Region:Asia

Author(s):Geetanshi

Product Code:KRAC3045

Pages:88

Published On:October 2025

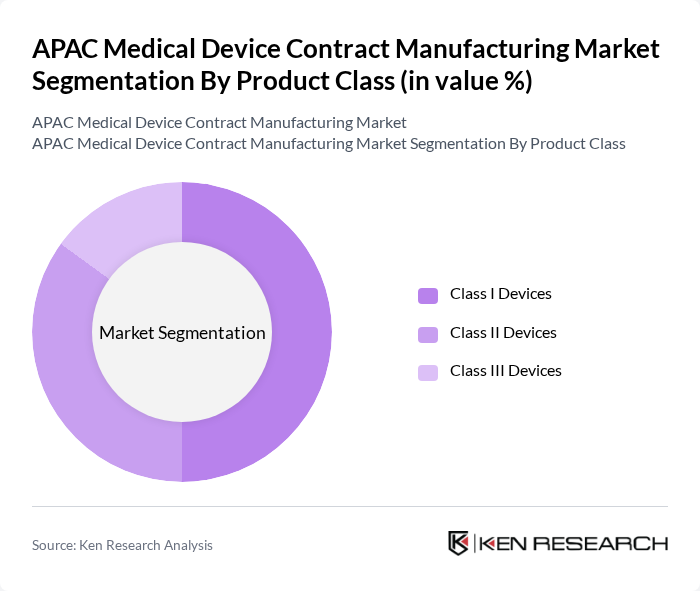

By Product Class:The product class segmentation includes Class I, Class II, and Class III devices. Class I devices, which are generally low-risk, account for the largest share of the market due to their widespread use in routine healthcare and lower regulatory requirements. Class II devices, which are moderate-risk, represent a significant portion of the market, driven by advancements in diagnostic and therapeutic technologies. Class III devices, being high-risk, have a smaller market share but are essential for complex and critical medical procedures .

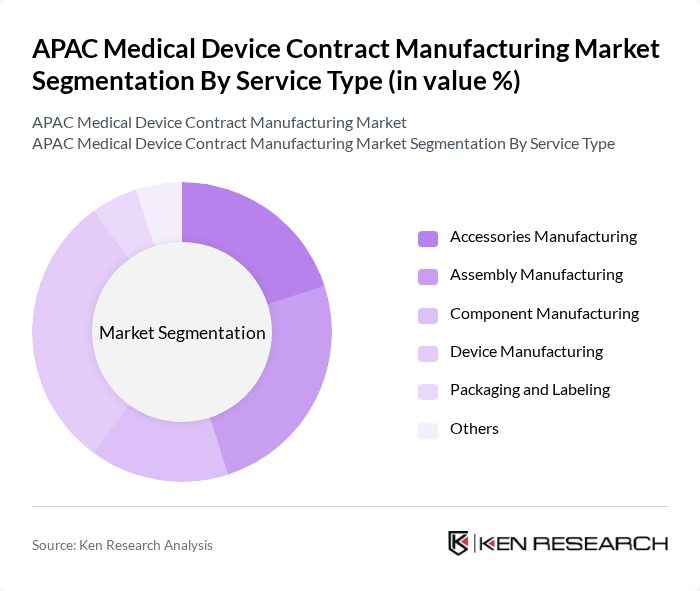

By Service Type:The service type segmentation includes Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, Packaging and Labeling, and Others. Device Manufacturing is the leading segment, driven by the increasing demand for innovative and high-quality medical devices. Assembly Manufacturing follows, as companies seek to optimize production efficiency and scalability. Accessories Manufacturing and Packaging and Labeling are also significant, reflecting the need for end-to-end service offerings in the medical device sector .

The APAC Medical Device Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jabil Healthcare, Flex Ltd., Sanmina Corporation, Celestica Inc., SHL Medical, Nipro Corporation, Synecco, SMC Ltd., MDI (Medical Device Innovation), SteriPack Group, United Orthopedic Corporation, Creganna Medical (TE Connectivity), Trelleborg Healthcare & Medical, Elos Medtech, Kinamed Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC medical device contract manufacturing market appears promising, driven by technological innovations and increasing healthcare investments. As manufacturers adopt automation and digital technologies, production efficiency will improve, enabling faster time-to-market for new devices. Additionally, the shift towards personalized medicine will create opportunities for customized solutions, enhancing patient outcomes. Strategic partnerships among manufacturers and healthcare providers will further facilitate market growth, ensuring that the region remains a key player in the global medical device landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Class | Class I Devices Class II Devices Class III Devices |

| By Service Type | Accessories Manufacturing Assembly Manufacturing Component Manufacturing Device Manufacturing Packaging and Labeling Others |

| By Therapeutic Area | Cardiovascular Devices Orthopedic Devices Ophthalmic Devices Diagnostic Devices Respiratory Devices Surgical Instruments Dental Devices Others |

| By End Use | Original Equipment Manufacturers (OEMs) Pharmaceutical & Biopharmaceutical Companies Others |

| By Country/Region | China Japan India South Korea Australia Singapore Malaysia Indonesia Taiwan Thailand Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contract Manufacturing for Orthopedic Devices | 100 | Manufacturing Managers, Product Development Leads |

| Contract Manufacturing for Diagnostic Equipment | 80 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Contract Manufacturing for Surgical Instruments | 90 | Operations Directors, Supply Chain Managers |

| Contract Manufacturing for Wearable Medical Devices | 70 | R&D Managers, Product Managers |

| Contract Manufacturing for Consumables | 85 | Procurement Officers, Logistics Coordinators |

The APAC Medical Device Contract Manufacturing Market is valued at approximately USD 31.8 billion, driven by increasing demand for advanced medical devices, technological innovations, and the rising prevalence of chronic diseases in the region.