Region:Global

Author(s):Rebecca

Product Code:KRAA1357

Pages:88

Published On:August 2025

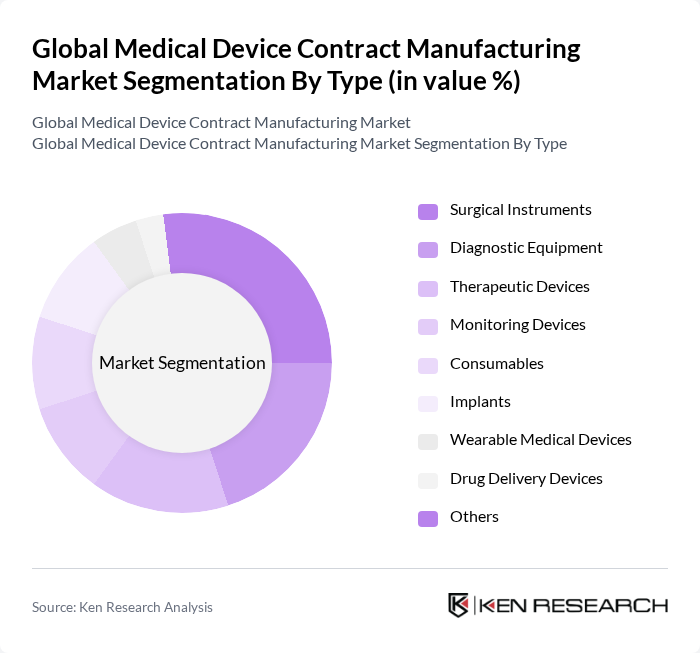

By Type:The market is segmented into various types of medical devices, including surgical instruments, diagnostic equipment, therapeutic devices, monitoring devices, consumables, implants, wearable medical devices, drug delivery devices, and others. Among these,surgical instrumentsanddiagnostic equipmentare leading segments, attributed to their critical roles in healthcare delivery and the growing demand for minimally invasive and technologically advanced procedures. The market is also witnessing increased demand for wearable medical devices and drug delivery devices, driven by the shift toward personalized and home-based healthcare solutions .

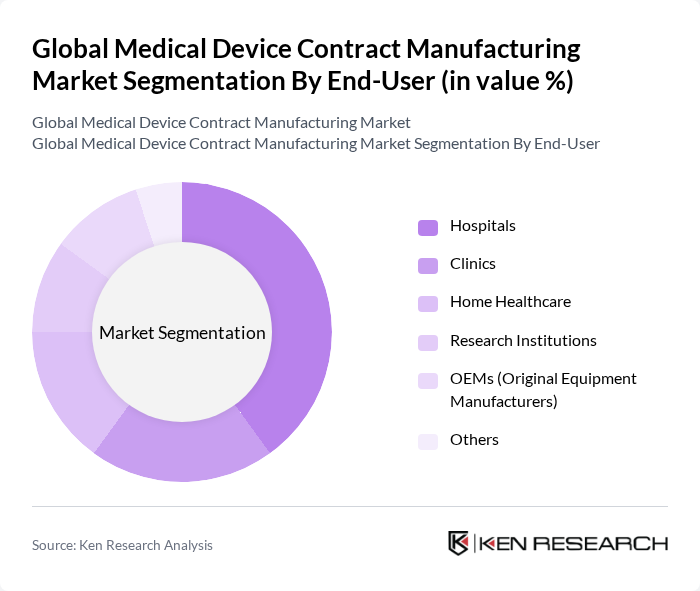

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, research institutions, OEMs (Original Equipment Manufacturers), and others.Hospitalsremain the dominant end-user segment, driven by the increasing number of surgical procedures and the demand for advanced medical technologies in patient care. The home healthcare segment is also expanding rapidly due to the rising adoption of portable and wearable medical devices for chronic disease management and elderly care .

The Global Medical Device Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jabil Inc., Flex Ltd., Sanmina Corporation, Celestica Inc., TE Connectivity (formerly Creganna Medical), Integer Holdings Corporation, West Pharmaceutical Services, Inc., Phillips-Medisize (a Molex company), SMC Ltd., Viant Medical, Nordson Corporation, Plexus Corp., Heraeus Holding GmbH, Resonetics LLC, and Nemera contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical device contract manufacturing market appears promising, driven by technological innovations and increasing healthcare demands. As manufacturers adopt automation and IoT technologies, production efficiency will improve, enabling faster time-to-market for new devices. Additionally, the growing trend of personalized medicine will necessitate more customized manufacturing solutions, further expanding opportunities for contract manufacturers. The focus on sustainability will also shape production practices, aligning with global environmental goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Instruments Diagnostic Equipment Therapeutic Devices Monitoring Devices Consumables Implants Wearable Medical Devices Drug Delivery Devices Others |

| By End-User | Hospitals Clinics Home Healthcare Research Institutions OEMs (Original Equipment Manufacturers) Others |

| By Application | Cardiovascular Orthopedic Neurology Dental Respiratory Diabetes Care Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price |

| By Regulatory Compliance | FDA Approved CE Marked ISO Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Device Manufacturing | 100 | Manufacturing Managers, Product Development Leads |

| Cardiovascular Device Production | 80 | Quality Control Managers, Regulatory Affairs Specialists |

| Diagnostic Equipment Assembly | 90 | Operations Directors, Supply Chain Analysts |

| Wearable Medical Devices | 60 | R&D Managers, Marketing Executives |

| In-vitro Diagnostic Devices | 50 | Clinical Affairs Managers, Procurement Officers |

The Global Medical Device Contract Manufacturing Market is valued at approximately USD 77 billion, driven by the increasing demand for advanced medical devices and the trend of outsourcing manufacturing processes to specialized firms.