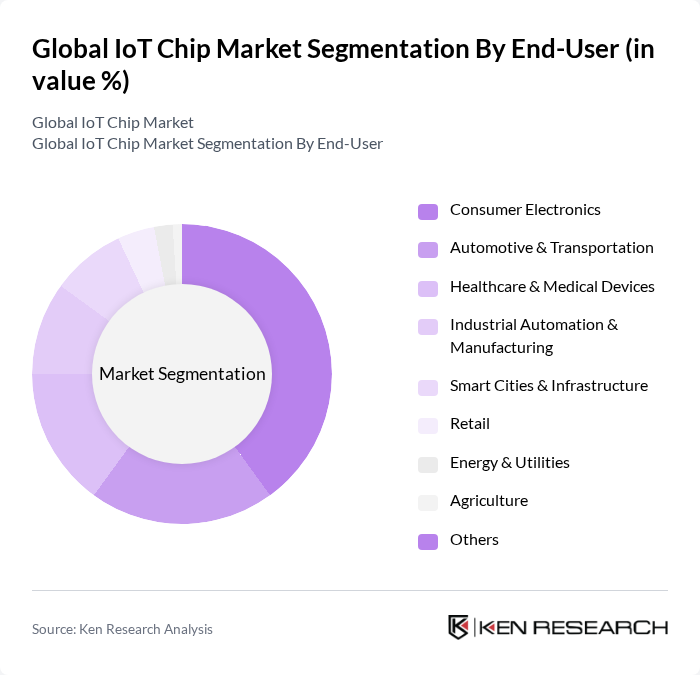

By End-User:End-user segmentation includes Consumer Electronics, Automotive & Transportation, Healthcare & Medical Devices, Industrial Automation & Manufacturing, Smart Cities & Infrastructure, Retail, Energy & Utilities, Agriculture, and Others. The Consumer Electronics segment leads the market, driven by surging demand for smart home devices, wearables, and personal IoT applications that require advanced chips for connectivity and functionality. Automotive & Transportation and Healthcare segments are also experiencing rapid growth due to the integration of IoT chips in connected vehicles and medical monitoring devices.

The Global IoT Chip Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Qualcomm Technologies, Inc., NXP Semiconductors N.V., Texas Instruments Incorporated, STMicroelectronics N.V., Broadcom Inc., MediaTek Inc., Infineon Technologies AG, Analog Devices, Inc., Cypress Semiconductor Corporation (now part of Infineon Technologies AG), Renesas Electronics Corporation, Microchip Technology Incorporated, onsemi (formerly ON Semiconductor Corporation), Nordic Semiconductor ASA, Espressif Systems (Shanghai) Co., Ltd., Samsung Electronics Co., Ltd., Silicon Labs, Marvell Technology, Inc., Realtek Semiconductor Corp., Dialog Semiconductor (now part of Renesas Electronics Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IoT chip market is poised for transformative growth, driven by technological advancements and increasing integration of AI. As industries adopt more sophisticated IoT solutions, the demand for chips that support edge computing and real-time analytics will rise. Furthermore, the convergence of IoT with AI technologies will enhance device capabilities, leading to smarter applications across sectors. This evolution will create a dynamic landscape, fostering innovation and expanding market potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Microcontrollers (MCUs) Sensors Connectivity ICs (Wi-Fi, Bluetooth, Zigbee, NB-IoT, LTE-M, etc.) Processors (CPUs, SoCs, Application Processors) Memory Devices (Flash, DRAM, SRAM) Logic Devices (FPGAs, ASICs) Others |

| By End-User | Consumer Electronics Automotive & Transportation Healthcare & Medical Devices Industrial Automation & Manufacturing Smart Cities & Infrastructure Retail Energy & Utilities Agriculture Others |

| By Application | Smart Home Devices Wearable Devices Connected Vehicles Industrial IoT (IIoT) Asset Tracking & Logistics Smart City Solutions Environmental Monitoring Others |

| By Component | Hardware Software Services |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive IoT Chip Applications | 100 | Product Engineers, Automotive Designers |

| Healthcare IoT Solutions | 60 | Healthcare IT Managers, Biomedical Engineers |

| Smart Home Device Manufacturers | 75 | Product Managers, R&D Specialists |

| Industrial IoT Implementations | 55 | Operations Managers, IoT Solution Architects |

| Consumer Electronics IoT Integration | 65 | Market Analysts, Product Development Managers |

The Global IoT Chip Market is valued at approximately USD 605 billion, reflecting significant growth driven by the increasing adoption of smart devices and advancements in connectivity technologies across various sectors.