Region:Global

Author(s):Geetanshi

Product Code:KRAC7886

Pages:88

Published On:December 2025

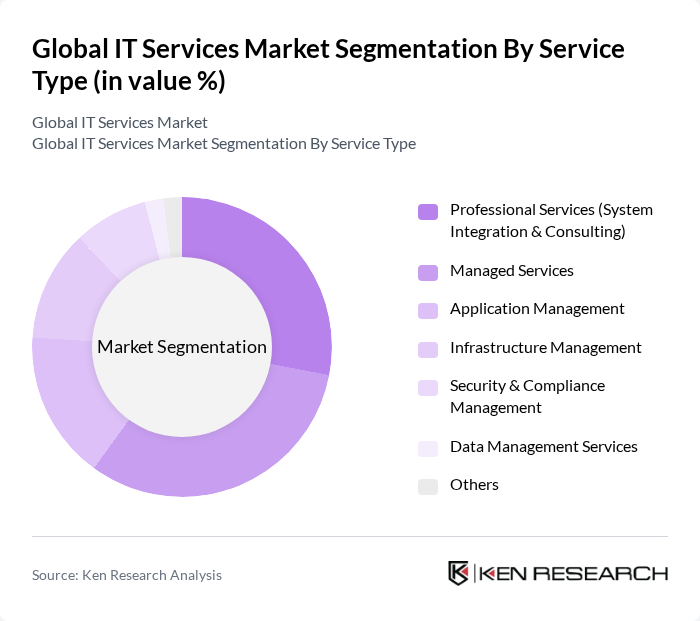

By Service Type:The service type segmentation includes various categories such as Professional Services (System Integration & Consulting), Managed Services, Application Management, Infrastructure Management, Security & Compliance Management, Data Management Services, and Others. Consulting services currently dominate the market as the leading sub-segment, driven by organizations' need for strategic technology guidance and digital transformation initiatives. The trend towards cloud-based solutions has also contributed to the growth of managed services, as businesses seek to leverage external expertise for better service delivery and operational efficiency.

By Technology:This segmentation encompasses AI & Machine Learning, Big Data Analytics, Threat Intelligence, Cloud Computing, and Others. Cloud Computing is the dominant sub-segment, accounting for over half of the technology market, as organizations increasingly migrate their operations to the cloud for enhanced flexibility, scalability, and cost-effectiveness. The growing reliance on remote work and digital collaboration tools has further accelerated the adoption of cloud technologies, making it a critical component of IT service offerings.

The Global IT Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Accenture plc, Tata Consultancy Services (TCS), Infosys Limited, Capgemini SE, Wipro Limited, Cognizant Technology Solutions, HCL Technologies Limited, Amazon Web Services (AWS), Microsoft Corporation, Google Cloud (Alphabet Inc.), Oracle Corporation, Fujitsu Limited, NTT Data Corporation, Rackspace Technology, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the IT services market is poised for transformative growth, driven by advancements in technology and evolving business needs. As organizations increasingly adopt cloud solutions and prioritize cybersecurity, the demand for managed IT services will rise. Additionally, the integration of AI and machine learning into IT operations will enhance efficiency and decision-making. Companies that embrace these trends will likely gain a competitive edge, positioning themselves for success in an ever-evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Professional Services (System Integration & Consulting) Managed Services Application Management Infrastructure Management Security & Compliance Management Data Management Services Others |

| By Technology | AI & Machine Learning Big Data Analytics Threat Intelligence Cloud Computing Others |

| By End-User Industry | BFSI (Banking, Financial Services & Insurance) Healthcare Retail Manufacturing Telecommunications Government Media & Communications Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Cloud Deployment Type | Public Cloud Private Cloud Hybrid Cloud Others |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By Geographic Region | North America (U.S., Canada) Europe (Germany, UK, France) Asia-Pacific (China, Japan, India, South Korea, Australia) Latin America (Brazil) Middle East & Africa (KSA, UAE, South Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Services Adoption | 120 | CIOs, IT Directors, Cloud Architects |

| Cybersecurity Solutions | 80 | Security Managers, Compliance Officers |

| IT Consulting Services | 60 | Consultants, Project Managers, Business Analysts |

| Managed IT Services | 100 | Operations Managers, IT Service Managers |

| Digital Transformation Initiatives | 70 | Digital Officers, Strategy Managers, Innovation Leads |

The Global IT Services Market is valued at approximately USD 1,400 billion, driven by the increasing demand for digital transformation, cloud computing, and cybersecurity solutions across various industries.