Region:Global

Author(s):Geetanshi

Product Code:KRAA2813

Pages:82

Published On:August 2025

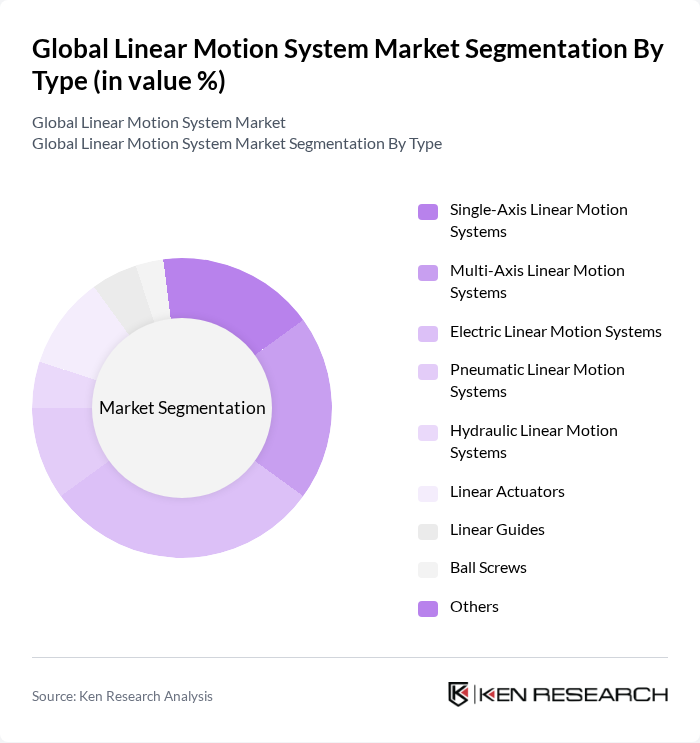

By Type:The linear motion systems market can be segmented into various types, including Single-Axis Linear Motion Systems, Multi-Axis Linear Motion Systems, Electric Linear Motion Systems, Pneumatic Linear Motion Systems, Hydraulic Linear Motion Systems, Linear Actuators, Linear Guides, Ball Screws, and Others. Among these,Electric Linear Motion Systemsare gaining traction due to their superior efficiency, precision, and integration capabilities with automation and smart factory solutions. These systems are increasingly preferred in applications requiring high-speed, accurate, and programmable motion control, such as robotics, semiconductor manufacturing, and automated assembly lines.

By End-User:The end-user segmentation includes Automotive, Aerospace, Electronics & Semiconductor, Healthcare & Medical Devices, Packaging, Food & Beverage, Machining Tools, and Others. TheAutomotivesector remains the largest consumer of linear motion systems, fueled by increasing automation in manufacturing processes, demand for precision in vehicle assembly, and integration of robotics in production lines. The Electronics & Semiconductor segment is also rapidly expanding, driven by the need for high-precision motion control in microelectronics fabrication and advanced packaging.

The Global Linear Motion System Market is characterized by a dynamic mix of regional and international players. Leading participants such as THK Co., Ltd., Bosch Rexroth AG, Siemens AG, Parker Hannifin Corporation, Mitsubishi Electric Corporation, Schneider Electric SE, NSK Ltd., SMC Corporation, Festo AG & Co. KG, igus GmbH, HIWIN Technologies Corp., SKF Group, Schneeberger Group, Thomson Industries, Inc. (Regal Rexnord Corporation), Ewellix AB (Schaeffler Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the linear motion system market appears promising, driven by technological advancements and increasing integration of smart manufacturing practices. As industries continue to embrace automation and Industry 4.0, the demand for efficient, precise, and reliable linear motion solutions will grow. Additionally, the focus on sustainability and energy efficiency will shape product development, encouraging manufacturers to innovate and adapt to changing market needs, particularly in emerging economies where industrialization is accelerating.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Axis Linear Motion Systems Multi-Axis Linear Motion Systems Electric Linear Motion Systems Pneumatic Linear Motion Systems Hydraulic Linear Motion Systems Linear Actuators Linear Guides Ball Screws Others |

| By End-User | Automotive Aerospace Electronics & Semiconductor Healthcare & Medical Devices Packaging Food & Beverage Machining Tools Others |

| By Application | Assembly Lines Material Handling Robotics CNC Machines Testing Equipment Logistics & Warehousing Others |

| By Component | Motors Drives Controllers Sensors Linear Bearings Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing | 100 | Production Managers, Automation Engineers |

| Aerospace Applications | 60 | Design Engineers, Quality Assurance Managers |

| Robotics and Automation | 70 | Robotics Engineers, Project Managers |

| Packaging Industry | 50 | Operations Managers, Supply Chain Analysts |

| Medical Device Manufacturing | 40 | Regulatory Affairs Specialists, Production Supervisors |

The Global Linear Motion System Market is valued at approximately USD 12 billion, driven by increasing automation across various industries such as manufacturing, automotive, electronics, and healthcare, alongside the rise of Industry 4.0 initiatives.