Region:Middle East

Author(s):Rebecca

Product Code:KRAA9245

Pages:83

Published On:November 2025

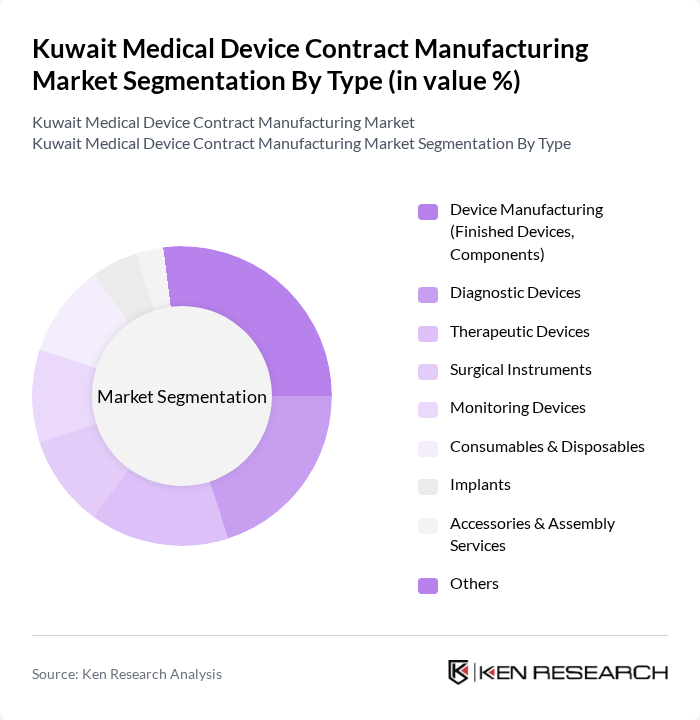

By Type:The market is segmented into various types of medical devices, each catering to specific healthcare needs. The subsegments include Device Manufacturing (Finished Devices, Components), Diagnostic Devices, Therapeutic Devices, Surgical Instruments, Monitoring Devices, Consumables & Disposables, Implants, Accessories & Assembly Services, and Others. Each of these subsegments plays a crucial role in the overall market dynamics, with varying levels of demand and growth potential. Device manufacturing and diagnostic devices are experiencing rapid expansion, particularly in areas such as diabetes care and diagnostic imaging, reflecting Kuwait’s healthcare priorities .

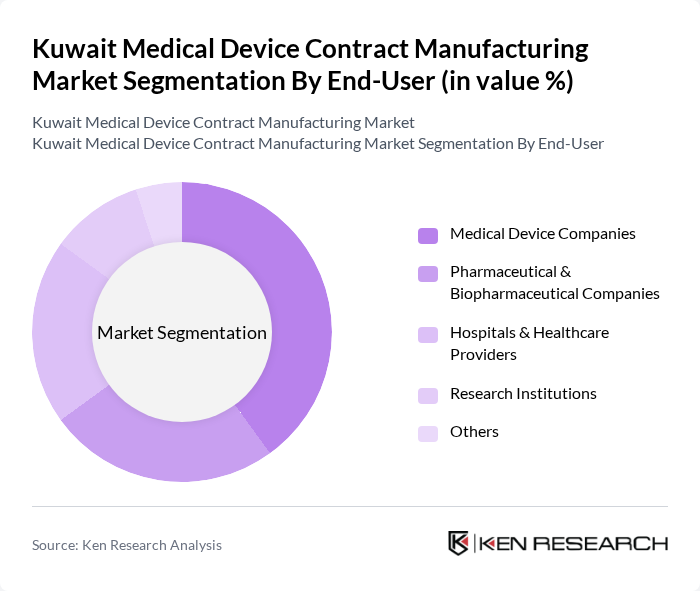

By End-User:The end-user segmentation includes Medical Device Companies, Pharmaceutical & Biopharmaceutical Companies, Hospitals & Healthcare Providers, Research Institutions, and Others. Each end-user category has distinct requirements and influences the demand for medical devices, shaping the market landscape. Pharmaceutical and biopharmaceutical companies represent the largest end-user segment, leveraging contract manufacturing to access specialized capabilities and reduce time-to-market .

The Kuwait Medical Device Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Warba Medical Supplies Company, Almahaba Medical Company, Gulf Pharmaceutical Industries (Julphar), Alghanim Healthcare, Medtronic Kuwait, Siemens Healthineers Kuwait, GE Healthcare Kuwait, Philips Healthcare Kuwait, Johnson & Johnson Medical Devices Kuwait, B. Braun Medical Kuwait, Stryker Kuwait, Abbott Laboratories Kuwait, Boston Scientific Kuwait, Zimmer Biomet Kuwait, Olympus Medical Systems Kuwait, Al-Dar Medical Company, Al-Mansoori Specialized Engineering contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait medical device contract manufacturing market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence and smart technologies into medical devices is expected to enhance product offerings significantly. Additionally, the government's commitment to improving healthcare infrastructure will likely create new opportunities for local manufacturers, fostering innovation and collaboration within the industry. As the market evolves, adaptability and responsiveness to emerging trends will be crucial for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Device Manufacturing (Finished Devices, Components) Diagnostic Devices Therapeutic Devices Surgical Instruments Monitoring Devices Consumables & Disposables Implants Accessories & Assembly Services Others |

| By End-User | Medical Device Companies Pharmaceutical & Biopharmaceutical Companies Hospitals & Healthcare Providers Research Institutions Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| By Material Type | Metals Plastics Ceramics Composites Others |

| By Regulatory Compliance | ISO 13485 Certification CE Marking US FDA Registration Kuwait Ministry of Health Approval Others |

| By Application Area | Cardiovascular Orthopedic Neurology Diabetes Care Diagnostic Imaging Dental General & Plastic Surgery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 45 | Production Managers, Quality Assurance Officers |

| Healthcare Providers | 50 | Hospital Administrators, Procurement Specialists |

| Regulatory Bodies | 40 | Regulatory Affairs Managers, Compliance Officers |

| Medical Device Distributors | 45 | Sales Managers, Logistics Coordinators |

| Research and Development Teams | 45 | R&D Managers, Innovation Leads |

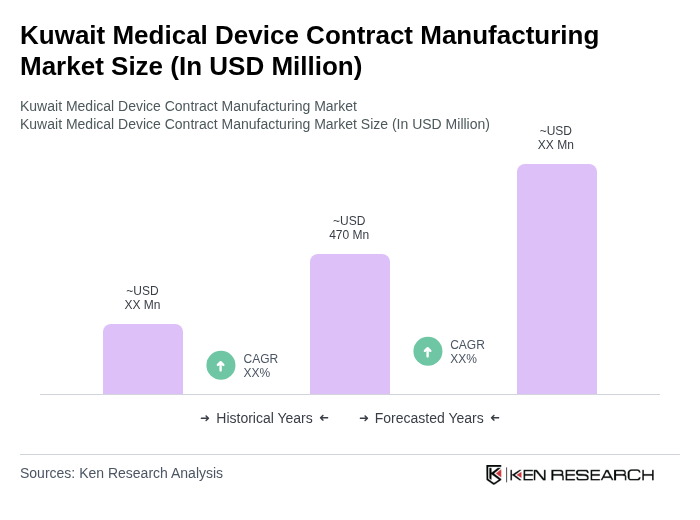

The Kuwait Medical Device Contract Manufacturing Market is valued at approximately USD 470 million, reflecting a significant growth driven by increasing demand for advanced medical technologies and rising healthcare expenditures.