Region:Global

Author(s):Shubham

Product Code:KRAA3126

Pages:97

Published On:August 2025

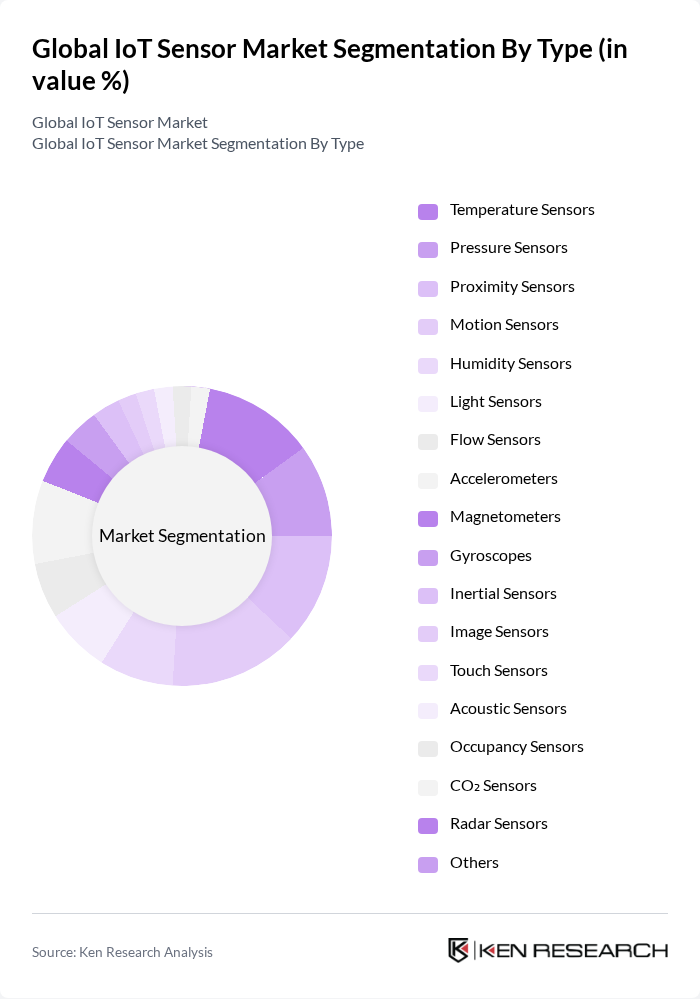

By Type:The IoT sensor market can be segmented into various types, including temperature sensors, pressure sensors, proximity sensors, motion sensors, humidity sensors, light sensors, flow sensors, accelerometers, magnetometers, gyroscopes, inertial sensors, image sensors, touch sensors, acoustic sensors, occupancy sensors, CO? sensors, radar sensors, and others. Each type serves specific applications across different industries, contributing to the overall market dynamics. Notably, the accelerometers/inertial/gyroscope segment represents the largest share among sensor types, driven by adoption in wearables, consumer electronics, and automotive applications .

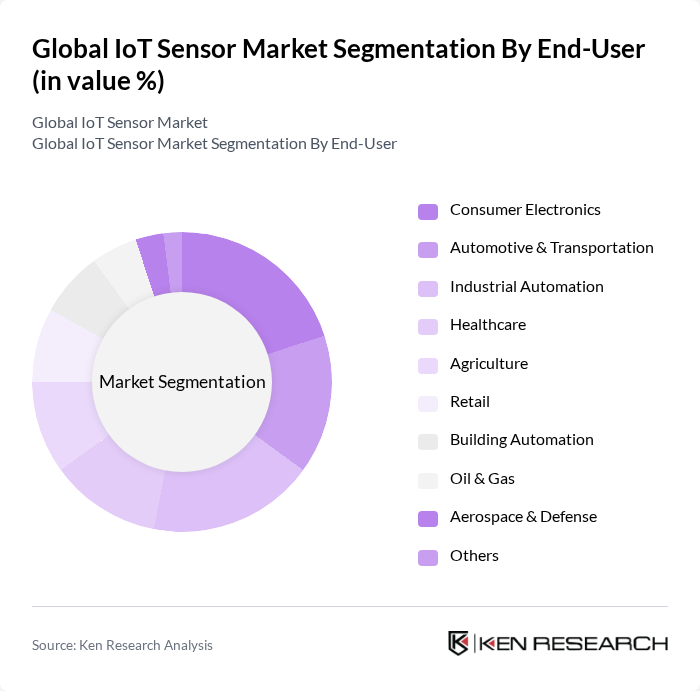

By End-User:The end-user segmentation of the IoT sensor market includes consumer electronics, automotive & transportation, industrial automation, healthcare, agriculture, retail, building automation, oil & gas, aerospace & defense, and others. Each sector utilizes IoT sensors for various applications, enhancing operational efficiency and enabling data-driven decision-making. Industrial automation and consumer electronics are among the leading end-use segments, driven by the adoption of Industry 4.0, smart manufacturing, and the proliferation of connected consumer devices .

The Global IoT Sensor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Bosch Sensortec GmbH, Honeywell International Inc., Texas Instruments Incorporated, STMicroelectronics N.V., NXP Semiconductors N.V., Analog Devices, Inc., Infineon Technologies AG, Qualcomm Technologies, Inc., TE Connectivity Ltd., Emerson Electric Co., Schneider Electric SE, ABB Ltd., General Electric Company, Mitsubishi Electric Corporation, Sensirion AG, Omron Corporation, Murata Manufacturing Co., Ltd., TDK Corporation, and Amphenol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IoT sensor market appears promising, driven by technological advancements and increasing integration across various sectors. The proliferation of 5G networks will enhance connectivity, enabling more sophisticated applications. Additionally, the rise of edge computing will facilitate real-time data processing, reducing latency and improving efficiency. As industries continue to embrace automation and smart technologies, the demand for IoT sensors is expected to grow, fostering innovation and new business models.

| Segment | Sub-Segments |

|---|---|

| By Type | Temperature Sensors Pressure Sensors Proximity Sensors Motion Sensors Humidity Sensors Light Sensors Flow Sensors Accelerometers Magnetometers Gyroscopes Inertial Sensors Image Sensors Touch Sensors Acoustic Sensors Occupancy Sensors CO? Sensors Radar Sensors Others |

| By End-User | Consumer Electronics Automotive & Transportation Industrial Automation Healthcare Agriculture Retail Building Automation Oil & Gas Aerospace & Defense Others |

| By Application | Smart Cities Environmental Monitoring Asset Tracking Smart Agriculture Smart Transportation Wearable Devices Building Automation Others |

| By Component | Hardware Software/Platform Connectivity Services |

| By Distribution Channel | Direct Sales Online Sales Retail Sales Distributors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial IoT Sensors | 100 | Manufacturing Engineers, Operations Managers |

| Healthcare Monitoring Devices | 60 | Healthcare Administrators, Biomedical Engineers |

| Smart Agriculture Sensors | 50 | Agronomists, Farm Managers |

| Environmental Monitoring Solutions | 40 | Environmental Scientists, Policy Makers |

| Consumer IoT Devices | 60 | Product Managers, Retail Buyers |

The Global IoT Sensor Market is valued at approximately USD 16 billion, driven by the increasing adoption of smart devices, advancements in sensor technology, and rising demand for automation across various industries.